Question: please solve using excel and show formulas pls Company Risk Pusher currently has debt that accounts for 50% of its total capital source and the

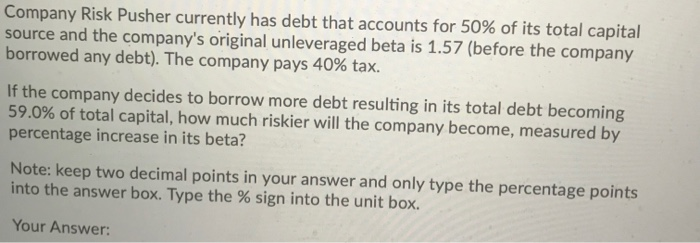

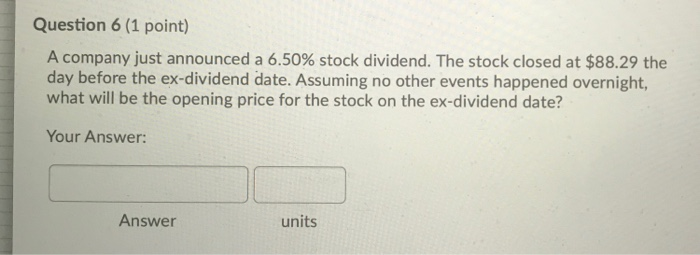

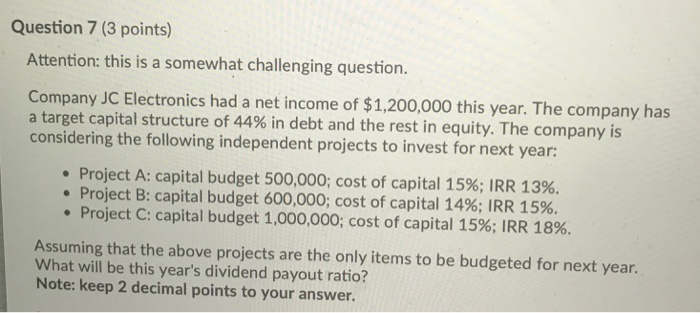

Company Risk Pusher currently has debt that accounts for 50% of its total capital source and the company's original unleveraged beta is 1.57 (before the company borrowed any debt). The company pays 40% tax. If the company decides to borrow more debt resulting in its total debt becoming 59.0% of total capital, how much riskier will the company become, measured by percentage increase in its beta? Note: keep two decimal points in your answer and only type the percentage points into the answer box. Type the % sign into the unit box. Your Answer Question 6 (1 point) A company just announced a 6.50% stock dividend. The stock closed at $88.29 the day before the ex-dividend date. Assuming no other events happened overnight, what will be the opening price for the stock on the ex-dividend date? Your Answer: Answer units Question 7 (3 points) Attention: this is a somewhat challenging question. Company JC Electronics had a net income of $1,200,000 this year. The company has a target capital structure of 44% in debt and the rest in equity. The company is considering the following independent projects to invest for next year: Project A: capital budget 500,000; cost of capital 15%; IRR 13%. Project B: capital budget 600,000; cost of capital 14%; IRR 15%. Project C: capital budget 1,000,000; cost of capital 15%; IRR 18%. Assuming that the above projects are the only items to be budgeted for next year. What will be this year's dividend payout ratio? Note: keep 2 decimal points to your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts