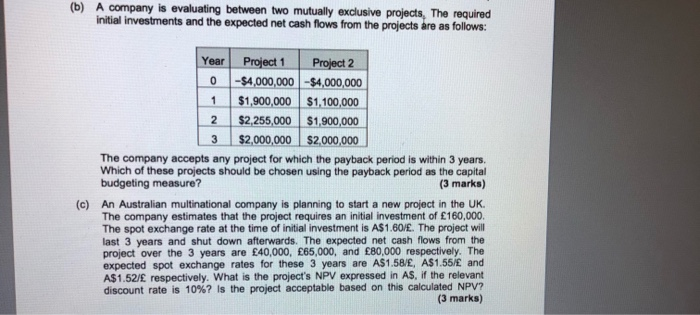

Question: (b) A company is evaluating between two mutually exclusive projects. The required initial investments and the expected net cash flows from the projects are as

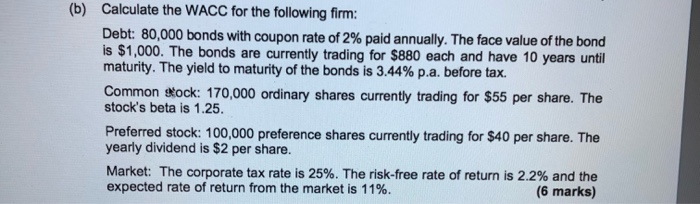

(b) A company is evaluating between two mutually exclusive projects. The required initial investments and the expected net cash flows from the projects are as follows: Project 1 Project 2 0 -$4,000,000 - $4,000,000 1 $1,900,000 $1,100,000 2 $2,255,000 $1,900,000 3 $2,000,000 $2,000,000 The company accepts any project for which the payback period is within 3 years, Which of these projects should be chosen using the payback period as the capital budgeting measure? (3 marks) An Australian multinational company is planning to start a new project in the UK The company estimates that the project requires an initial investment of 160,000. The spot exchange rate at the time of initial investment is A$ 1.60/. The project will last 3 years and shut down afterwards. The expected net cash flows from the project over the 3 years are 40,000, 65,000, and 80,000 respectively. The expected spot exchange rates for these 3 years are A$1.58/, A$1.55/ and A$1.52/E respectively. What is the project's NPV expressed in AS. If the relevant discount rate is 10%? Is the project acceptable based on this calculated NPV? (3 marks) (c) (b) Calculate the WACC for the following firm: Debt: 80,000 bonds with coupon rate of 2% paid annually. The face value of the bond is $1,000. The bonds are currently trading for $880 each and have 10 years until maturity. The yield to maturity of the bonds is 3.44% p.a. before tax. Common sock: 170,000 ordinary shares currently trading for $55 per share. The stock's beta is 1.25. Preferred stock: 100,000 preference shares currently trading for $40 per share. The yearly dividend is $2 per share. Market: The corporate tax rate is 25%. The risk-free rate of return is 2.2% and the expected rate of return from the market is 11%. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts