Question: (b) A manager faces two separate markets. The estimated demand functions for the two markets are: QA=1,60080PA and QB=2,400100PB The manager decides to price-discriminate. The

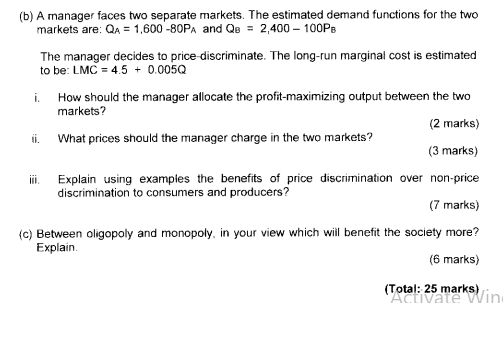

(b) A manager faces two separate markets. The estimated demand functions for the two markets are: QA=1,60080PA and QB=2,400100PB The manager decides to price-discriminate. The long-run marginal cost is estimated to be: LMC=4.5+0.005Q i. How should the manager allocate the profit-maximizing output between the two markets? (2 marks) ii. What prices should the manager charge in the two markets? (3 marks) iii. Explain using examples the benefits of price discrimination over non-price discrimination to consumers and producers? (7 marks) (c) Between oligopoly and monopoly, in your view which wiil benefit the society more? Explain. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts