Question: b) and c) all belong to one question, please answer them all. Thanks. b) A financial institution has the following portfolio of over the counter

b) and c) all belong to one question, please answer them all.

Thanks.

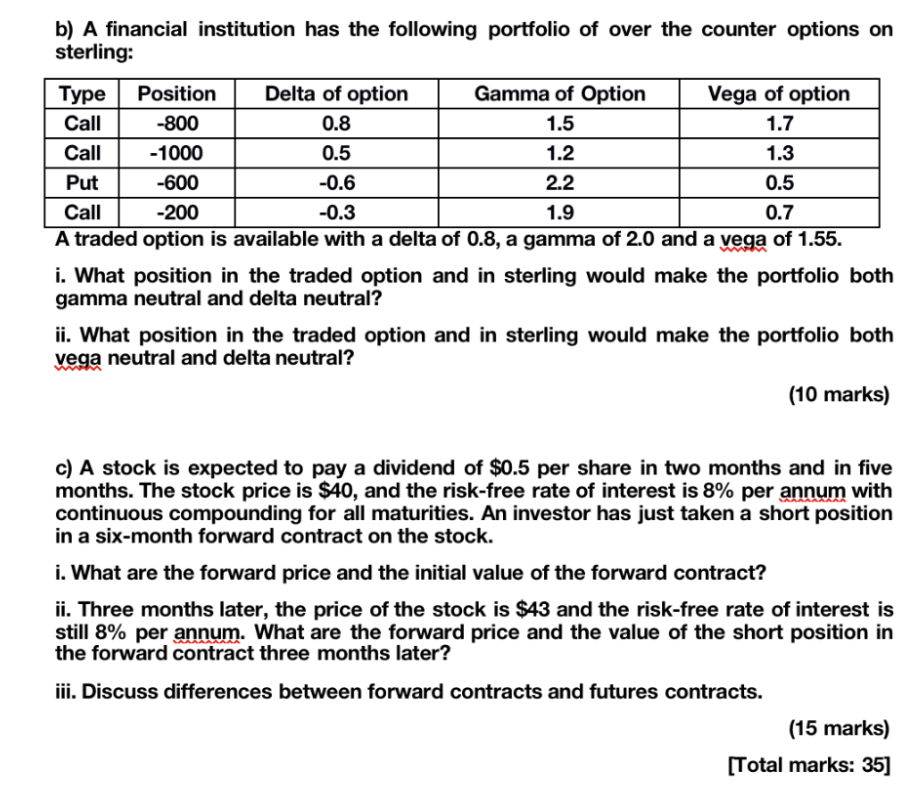

b) A financial institution has the following portfolio of over the counter options on sterling: Type Position Delta of option Gamma of Option Vega of option Call -800 0.8 1.5 1.7 Call -1000 0.5 1.2 1.3 Put -600 -0.6 2.2 0.5 Call -200 -0.3 1.9 0.7 A traded option is available with a delta of 0.8, a gamma of 2.0 and a vega of 1.55. i. What position in the traded option and in sterling would make the portfolio both gamma neutral and delta neutral? ii. What position in the traded option and in sterling would make the portfolio both vega neutral and delta neutral? (10 marks) c) A stock is expected to pay a dividend of $0.5 per share in two months and in five months. The stock price is $40, and the risk-free rate of interest is 8% per annum with continuous compounding for all maturities. An investor has just taken a short position in a six-month forward contract on the stock. i. What are the forward price and the initial value of the forward contract? ii. Three months later, the price of the stock is $43 and the risk-free rate of interest is still 8% per annum. What are the forward price and the value of the short position in the forward contract three months later? iii. Discuss differences between forward contracts and futures contracts. (15 marks) [Total marks: 35] b) A financial institution has the following portfolio of over the counter options on sterling: Type Position Delta of option Gamma of Option Vega of option Call -800 0.8 1.5 1.7 Call -1000 0.5 1.2 1.3 Put -600 -0.6 2.2 0.5 Call -200 -0.3 1.9 0.7 A traded option is available with a delta of 0.8, a gamma of 2.0 and a vega of 1.55. i. What position in the traded option and in sterling would make the portfolio both gamma neutral and delta neutral? ii. What position in the traded option and in sterling would make the portfolio both vega neutral and delta neutral? (10 marks) c) A stock is expected to pay a dividend of $0.5 per share in two months and in five months. The stock price is $40, and the risk-free rate of interest is 8% per annum with continuous compounding for all maturities. An investor has just taken a short position in a six-month forward contract on the stock. i. What are the forward price and the initial value of the forward contract? ii. Three months later, the price of the stock is $43 and the risk-free rate of interest is still 8% per annum. What are the forward price and the value of the short position in the forward contract three months later? iii. Discuss differences between forward contracts and futures contracts. (15 marks) [Total marks: 35]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts