Answered step by step

Verified Expert Solution

Question

1 Approved Answer

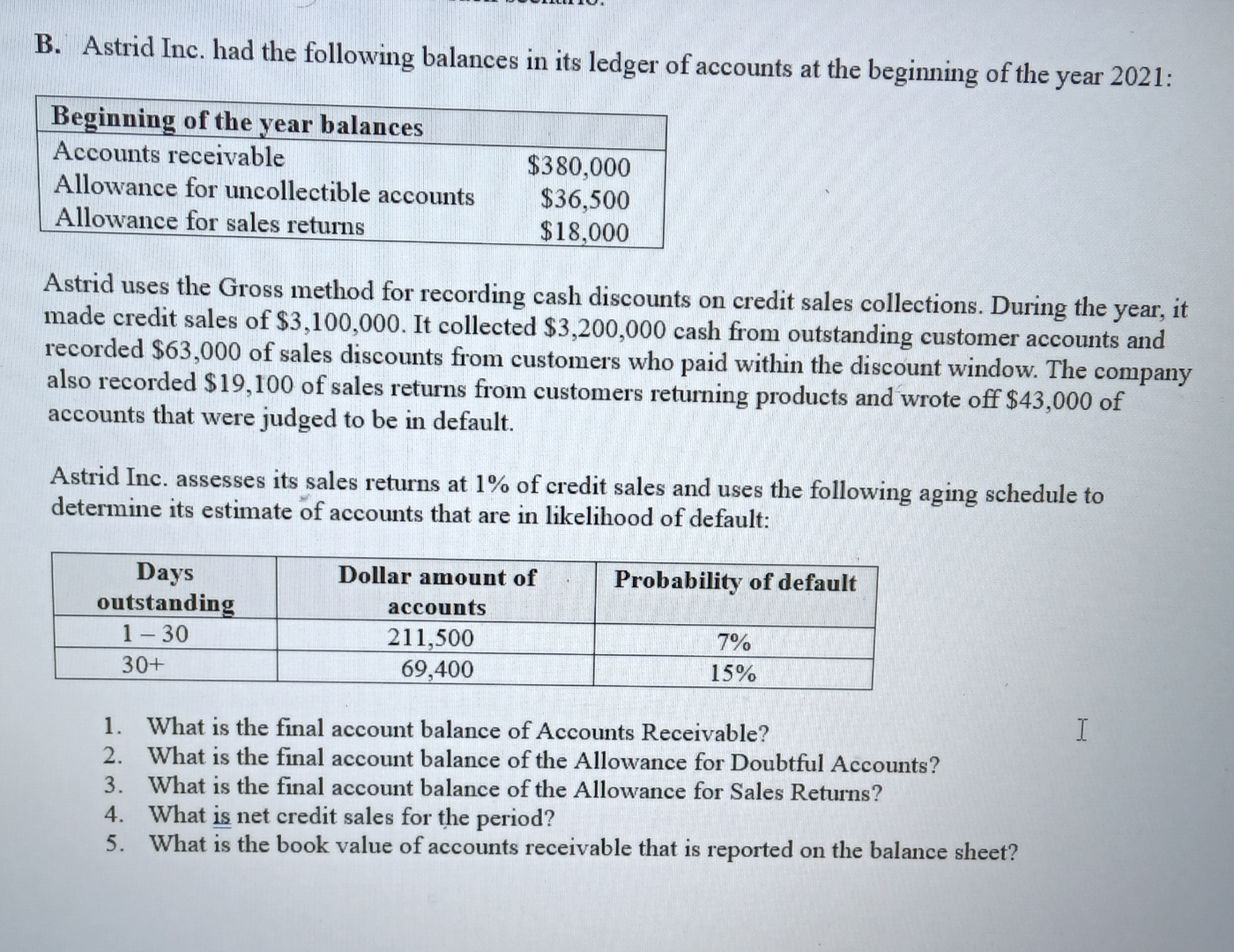

B. Astrid Inc. had the following balances in its ledger of accounts at the beginning of the year 2021: Beginning of the year balances

B. Astrid Inc. had the following balances in its ledger of accounts at the beginning of the year 2021: Beginning of the year balances Accounts receivable $380,000 Allowance for uncollectible accounts Allowance for sales returns $36,500 $18,000 Astrid uses the Gross method for recording cash discounts on credit sales collections. During the year, it made credit sales of $3,100,000. It collected $3,200,000 cash from outstanding customer accounts and recorded $63,000 of sales discounts from customers who paid within the discount window. The company also recorded $19,100 of sales returns from customers returning products and wrote off $43,000 of accounts that were judged to be in default. Astrid Inc. assesses its sales returns at 1% of credit sales and uses the following aging schedule to determine its estimate of accounts that are in likelihood of default: Days outstanding 1-30 30+ Dollar amount of accounts 211,500 69,400 Probability of default 7% 15% 1. What is the final account balance of Accounts Receivable? 2. What is the final account balance of the Allowance for Doubtful Accounts? 3. What is the final account balance of the Allowance for Sales Returns? 4. What is net credit sales for the period? 5. What is the book value of accounts receivable that is reported on the balance sheet? I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To determine the final balances for Accounts Receivable Allowance for Doubtful Accounts and A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664260ffdf8cf_981543.pdf

180 KBs PDF File

664260ffdf8cf_981543.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started