Question: b. At what expected spot exchange rate (using the uncovered interest rate parity formula) do you earn zero profits and have no monetary incentive to

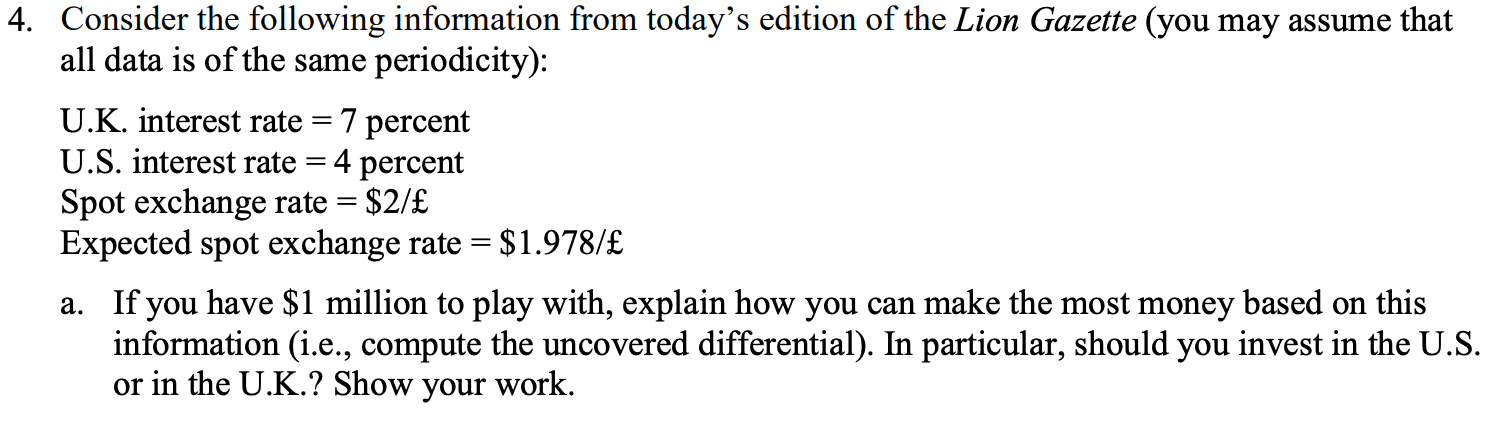

b. At what expected spot exchange rate (using the uncovered interest rate parity formula) do you earn zero profits and have no monetary incentive to play this game? Assume the forward exchange rate is equal to the expected spot exchange rate. 4. Consider the following information from today's edition of the Lion Gazette (you may assume that all data is of the same periodicity): U.K. interest rate = 7 percent U.S. interest rate = 4 percent Spot exchange rate = $2/ Expected spot exchange rate = $1.978/ a. If you have $1 million to play with, explain how you can make the most money based on this information (i.e., compute the uncovered differential). In particular, should you invest in the U.S. or in the U.K.? Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts