Question: b. Based on Exhibit 2 (Industry Ratios), how does Mosaic Days Payable Outstanding; Days Sales Outstanding and Days Inventory Outstanding compare with the industry? c.

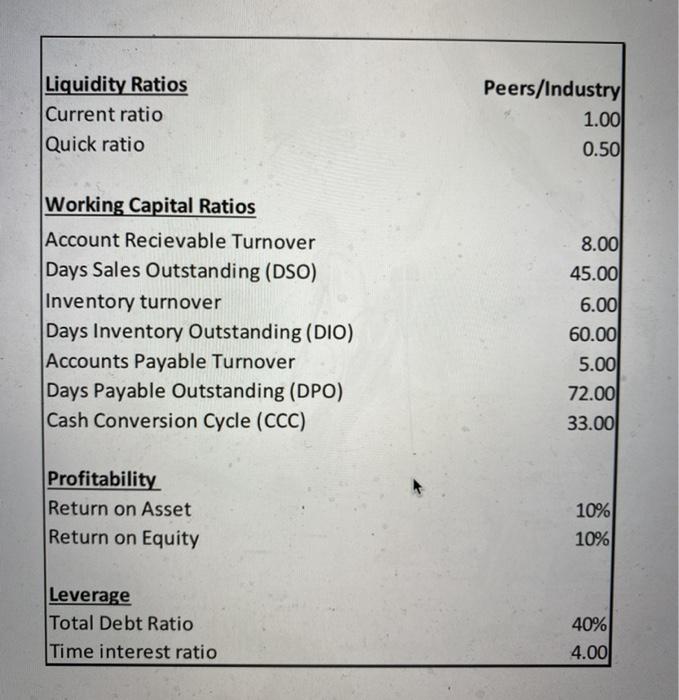

b. Based on Exhibit 2 (Industry Ratios), how does Mosaic Days Payable Outstanding; Days Sales Outstanding and Days Inventory Outstanding compare with the industry? c. Which of the working capital metrics should Mosaic Treasurer improve? Include your recommendations. d. How does Mosaic's cash conversion cycle compare to the industry? What does "cash conversion cycle" mean to you? e. What are the general problems of using ratio analysis? Liquidity Ratios Current ratio Quick ratio Peers/Industry 1.00 0.50 Working Capital Ratios Account Recievable Turnover Days Sales Outstanding (DSO) Inventory turnover Days Inventory Outstanding (DIO) Accounts Payable Turnover Days Payable Outstanding (DPO) Cash Conversion Cycle (CCC) 8.00 45.00 6.00 60.00 5.00 72.00 33.00 Profitability Return on Asset Return on Equity 10% 10% Leverage Total Debt Ratio Time interest ratio 40% 4.00 b. Based on Exhibit 2 (Industry Ratios), how does Mosaic Days Payable Outstanding; Days Sales Outstanding and Days Inventory Outstanding compare with the industry? c. Which of the working capital metrics should Mosaic Treasurer improve? Include your recommendations. d. How does Mosaic's cash conversion cycle compare to the industry? What does "cash conversion cycle" mean to you? e. What are the general problems of using ratio analysis? Liquidity Ratios Current ratio Quick ratio Peers/Industry 1.00 0.50 Working Capital Ratios Account Recievable Turnover Days Sales Outstanding (DSO) Inventory turnover Days Inventory Outstanding (DIO) Accounts Payable Turnover Days Payable Outstanding (DPO) Cash Conversion Cycle (CCC) 8.00 45.00 6.00 60.00 5.00 72.00 33.00 Profitability Return on Asset Return on Equity 10% 10% Leverage Total Debt Ratio Time interest ratio 40% 4.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts