Question: b. Based on Exhibit 2 (Industry Ratios), how does Mosaic Days Payable Outstanding; Days Sales Outstanding and Days Inventory Outstanding compare with the industry? c.

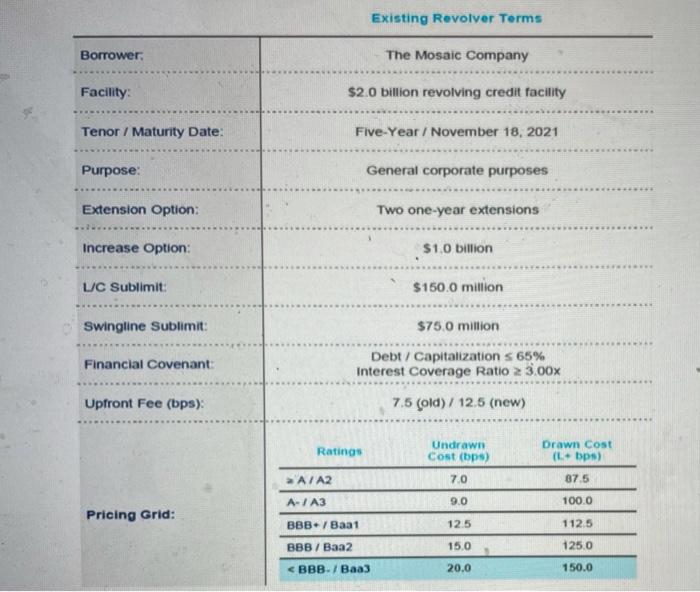

b. Based on Exhibit 2 (Industry Ratios), how does Mosaic Days Payable Outstanding; Days Sales Outstanding and Days Inventory Outstanding compare with the industry? c. Which of the working capital metrics should Mosaic Treasurer improve? Include your recommendations. d. How does Mosaic's cash conversion cycle compare to the industry? What does "cash conversion cycle" mean to you? e. What are the general problems of using ratio analysis? Existing Revolver Terms Borrower: The Mosaic Company Facility: $2.0 billion revolving credit facility Tenor / Maturity Date: Five-Year / November 18, 2021 Purpose: General corporate purposes Extension Option: Two one-year extensions Increase Option: $1.0 billion LC Sublimit: $150.0 million Swingline Sublimit: $75.0 million Financial Covenant Debt / Capitalization 65% Interest Coverage Ratio 23.00x Upfront Fee (bps): 7.5 (old) / 12.5 (new) Ratings Undrawn Cost (bps) Drawn Cost (1.bps) 70 87.5 A/A2 A-/ A3 9.0 100.0 Pricing Grid: BBB./Baa1 125 1125 BBB / Baa2 15.0 125.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts