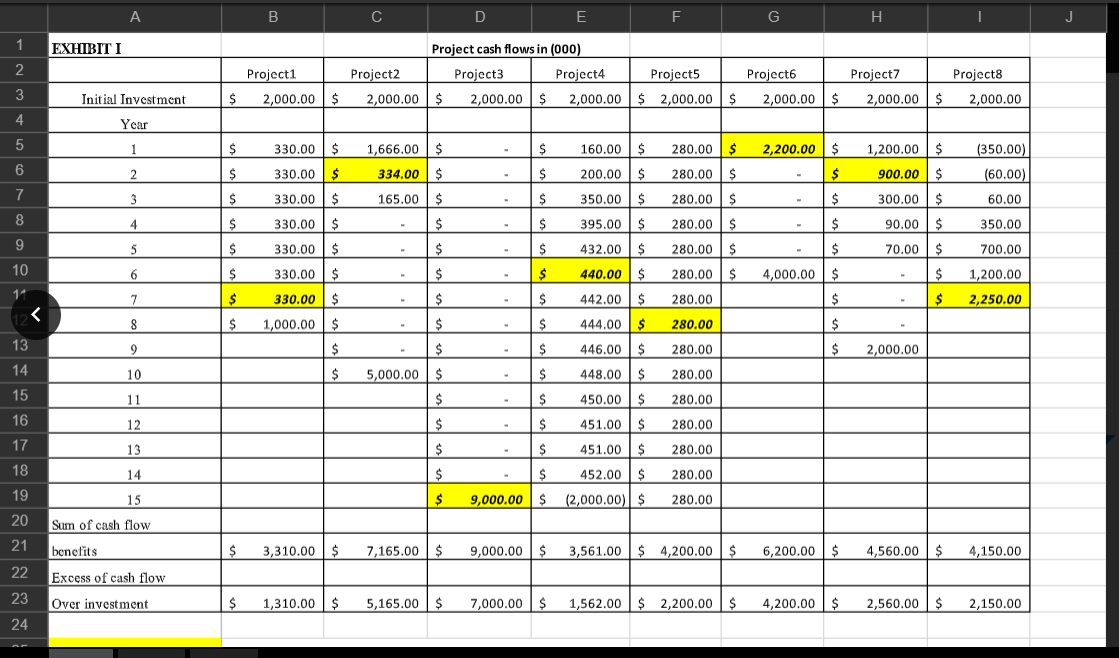

Question: . B C D E F 1 EXHIBITI 2 Project 1 Project cash flows in (000) Project 2 Project3 Project4 Projects 2,000.00 $ 2,000.00 $

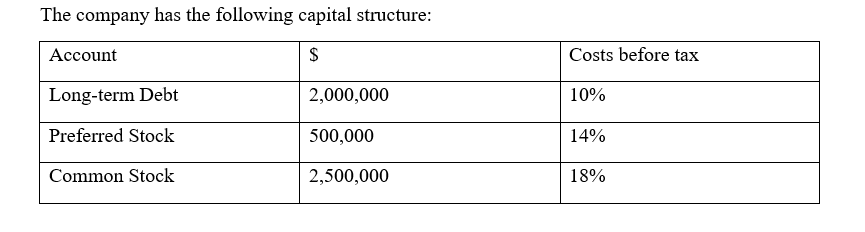

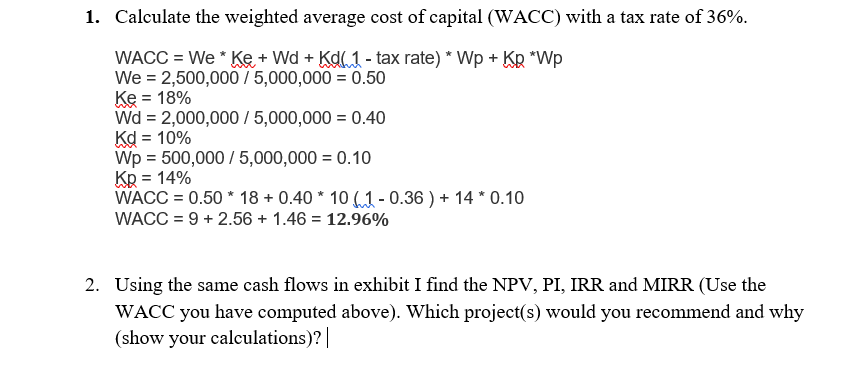

. B C D E F 1 EXHIBITI 2 Project 1 Project cash flows in (000) Project 2 Project3 Project4 Projects 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ Project 6 Project 7 Projects 3 Initial Investment $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 4 Year 5 1 $ 1,666.00 $ $ 2,200.00 $ (350.00) 160.00 $ 200.00 $ 1,200.00 $ 900.00 $ 6 2 $ 334.00 $ $ $ (60.00) 7 3 $ 165.00 $ $ $ 300.00 $ 60.00 280.00 $ 280.00 $ 280.00 $ 280.00 $ 280.00 $ 280.00 $ 8 4 $ $ 330.00 $ 330.00 $ 330.00 $ 330.00 $ 330.00 $ 330.00 $ 330.00 $ 1,000.00 $ $ $ $ 90.00 $ 70.00 $ 350.00 700.00 9 5 $ $ $ 4,000.00 $ 10 6 $ $ $ $ 1,200.00 2,250.00 14 7 $ $ 350.00 $ 395.00 $ 432.00 $ 440.00 $ 442.00 $ 444.00 $ 446.00 $ 448.00 $ 450.00 $ $ 280.00 $ $ 8 $ $ $ 280.00 $ 13 9 $ $ $ $ 2,000.00 280.00 280.00 14 10 $ 5,000.00 $ $ 15 11 $ $ 280.00 16 12 $ $ 451.00 $ 280.00 17 13 $ 280.00 18 14 $ $ 451.00 $ $ 452.00 $ 9,000.00 $ (2,000.00 $ 280.00 19 15 $ 280.00 20 Sum of cash flow 21 benefits $ 3,310.00 $ 7,165.00 $ 9,000.00 $ 3,561.00 $4,200.00 $ 6,200.00 $ 4,560.00 $ 4,150.00 22 Excess of cash flow 23 Over investment $ 1,310.00 $ 5,165.00 $ 7,000.00 $ 1,562.00 $ 2,200.00 $ 4,200.00 $ 2,560.00 $ 2,150.00 24 The company has the following capital structure: Account $ Costs before tax Long-term Debt 2,000,000 10% Preferred Stock 500,000 14% Common Stock 2,500,000 18% 1. Calculate the weighted average cost of capital (WACC) with a tax rate of 36%. WACC = We * Ke + Wd + Kd6.1 - tax rate) * Wp + KR *Wp We = 2,500,000 / 5,000,000 = 0.50 Ke = 18% Wd = 2,000,000 / 5,000,000 = 0.40 Kd = 10% Wp = 500,000 / 5,000,000 = 0.10 KR = 14% WACC = 0.50 * 18 +0.40 * 10.4.1-0.36 ) + 14 * 0.10 WACC = 9 + 2.56 + 1.46 = 12.96% 2. Using the same cash flows in exhibit I find the NPV, PI, IRR and MIRR (Use the WACC you have computed above). Which project(s) would you recommend and why (show your calculations)? |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts