Question: (b) (c) (d) (e) (f) Explain how assets and liabilities are recognized in financial statement. Differentiate between capital expenditures and revenue expenditures, giving an

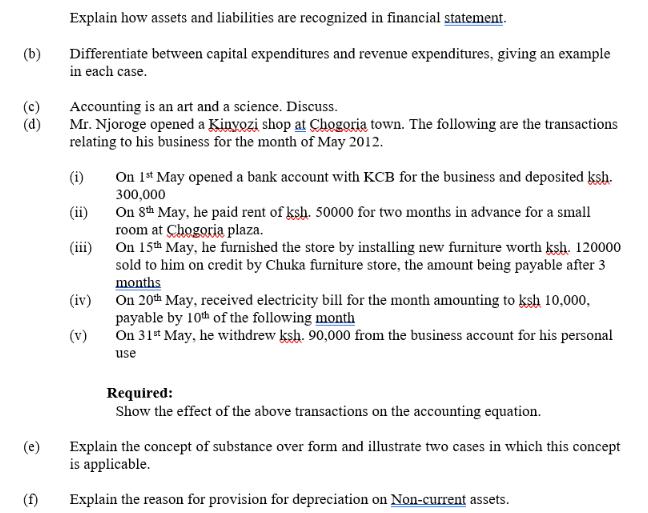

(b) (c) (d) (e) (f) Explain how assets and liabilities are recognized in financial statement. Differentiate between capital expenditures and revenue expenditures, giving an example in each case. Accounting is an art and a science. Discuss. Mr. Njoroge opened a Kinyozi shop at Chogoria town. The following are the transactions relating to his business for the month of May 2012. (i) (ii) (iii) (iv) (v) On 1st May opened a bank account with KCB for the business and deposited ksh. 300,000 On 8th May, he paid rent of ksh. 50000 for two months in advance for a small room at Chogoria plaza. On 15th May, he furnished the store by installing new furniture worth ksh. 120000 sold to him on credit by Chuka furniture store, the amount being payable after 3 months On 20th May, received electricity bill for the month amounting to ksh 10,000, payable by 10th of the following month On 31st May, he withdrew ksh. 90,000 from the business account for his personal use Required: Show the effect of the above transactions on the accounting equation. Explain the concept of substance over form and illustrate two cases in which this concept is applicable. Explain the reason for provision for depreciation on Non-current assets.

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

a Assets and liabilities are recognized in financial statements when they meet the following criteria They have future economic benefits They are controlled by the entity They are measurable with reli... View full answer

Get step-by-step solutions from verified subject matter experts