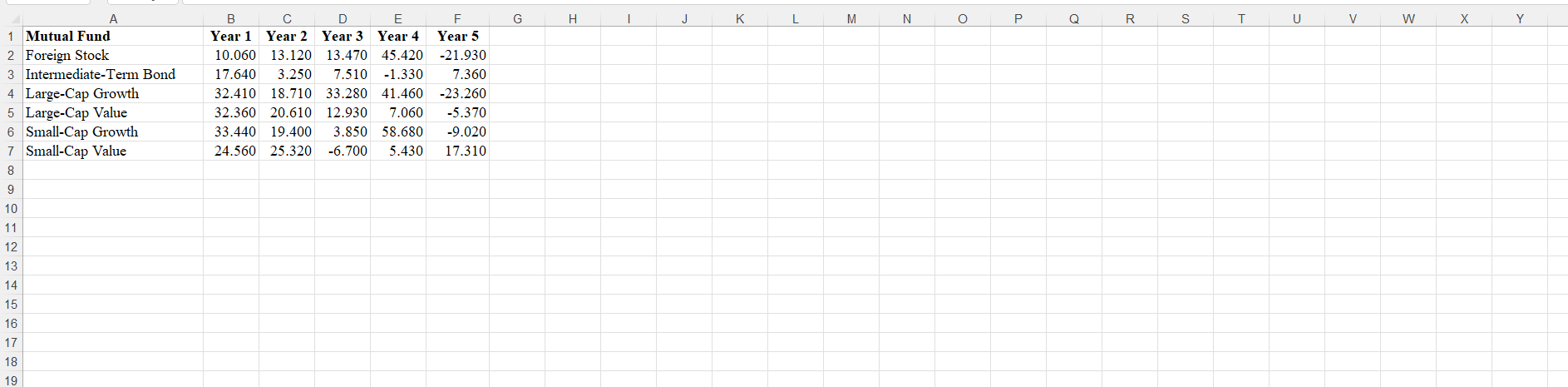

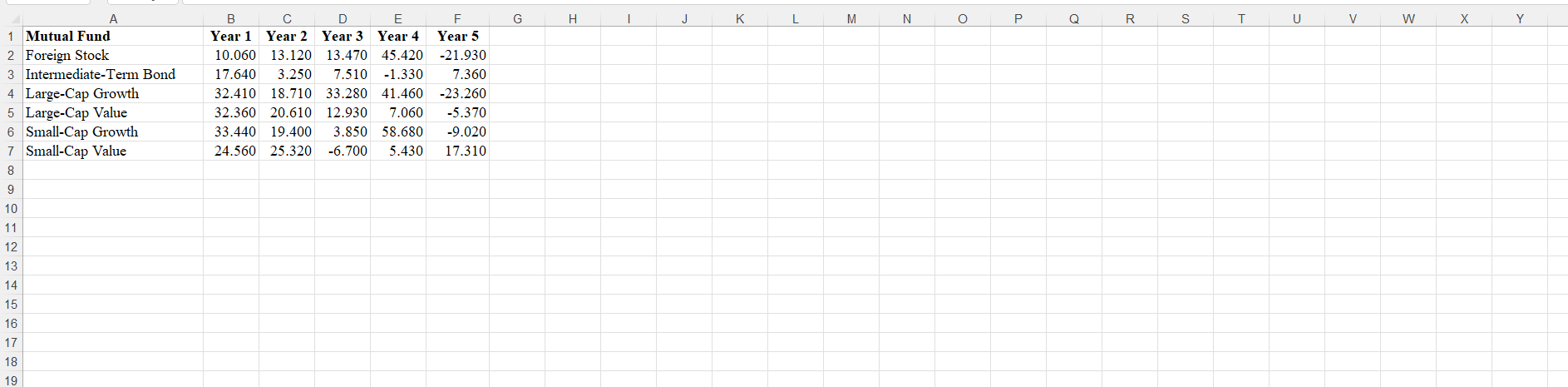

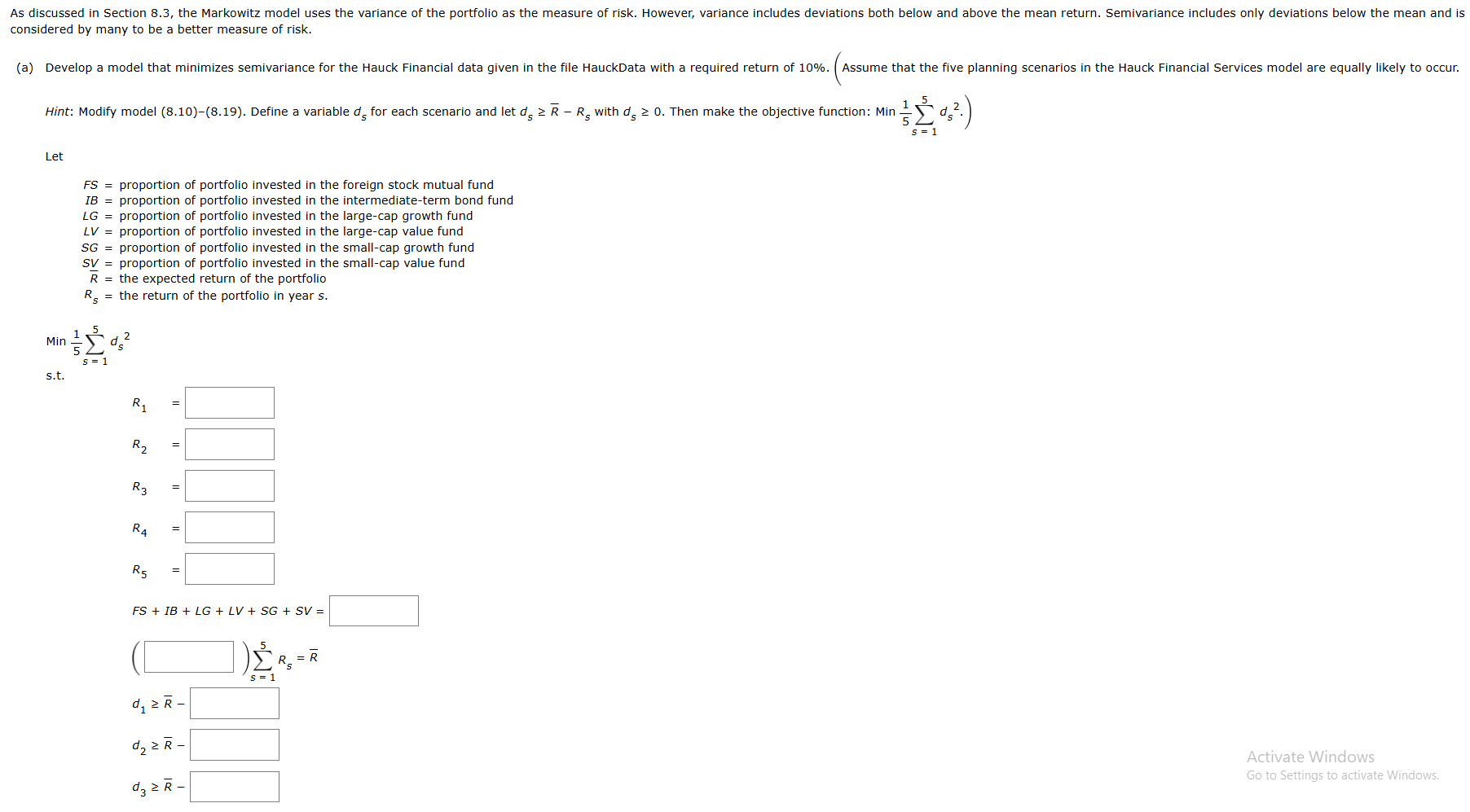

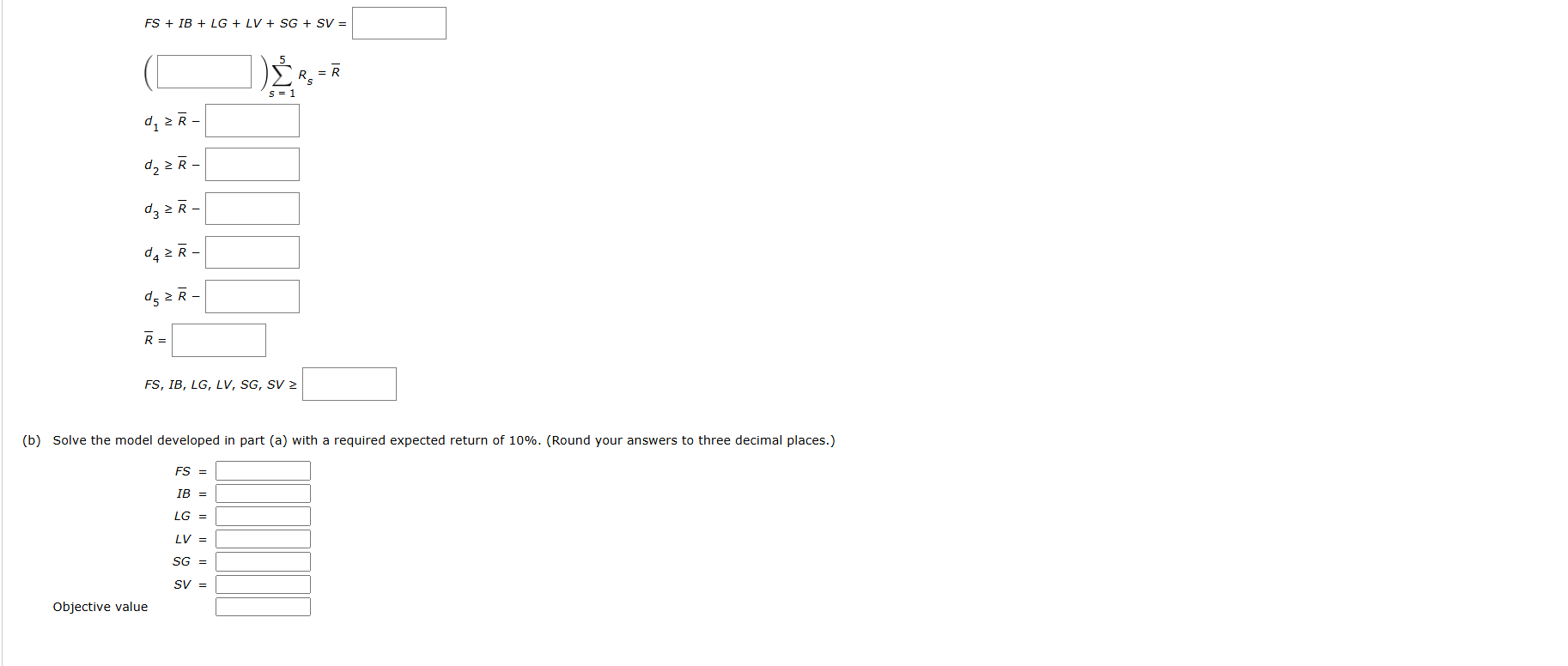

Question: B C D E F G H K M N O P Q R S T U V W X 1 Mutual Fund Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts