Question: b. Consider cases A, B, and C. How does increasing leverage affect the three ratios? Why does the ROE grow from case A to case

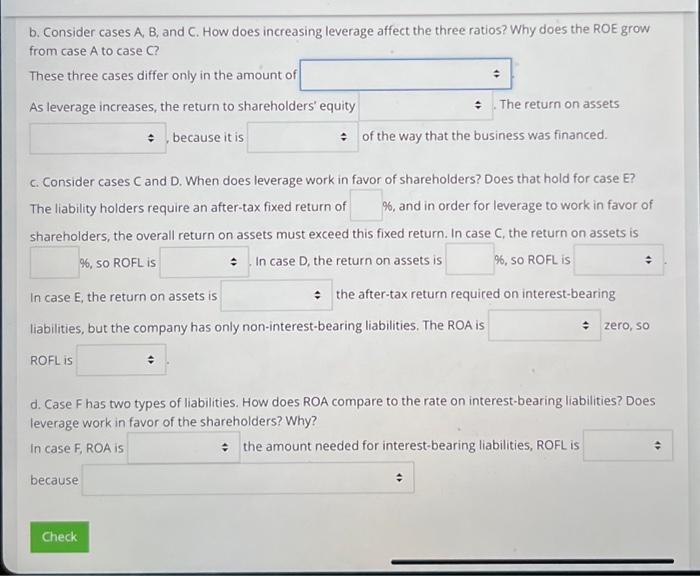

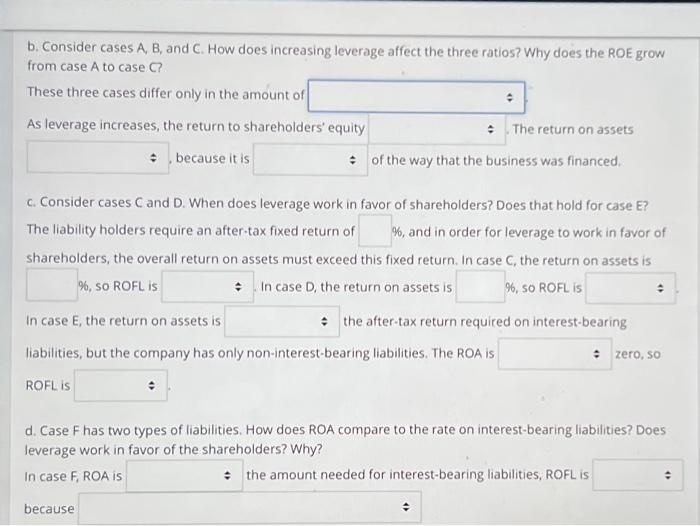

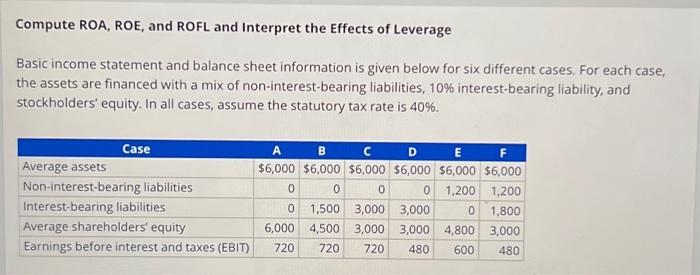

b. Consider cases A, B, and C. How does increasing leverage affect the three ratios? Why does the ROE grow from case A to case C ? These three cases differ only in the amount of As leverage increases, the return to shareholders' equity The return on assets because it is of the way that the business was financed. c. Consider cases C and D. When does leverage work in favor of shareholders? Does that hold for case E? The liability holders require an after-tax fixed return of %, and in order for leverage to work in favor of shareholders, the overall return on assets must exceed this fixed return. In case C, the return on assets is 6. so ROFL is In case D, the return on assets is *, so ROFL is In case E, the return on assets is the after-tax return required on interest-bearing liabilities, but the company has only non-interest-bearing liabilities. The ROA is zero, so ROFL is d. Case F has two types of liabilities. How does ROA compare to the rate on interest-bearing liabilities? Does leverage work in favor of the shareholders? Why? In case F, ROA is the amount needed for interest-bearing liabilities, ROFL is because b. Consider cases A, B, and C. How does increasing leverage affect the three ratios? Why does the ROE grow from case A to case C ? These three cases differ only in the amount of As leverage increases, the return to shareholders' equity The return on assets because it is of the way that the business was financed. c. Consider cases C and D. When does leverage work in favor of shareholders? Does that hold for case E? The liability holders require an after-tax fixed return of %, and in order for leverage to work in favor of shareholders, the overall return on assets must exceed this fixed return. In case C, the return on assets is %, so ROFL is In case D, the return on assets is 6 , so ROFL is In case E, the return on assets is the after-tax return required on interest-bearing liabilities, but the company has only non-interest-bearing liabilities. The ROA is zero, so ROFL is d. Case F has two types of liabilities. How does ROA compare to the rate on interest-bearing liabilities? Does leverage work in favor of the shareholders? Why? In case F,ROA is the amount needed for interest-bearing liabilities, ROFL is becausi Compute ROA, ROE, and ROFL and Interpret the Effects of Leverage Basic income statement and balance sheet information is given below for six different cases. For each case, the assets are financed with a mix of non-interest-bearing liabilities, 10% interest-bearing liability, and stockholders' equity. In all cases, assume the statutory tax rate is 40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts