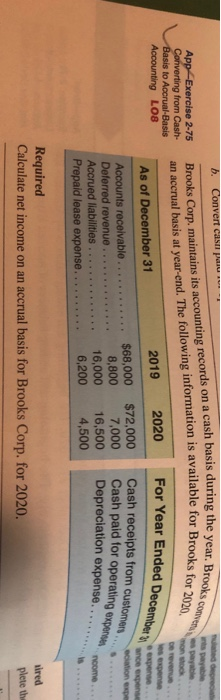

Question: b. Convert case pa CI non ho App-Exercise 2-75 Converting from Cash- Basis to Accrual-Basis Accounting LOS 2019 2020 As of December 31 es expense

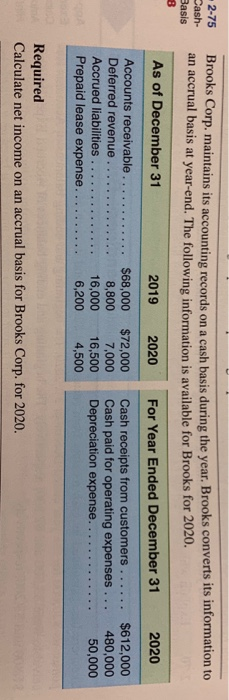

b. Convert case pa CI non ho App-Exercise 2-75 Converting from Cash- Basis to Accrual-Basis Accounting LOS 2019 2020 As of December 31 es expense expense expense con expe Cash receipts from customers Accounts receivable Deferred revenue. Accrued liabilities Prepaid lease expense. $68,000 8,800 16,000 6,200 $72,000 7,000 16,500 4,500 Depreciation expense. roome +++ Required Calculate net income on an accrual basis for Brooks Corp. for 2020. tired plete the Brooks Corp. maintains its accounting records on a cash basis during the year. Brooks an accrual basis at year-end. The following information is available for Brooks for 2020, For Year Ended December Cash paid for operating experts -2-75 Cash- Basis 8 Brooks Corp. maintains its accounting records on a cash basis during the year. Brooks converts its information to an accrual basis at year-end. The following information is available for Brooks for 2020. As of December 31 2019 2020 For Year Ended December 31 2020 Accounts receivable. Deferred revenue Accrued liabilities Prepaid lease expense. $68,000 $72,000 8,800 7,000 16,000 16,500 6,200 4,500 Cash receipts from customers Cash paid for operating expenses. Depreciation expense.. $612,000 480,000 50,000 Required Calculate net income on an accrual basis for Brooks Corp. for 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts