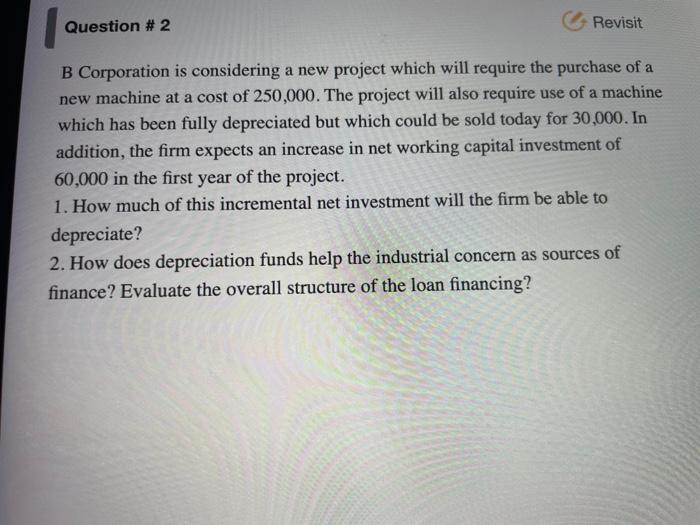

Question: B Corporation is considering a new project which will require the purchase of a new machine at a cost of 250,000 . The project will

B Corporation is considering a new project which will require the purchase of a new machine at a cost of 250,000 . The project will also require use of a machine which has been fully depreciated but which could be sold today for 30,000 . In addition, the firm expects an increase in net working capital investment of 60,000 in the first year of the project. 1. How much of this incremental net investment will the firm be able to depreciate? 2. How does depreciation funds help the industrial concern as sources of finance? Evaluate the overall structure of the loan financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts