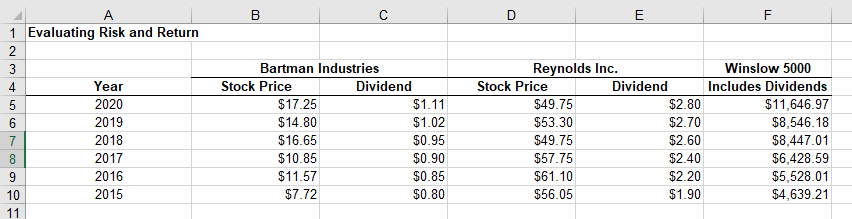

Question: B D E F A 1 Evaluating Risk and Return 2 3 4 Year 5 2020 6 2019 7 2018 8 2017 9 2016 10

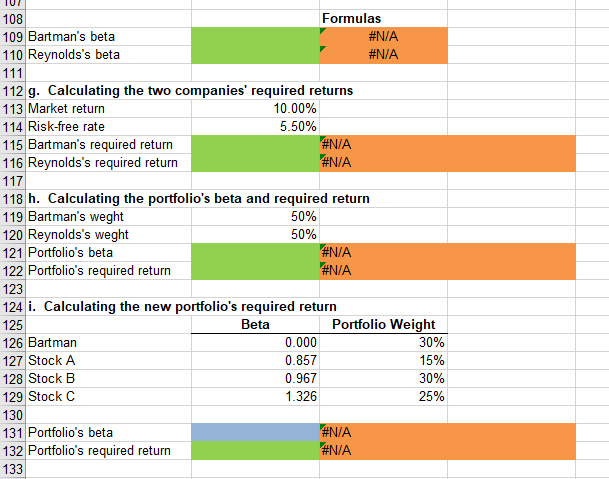

B D E F A 1 Evaluating Risk and Return 2 3 4 Year 5 2020 6 2019 7 2018 8 2017 9 2016 10 2015 11 NO CO WN Bartman Industries Stock Price Dividend $17.25 $1.11 $14.80 $1.02 $16.65 $0.95 $10.85 $0.90 $11.57 $0.85 $7.72 $0.80 Reynolds Inc. Stock Price Dividend $49.75 $2.80 $53.30 $2.70 $49.75 $2.60 $57.75 $2.40 $61.10 $2.20 $56.05 $1.90 Winslow 5000 Includes Dividends $11,646.97 $8,546.18 $8,447.01 $6,428.59 $5,528.01 $4,639.21 TUT 108 Formulas 109 Bartman's beta #N/A 110 Reynolds's beta #N/A 111 112 g. Calculating the two companies' required returns 113 Market return 10.00% 114 Risk-free rate 5.50% 115 Bartman's required return #N/A 116 Reynolds's required return #N/A 117 118 h. Calculating the portfolio's beta and required return 119 Bartman's weght 50% 120 Reynolds's weght 50% 121 Portfolio's beta #N/A 122 Portfolio's required return #N/A 123 124 i. Calculating the new portfolio's required return 125 Beta Portfolio Weight 126 Bartman 0.000 30% 127 Stock A 0.857 15% 128 Stock B 0.967 30% 129 Stock C 1.326 25% 130 131 Portfolio's beta #N/A 132 Portfolio's required return #N/A 133 B D E F A 1 Evaluating Risk and Return 2 3 4 Year 5 2020 6 2019 7 2018 8 2017 9 2016 10 2015 11 NO CO WN Bartman Industries Stock Price Dividend $17.25 $1.11 $14.80 $1.02 $16.65 $0.95 $10.85 $0.90 $11.57 $0.85 $7.72 $0.80 Reynolds Inc. Stock Price Dividend $49.75 $2.80 $53.30 $2.70 $49.75 $2.60 $57.75 $2.40 $61.10 $2.20 $56.05 $1.90 Winslow 5000 Includes Dividends $11,646.97 $8,546.18 $8,447.01 $6,428.59 $5,528.01 $4,639.21 TUT 108 Formulas 109 Bartman's beta #N/A 110 Reynolds's beta #N/A 111 112 g. Calculating the two companies' required returns 113 Market return 10.00% 114 Risk-free rate 5.50% 115 Bartman's required return #N/A 116 Reynolds's required return #N/A 117 118 h. Calculating the portfolio's beta and required return 119 Bartman's weght 50% 120 Reynolds's weght 50% 121 Portfolio's beta #N/A 122 Portfolio's required return #N/A 123 124 i. Calculating the new portfolio's required return 125 Beta Portfolio Weight 126 Bartman 0.000 30% 127 Stock A 0.857 15% 128 Stock B 0.967 30% 129 Stock C 1.326 25% 130 131 Portfolio's beta #N/A 132 Portfolio's required return #N/A 133

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts