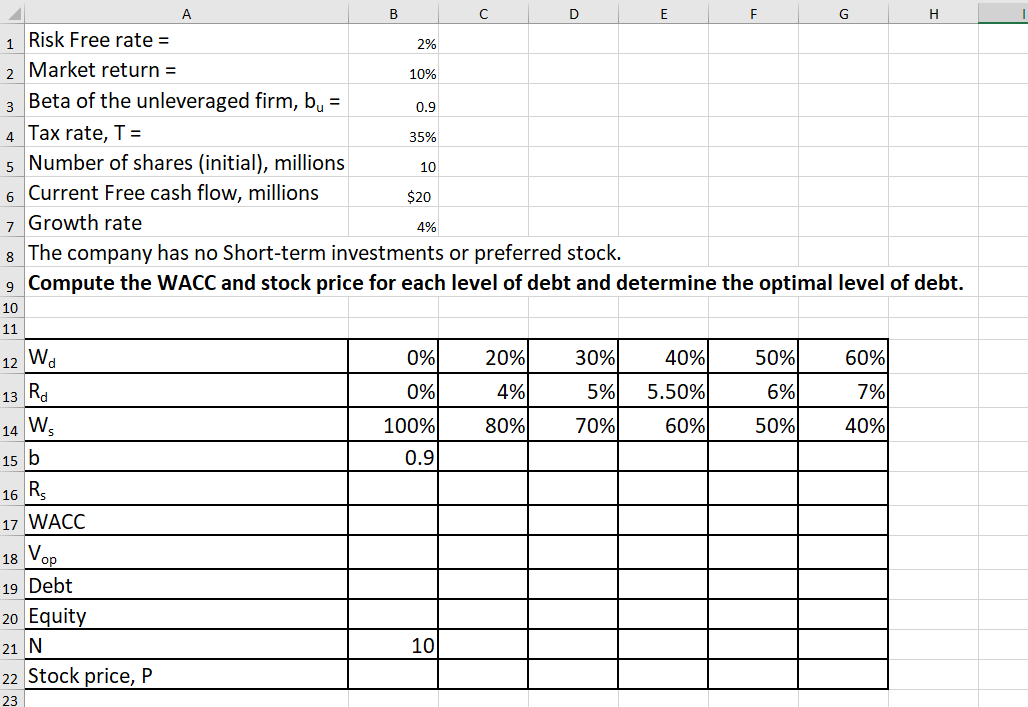

Question: B D E F. G G H 2% 10% 3 0.9 4 35% 1 Risk Free rate = 2 Market return = Beta of the

B D E F. G G H 2% 10% 3 0.9 4 35% 1 Risk Free rate = 2 Market return = Beta of the unleveraged firm, bu = Tax rate, T = 5 Number of shares (initial), millions 6 Current Free cash flow, millions $20 Growth rate 8 The company has no Short-term investments or preferred stock. 9 Compute the WACC and stock price for each level of debt and determine the optimal level of debt. 10 7 4% 10 11 12 Wa 0% 20% 30% 40% 50% 60% 0% 4% 5% 5.50% 6% 7% 40% 100% 80% 70% 60% 50% 0.9 13 Rd 14 Ws 15 b 16 RS 17 WACC 18 Vop 19 Debt 20 Equity 21 N 22 Stock price, P 23 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts