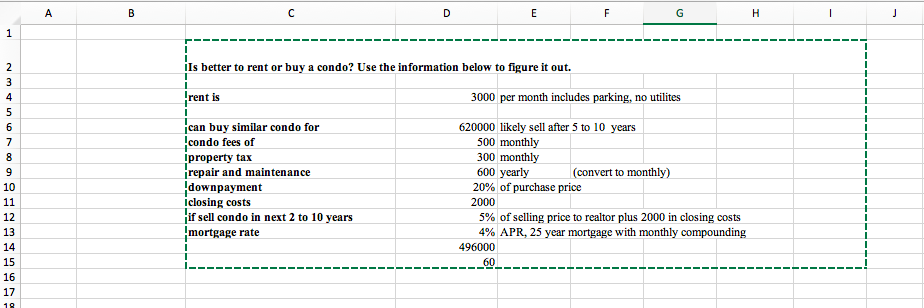

Question: B D E F G H 1 J 1 Is better to rent or buy a condo? Use the information below to figure it out.

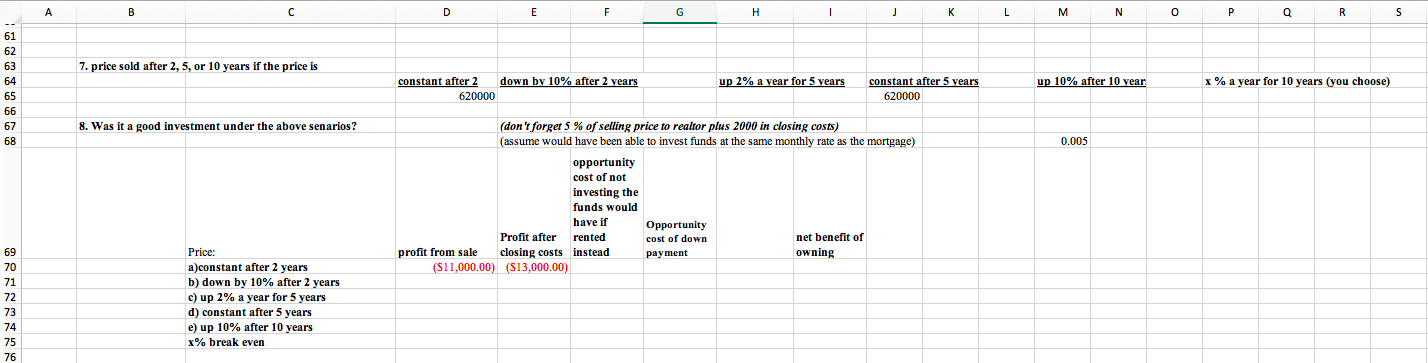

B D E F G H 1 J 1 Is better to rent or buy a condo? Use the information below to figure it out. 1 1 3000 per month includes parking, no utilites 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 rent is 1 can buy similar condo for condo fees of property tax repair and maintenance downpayment iclosing costs if sell condo in next 2 to 10 years mortgage rate 620000 likely sell after 5 to 10 years 500 monthly 300 monthly 600 yearly (convert to monthly) 20% of purchase price 2000 5% of selling price to realtor plus 2000 in closing costs 4% APR, 25 year mortgage with monthly compounding 496000 60 B D E F G H 1 J K L M N o P Q R S 7. price sold after 2,5, or 10 years if the price is up 2% a year for 5 years up 10% after 10 year x % a year for 10 years (you choose) 61 62 63 64 65 66 67 68 constant after 2 down by 10% after 2 years 620000 constant after 5 years 620000 8. Was it a good investment under the above senarios? 0.005 (don't forget 5 % of selling price to realtor plus 2000 in closing costs) (assume would have been able to invest funds at the same monthly rate as the mortgage) opportunity cost of not investing the funds would have if Opportunity Profit after rented cost of down net benefit of profit from sale closing costs instead payment owning (S11,000.00) (S13,000.00) 69 70 71 72 73 74 75 76 Price: a)constant after 2 years b) down by 10% after 2 years c) up 2% a year for 5 years 1) constant after 5 years e) up 10% after 10 years x% break even B D E F G H 1 J 1 Is better to rent or buy a condo? Use the information below to figure it out. 1 1 3000 per month includes parking, no utilites 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 rent is 1 can buy similar condo for condo fees of property tax repair and maintenance downpayment iclosing costs if sell condo in next 2 to 10 years mortgage rate 620000 likely sell after 5 to 10 years 500 monthly 300 monthly 600 yearly (convert to monthly) 20% of purchase price 2000 5% of selling price to realtor plus 2000 in closing costs 4% APR, 25 year mortgage with monthly compounding 496000 60 B D E F G H 1 J K L M N o P Q R S 7. price sold after 2,5, or 10 years if the price is up 2% a year for 5 years up 10% after 10 year x % a year for 10 years (you choose) 61 62 63 64 65 66 67 68 constant after 2 down by 10% after 2 years 620000 constant after 5 years 620000 8. Was it a good investment under the above senarios? 0.005 (don't forget 5 % of selling price to realtor plus 2000 in closing costs) (assume would have been able to invest funds at the same monthly rate as the mortgage) opportunity cost of not investing the funds would have if Opportunity Profit after rented cost of down net benefit of profit from sale closing costs instead payment owning (S11,000.00) (S13,000.00) 69 70 71 72 73 74 75 76 Price: a)constant after 2 years b) down by 10% after 2 years c) up 2% a year for 5 years 1) constant after 5 years e) up 10% after 10 years x% break even

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts