Question: B D E G H K You have been considering diversifying your portfolio by adding some bonds. Your choices have come down to these two

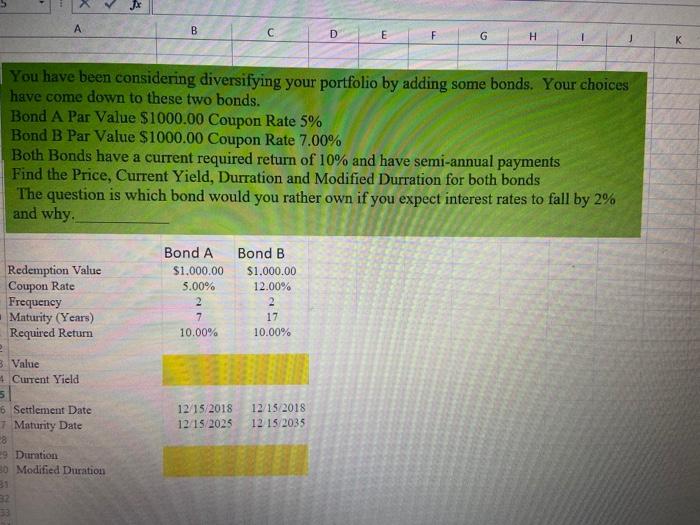

B D E G H K You have been considering diversifying your portfolio by adding some bonds. Your choices have come down to these two bonds. Bond A Par Value $1000.00 Coupon Rate 5% Bond B Par Value $1000.00 Coupon Rate 7.00% Both Bonds have a current required return of 10% and have semi-annual payments Find the Price, Current Yield, Durration and Modified Durration for both bonds The question is which bond would you rather own if you expect interest rates to fall by 2% and why. Bond A $1.000,00 5.00% 2 7 10.00% Bond B $1.000.00 12.00% 2 17 10.00% Redemption Value Coupon Rate Frequency Maturity (Years) Required Return 2 3. Value Current Yield 5 6 Settlement Date 7 Maturity Date 8 9 Duration 30 Modified Duration 12/15/2018 12/15/2025 12/15/2018 12 15/2035

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts