Question: b. Determine the cost per unit for overhead when using direct labor hours as the allocation base and when using ABC. ( Round intermediate calculations

b.

b.

| Determine the cost per unit for overhead when using direct labor hours as the allocation base and when using ABC. (Round intermediate calculations and final answers to 2 decimal places.) |

| 2. | Spiro Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow. | | | | | Activities | | | | | | | | | Unit Level | Batch Level | Product Level | Facility Level | | | | Cost | $90,000 | $20,000 | $10,000 | $120,000 | | | | Cost driver | 1,500 labor hrs. | 40 setups | Percentage of use | 12,000 units | | | | | Production of 800 sets of cutting shears, one of the companys 20 products, took 200 labor hours and 6 setups and consumed 15 percent of the product-sustaining activities. | | | | a. | Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? | | | | | | | | | | | b. | How much overhead is allocated to the cutting shears using activity-based costing? | | | | | | | | | | | c. | Compute the overhead cost per unit for cutting shears first using activity-based costing and then using direct labor hours for allocation if 800 units are produced. If direct product costs are $120 and the product is priced at 30 percent above cost, for what price would the product sell under each allocation system? (Round intermediate calculations and final answers to 2 decimal places.) | | | | | | | | |

| | |

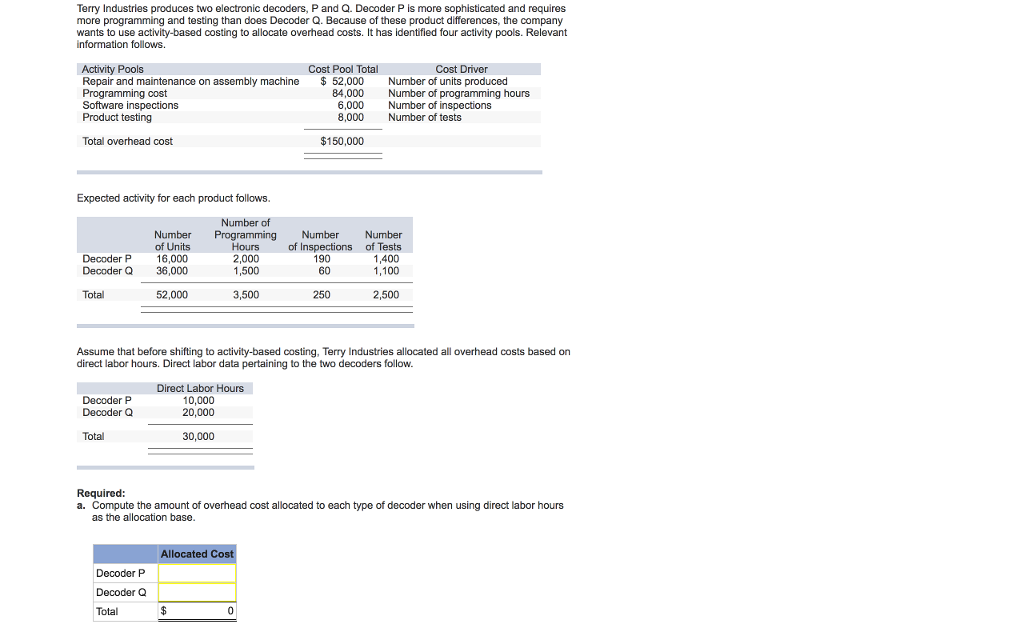

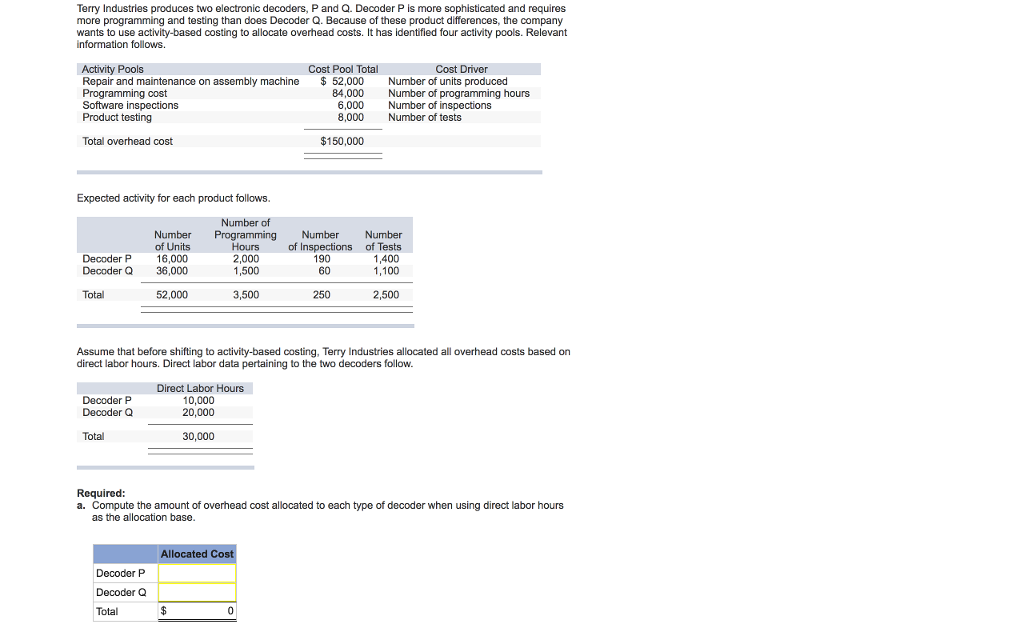

Terry Industries produces two electronic decoders, Pand Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to allocate overhead costs. It has identified four activity pools. Relevant information follows. Activity Pools Cost Pool Total Cost Drive Repair and maintenance on assembly machine 52,000 Number of units produced Programming cost 84,000 Number of programming hours 6,000 Number of inspections Software inspections Product testing 8,000 Number of tests Total overhead cost $150,000 Expected activity for each product follows. Number of Number Programming Number Number of Units Hours of Inspections of Tests Decoder P 6,000 2,000 90 1,400 Decoder Q 36,000 60 1,100 1,500 Total 52,000 3,500 2,500 250 Assume that before shifting to activity-based costing, Terry Industries allocated all overhead costs based on direct labor hours. Direct labor data pertaining to the two decoders follow. Direct Labor Hours 10,000 Decoder P Decoder Q 20,000 30,000 Required: a. Compute the amount of overhead cost allocated to each type of decoder when using direct labor hours as the allocation base. Allocated Co Decoder P Decoder Q Total

b.

b.