Question: determine the cost per unit for overhead when using direct labor hours as the allocation base and when using ABC Snowden Industries produces two electronic

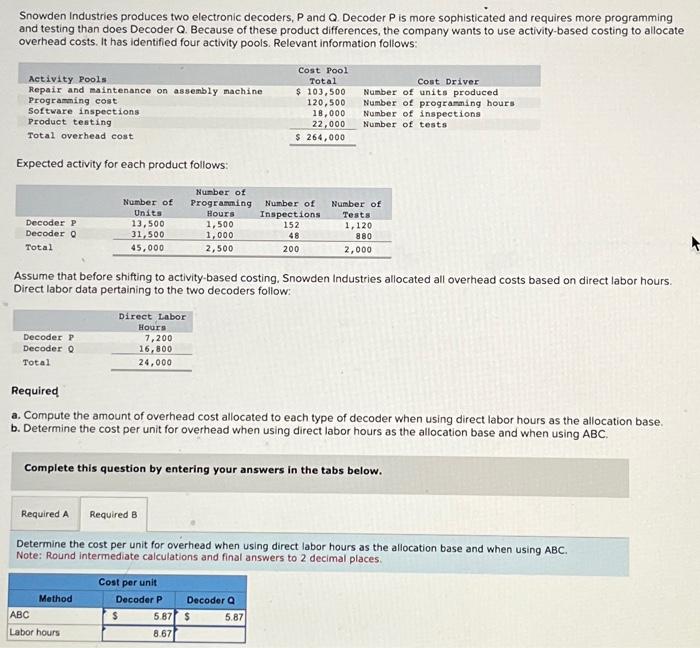

Snowden Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to allocate overhead costs. It has identifled four activity pools. Relevant information follows: Expected activity for each product follows: Assume that before shifting to activity-based costing. Snowden Industries allocated all overhead costs based on direct labor hours. Direct labor data pertaining to the two decoders follow: Required a. Compute the amount of overhead cost allocated to each type of decoder when using direct labor hours as the allocation base. b. Determine the cost per unit for overhead when using direct labor hours as the allocation base and when using ABC. Complete this question by entering your answers in the tabs below. Determine the cost per unit for overhead when using direct labor hours as the allocation base and when using ABC. Note: Round intermediate calculations and final answers to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts