Question: b . Does a taxpayer's accounting method affect the total amount of income reported over an extended time period? A . Accounting methods generally affect

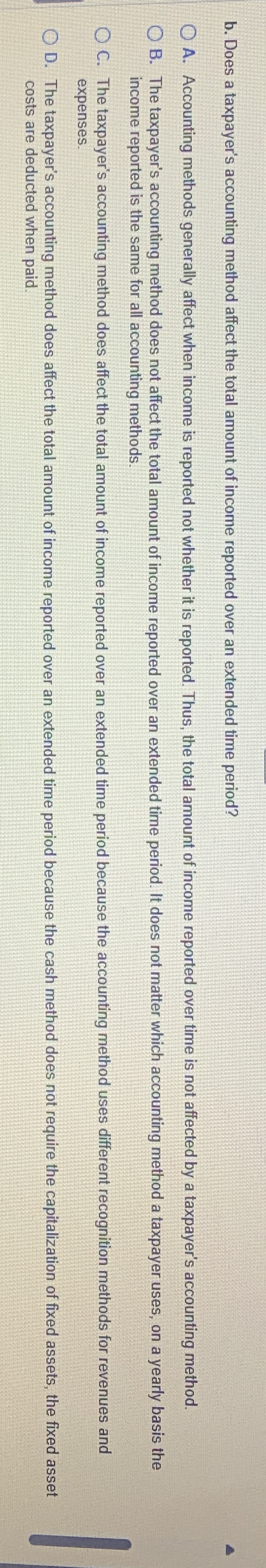

b Does a taxpayer's accounting method affect the total amount of income reported over an extended time period?

A Accounting methods generally affect when income is reported not whether it is reported. Thus, the total amount of income reported over time is not affected by a taxpayer's accounting method.

B The taxpayer's accounting method does not affect the total amount of income reported over an extended time period. It does not matter which accounting method a taxpayer uses, on a yearly basis the income reported is the same for all accounting methods.

C The taxpayer's accounting method does affect the total amount of income reported over an extended time period because the accounting method uses different recognition methods for revenues and expenses.

D The taxpayer's accounting method does affect the total amount of income reported over an extended time period because the cash method does not require the capitalization of fixed assets, the fixed asset costs are deducted when paid.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock