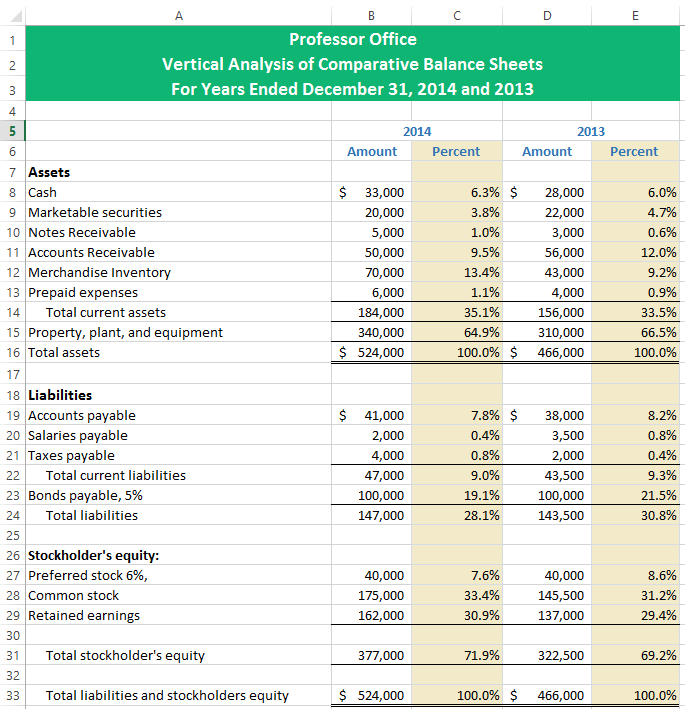

Question: B E 1 A Professor Office Vertical Analysis of Comparative Balance Sheets For Years Ended December 31, 2014 and 2013 2 3 4 5 2014

B E 1 A Professor Office Vertical Analysis of Comparative Balance Sheets For Years Ended December 31, 2014 and 2013 2 3 4 5 2014 Amount Percent 2013 Amount Percent 6 $ 33,000 20,000 5,000 50,000 70,000 6,000 184,000 340,000 $ 524,000 6.3% $ 3.8% 1.0% 9.5% 13.4% 1.1% 35.1% 64.9% 100.0% $ 28,000 22,000 3,000 56,000 43,000 4,000 156,000 310,000 466,000 6.0% 4.7% 0.6% 12.0% 9.2% 0.9% 33.5% 66.5% 100.0% 7 Assets 8 Cash 9 Marketable securities 10 Notes Receivable 11 Accounts Receivable 12 Merchandise Inventory 13 Prepaid expenses 14 Total current assets 15 Property, plant, and equipment 16 Total assets 17 18 Liabilities 19 Accounts payable 20 Salaries payable 21 Taxes payable 22 Total current liabilities 23 Bonds payable, 5% 24 Total liabilities 25 26 Stockholder's equity: 27 Preferred stock 6%, 28 Common stock 29 Retained earnings 30 31 Total stockholder's equity 32 33 Total liabilities and stockholders equity $ 41,000 2,000 4,000 47,000 100,000 147,000 7.8% $ 0.4% 0.8% 9.0% 19.1% 28.1% 38,000 3,500 2,000 43,500 100,000 143,500 8.2% 0.8% 0.4% 9.3% 21.5% 30.8% 40,000 175,000 162,000 7.6% 33.4% 30.9% 40,000 145,500 137,000 8.6% 31.2% 29.4% 377,000 71.9% 322,500 69.2% $ 524,000 100.0% $ 466,000 100.0% B E 1 A Professor Office Vertical Analysis of Comparative Balance Sheets For Years Ended December 31, 2014 and 2013 2 3 4 5 2014 Amount Percent 2013 Amount Percent 6 $ 33,000 20,000 5,000 50,000 70,000 6,000 184,000 340,000 $ 524,000 6.3% $ 3.8% 1.0% 9.5% 13.4% 1.1% 35.1% 64.9% 100.0% $ 28,000 22,000 3,000 56,000 43,000 4,000 156,000 310,000 466,000 6.0% 4.7% 0.6% 12.0% 9.2% 0.9% 33.5% 66.5% 100.0% 7 Assets 8 Cash 9 Marketable securities 10 Notes Receivable 11 Accounts Receivable 12 Merchandise Inventory 13 Prepaid expenses 14 Total current assets 15 Property, plant, and equipment 16 Total assets 17 18 Liabilities 19 Accounts payable 20 Salaries payable 21 Taxes payable 22 Total current liabilities 23 Bonds payable, 5% 24 Total liabilities 25 26 Stockholder's equity: 27 Preferred stock 6%, 28 Common stock 29 Retained earnings 30 31 Total stockholder's equity 32 33 Total liabilities and stockholders equity $ 41,000 2,000 4,000 47,000 100,000 147,000 7.8% $ 0.4% 0.8% 9.0% 19.1% 28.1% 38,000 3,500 2,000 43,500 100,000 143,500 8.2% 0.8% 0.4% 9.3% 21.5% 30.8% 40,000 175,000 162,000 7.6% 33.4% 30.9% 40,000 145,500 137,000 8.6% 31.2% 29.4% 377,000 71.9% 322,500 69.2% $ 524,000 100.0% $ 466,000 100.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts