Question: b) Each individual has an expected utility function that looks like the following: EU=pin(+ (1-2)50). where p is the probability of an accident, F is

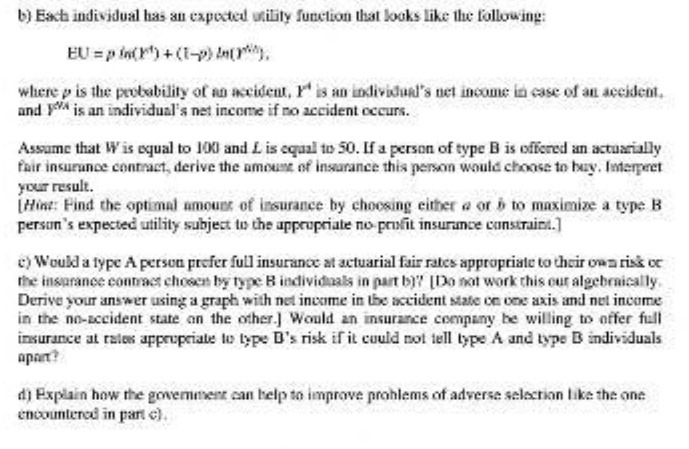

b) Each individual has an expected utility function that looks like the following: EU=pin(+ (1-2)50). where p is the probability of an accident, F is an individual's net income in case of an accident. and You is an individual's net income if no accident occurs. Assume that W is equal to 100 and L is equal to 50. If a person of type B is offered an actuarially fair insurance contract, derive the amount of insurance this person would choose to buy, Interpret your result. [ Hint: Find the optimal amount of insurance by choosing either a or b to maximize a type B person's expected utility subject to the appropriate no profit insurance constraint.] () Would a type A person prefer full insurance at actuarial fair rates appropriate to their own risk or the insprance contact chosen by type B individuals in part b) [Do not work this our algebraically. Derive your answer using a graph with net income in the accident Mate on one axis and net income in the no-accident state on the other.) Would an insurance company be willing to offer full insurance at cales appropriate to type D's risk if it could not tell type A and type B individuals d) Explain how the government can belp to improve problems of adverse selection like the one encountered in part c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts