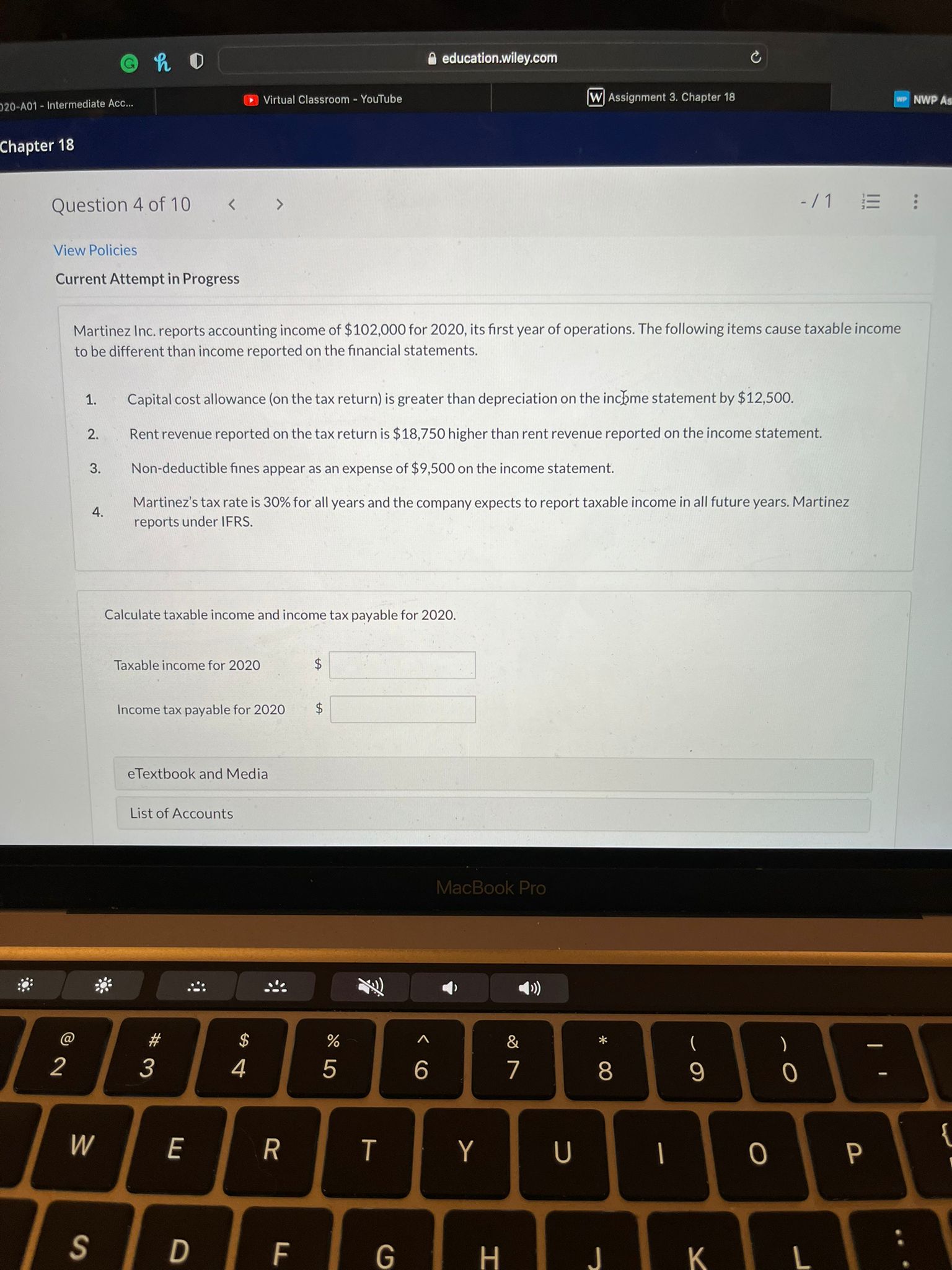

Question: B educationmileycom Question4of10 -/1 E View Policies Current Attempt in Progress Martinez lnc. reports accounting income of $102,000 for 2020, its rst year of operations.

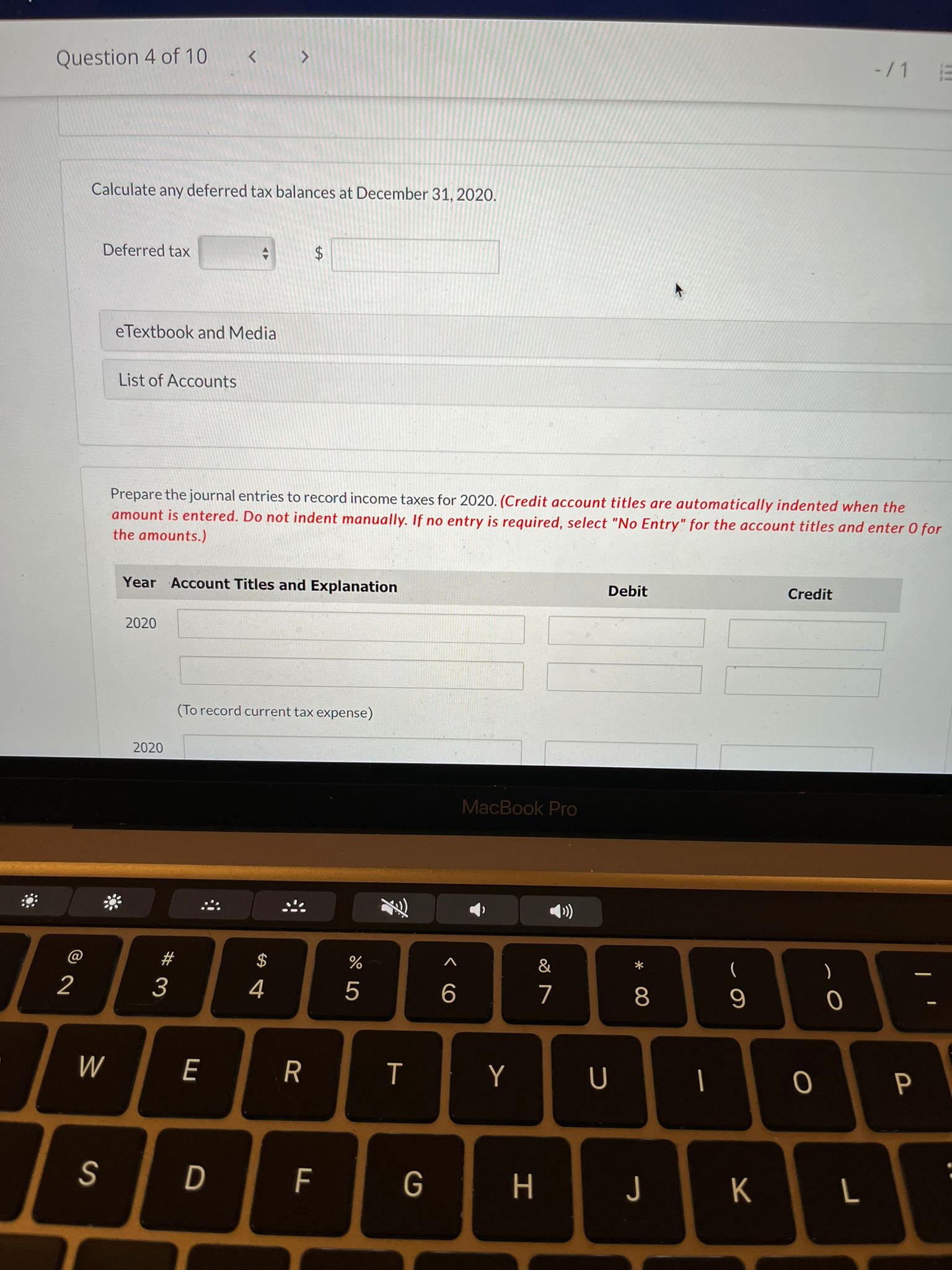

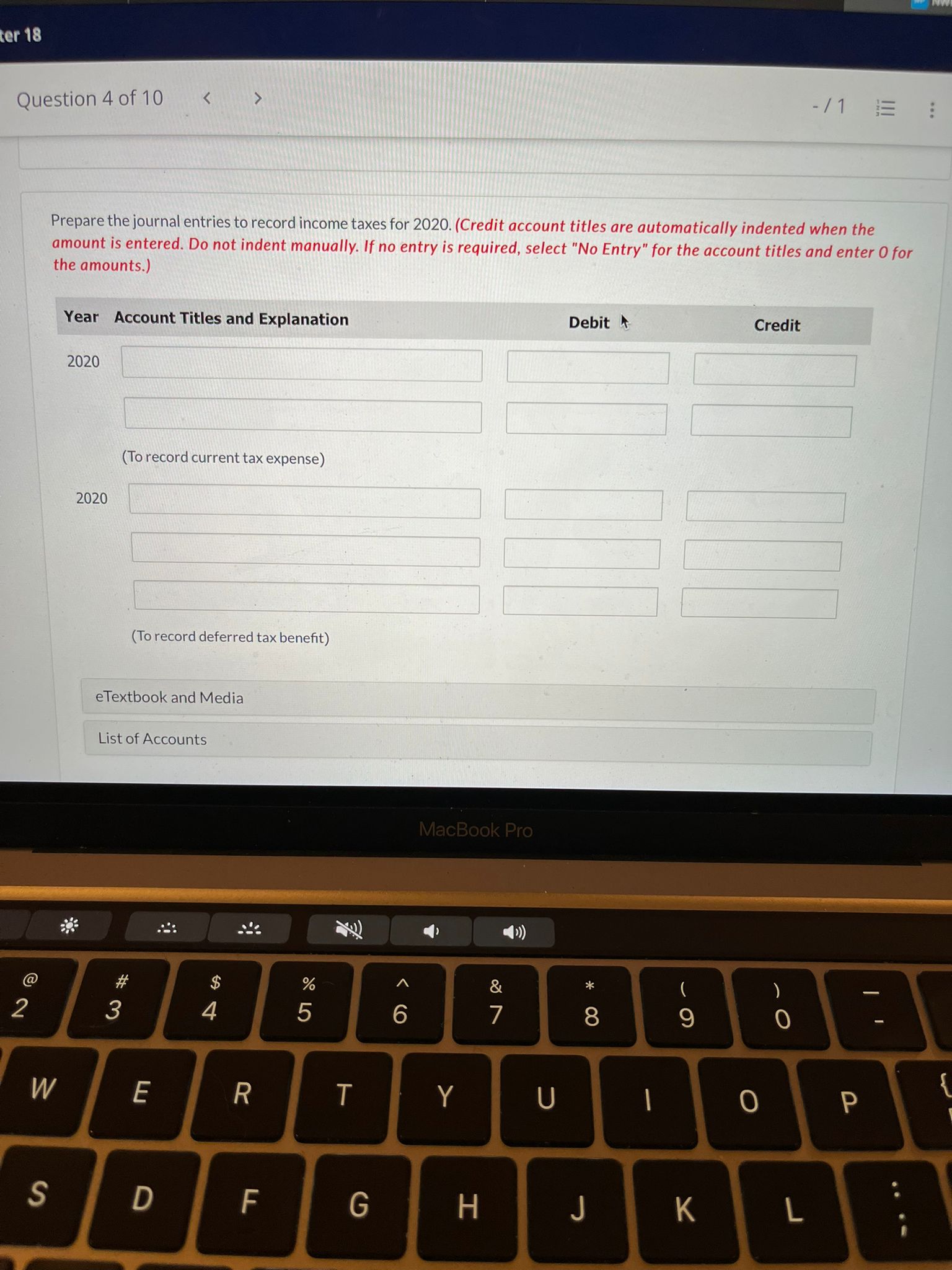

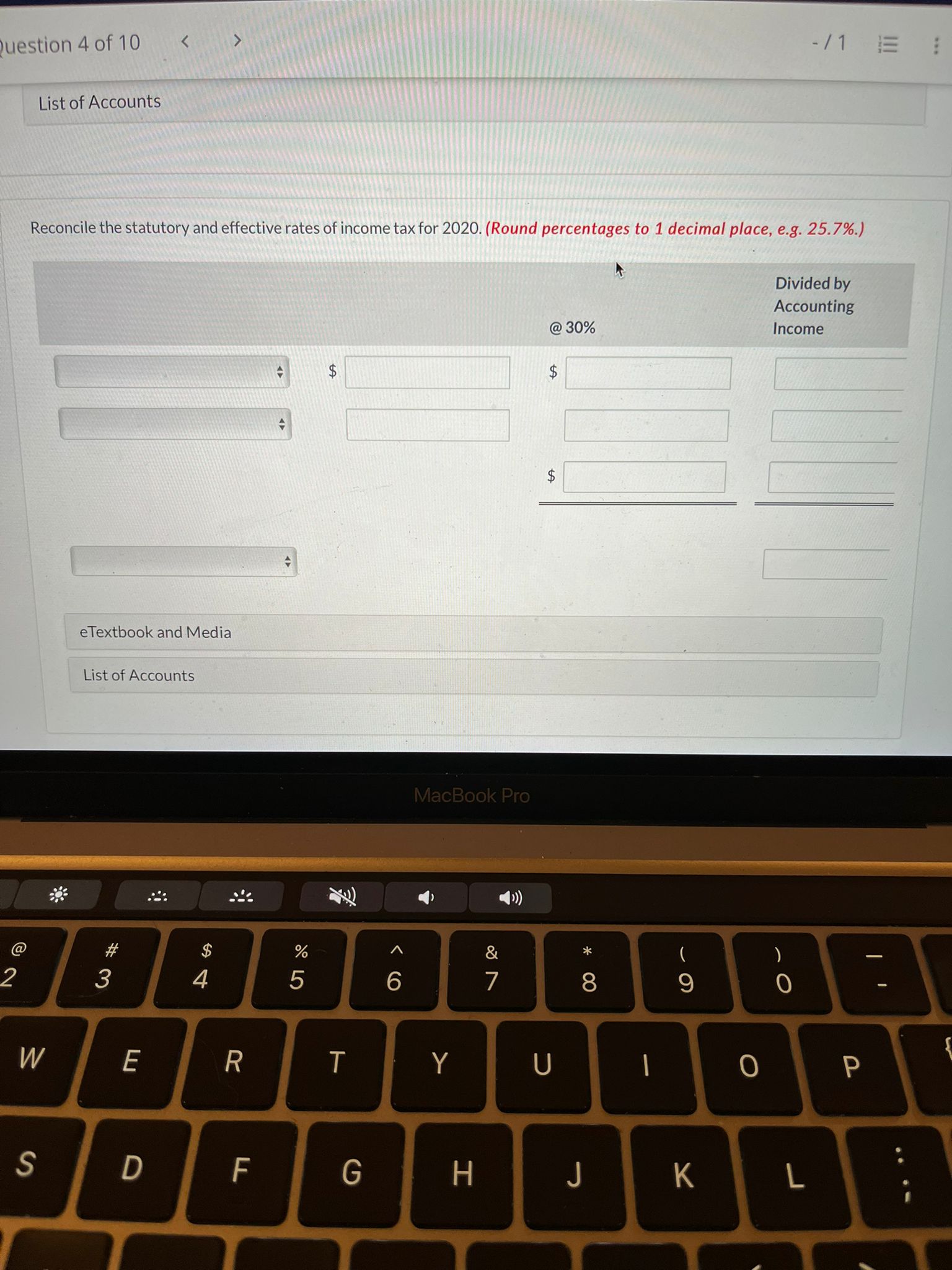

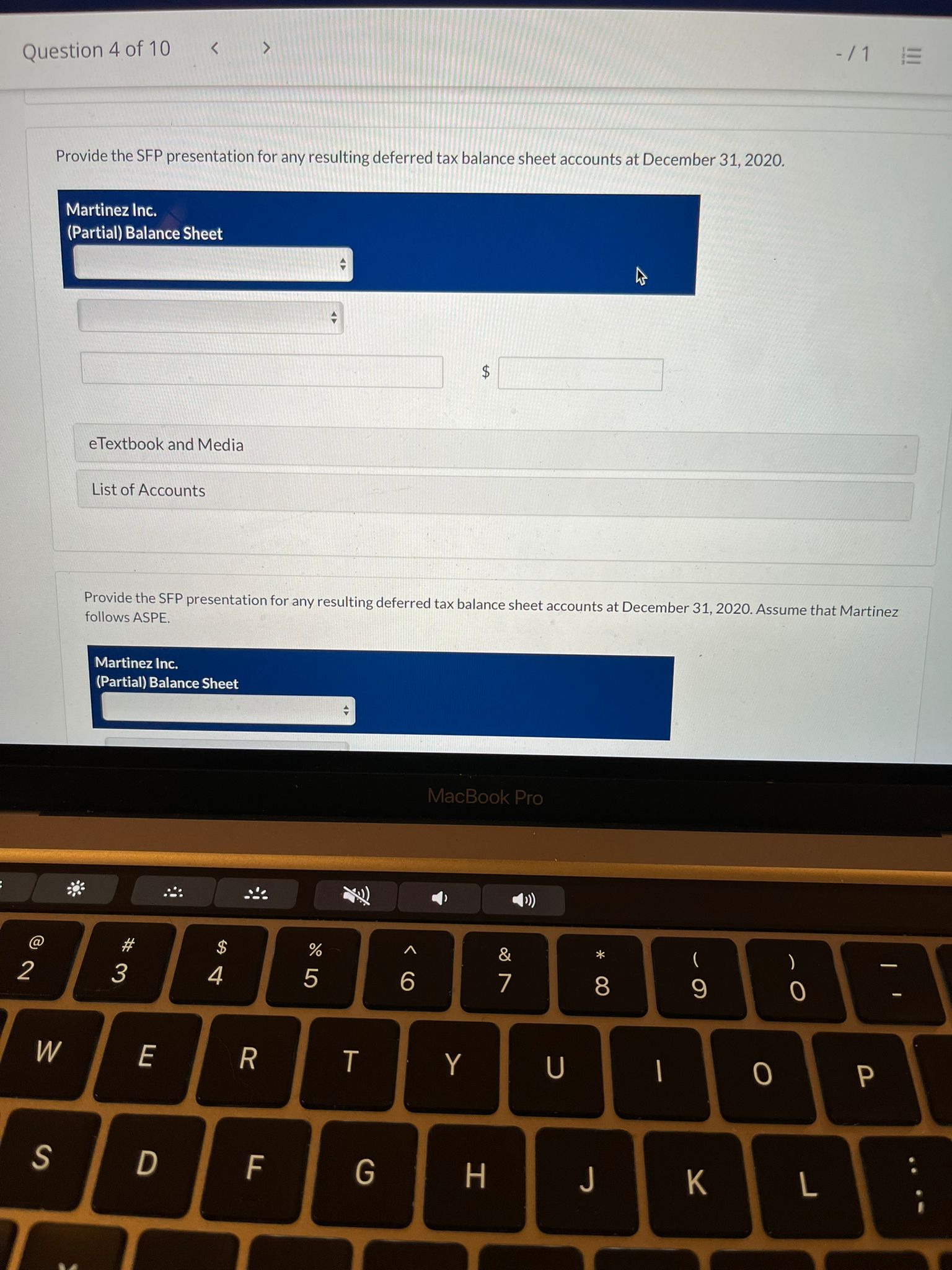

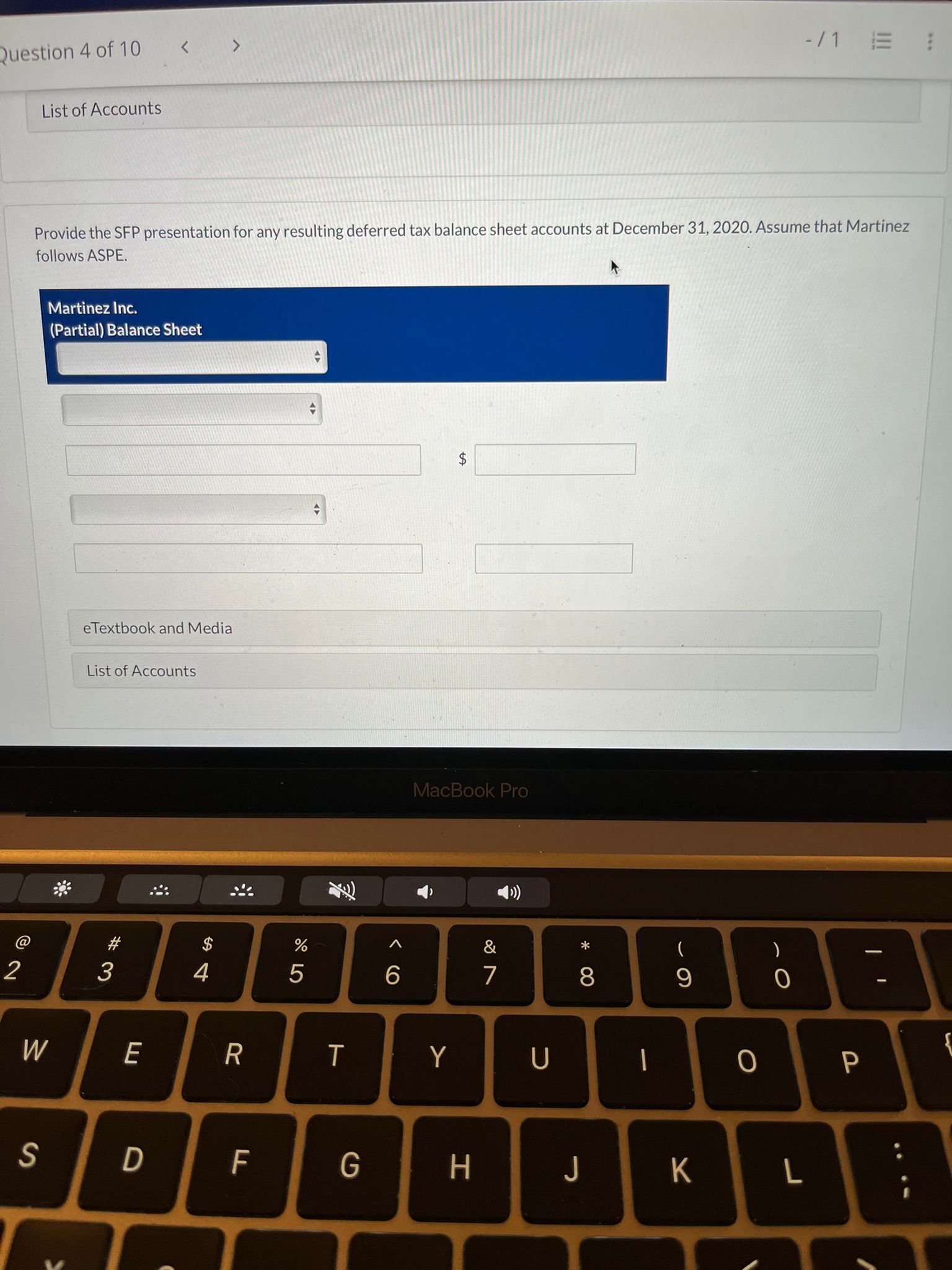

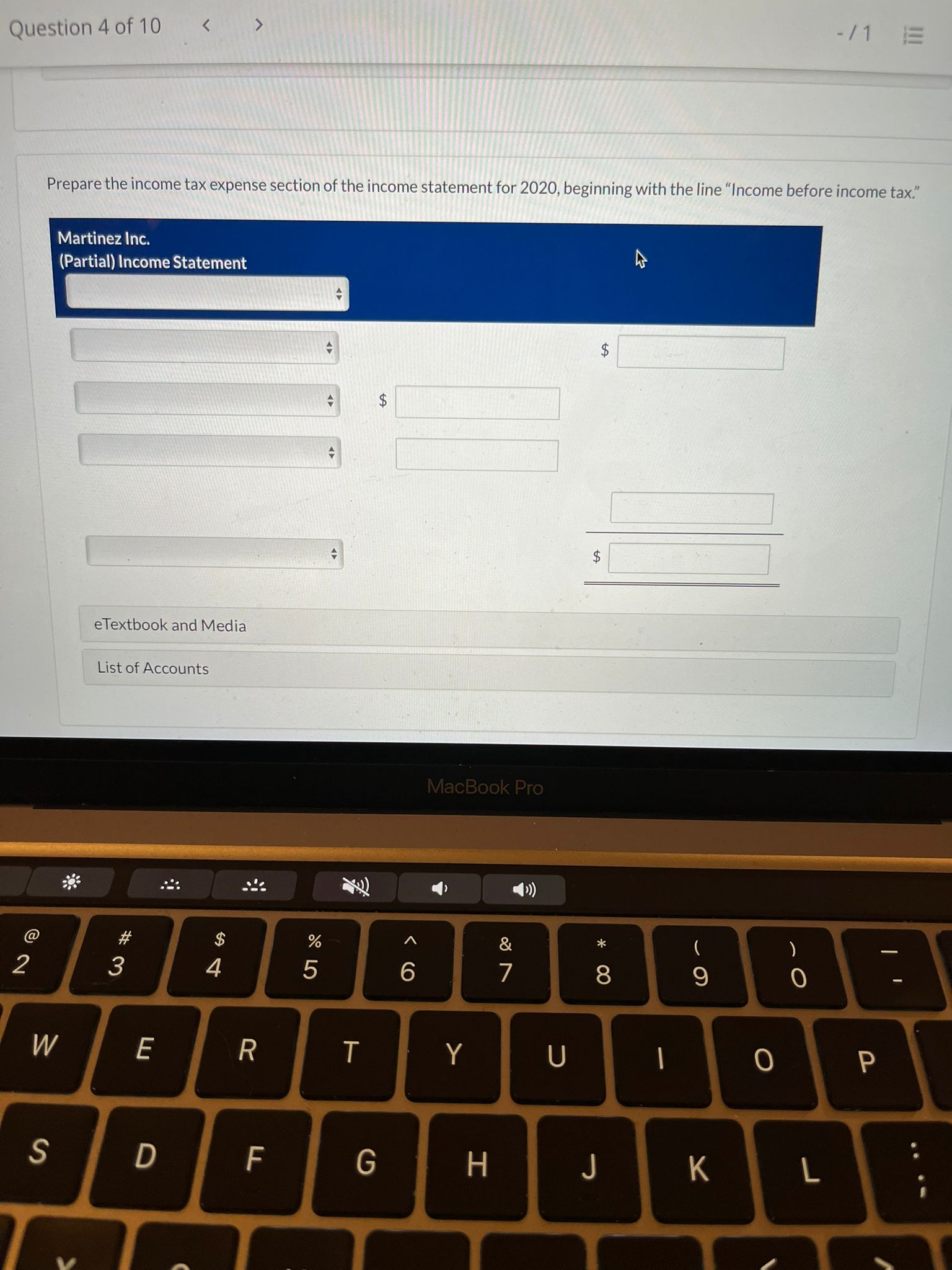

B educationmileycom Question4of10 -/1 E View Policies Current Attempt in Progress Martinez lnc. reports accounting income of $102,000 for 2020, its rst year of operations. The following items cause taxable income to be different than income reported on the nancial statements. 1. Capital cost allowance (on the tax return) is greater than depreciation on the incI)me statement by $12,500. 2. Rent revenue reported on the tax return is $18,750 higher than rent revenue reported on the income statement. 3. Non-deductible nes appear as an expense of $9,500 on the income statement. Martinez's tax rate is 30% for all years and the company expects to report taxabie income in all future years. Martinez reports under lFRS. Calculate taxable income and income tax payable for 2020. Taxable income for 2020 $ ; income tax payab'le for 2020 $ eTextbook and Media List of Accounts Question 4 of 10 - /1 Calculate any deferred tax balances at December 31, 2020. Deferred tax eTextbook and Media List of Accounts Prepare the journal entries to record income taxes for 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Year Account Titles and Explanation Debit Credit 2020 (To record current tax expense) 2020 MacBook Pro 1)) # $ % 5 6 O N 8 9 W E R T Y U O P S D F G H KQuestion4of10 _ -/1 E 5 | l Prepare thejournal entries to record income taxes for 2020. (Credit account titles are automatically indented when the ' amount is entered. Do not indent manually. lf no entry is required, select "No Entry" for the account titles and enter 0 for f the amounts.) ' Year Account Titles and Explanation Debit k; Credit : 2020 - \" (To record current tax expense) ' (To record deferred tax benet) ' eTextbook and Media 1 l 1 List of Accounts 5 Question 4 of 10 - 11 E Provide the SFP presentation for any resulting deferred tax balance sheet accounts at December 31, 2020. Martinez Inc. (Partial) Balance Sheet $ eTextbook and Media List of Accounts Provide the SFP presentation for any resulting deferred tax balance sheet accounts at December 31, 2020. Assume that Martinez follows ASPE. Martinez Inc. (Partial) Balance Sheet MacBook Pro # $ o & PK 3 5 8 9 O W E R T Y U O P S D F G H J K- /1 E Question 4 of 10 List of Accounts Provide the SFP presentation for any resulting deferred tax balance sheet accounts at December 31, 2020. Assume that Martinez follows ASPE. Martinez Inc. (Partial) Balance Sheet to eTextbook and Media List of Accounts MacBook Pro & @ $ % K # 4 5 6 9 O 2 3 W E R T Y U O P S D F G H K- /1 E Question 4 of 10 Prepare the income tax expense section of the income statement for 2020, beginning with the line "Income before income tax." Martinez Inc. (Partial) Income Statement to 4 to $ eTextbook and Media List of Accounts MacBook Pro @ A PK # % N 3 A 5 6 8 9 W E R T Y U O P S D F G H K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts