Question: b) Excellent Berhad recognised a deferred tax liability for the year ended 31 March 2014 which was related solely to a difference between rates of

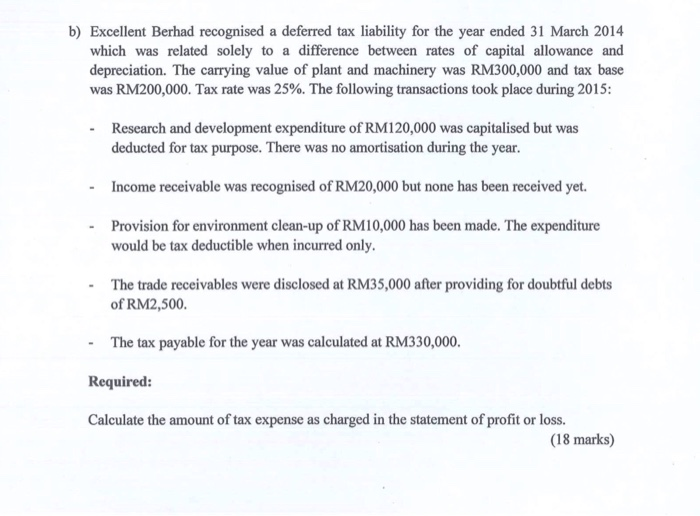

b) Excellent Berhad recognised a deferred tax liability for the year ended 31 March 2014 which was related solely to a difference between rates of capital allowance and depreciation. The carrying value of plant and machinery was RM300,000 and tax base was RM200,000. Tax rate was 25%. The following transactions took place during 2015: Research and development expenditure of RM120,000 was capitalised but was - deducted for tax purpose. There was no amortisation during the year. Income receivable was recognised of RM20,000 but none has been received yet. Provision for environment clean-up of RM10,000 has been made. The expenditure would be tax deductible when incurred only. The trade receivables were disclosed at RM35,000 after providing for doubtful debts of RM2,500 The tax payable for the year was calculated at RM330,000. Required: Calculate the amount of tax expense as charged in the statement of profit or loss. (18 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts