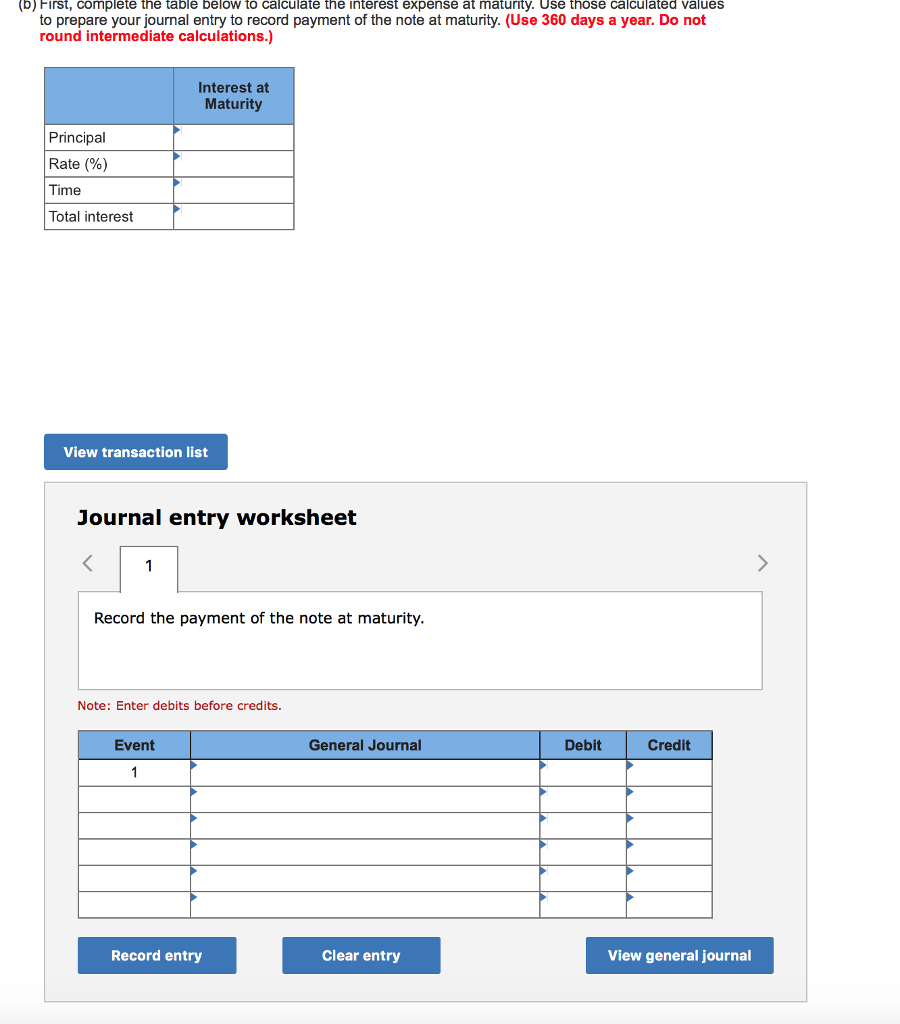

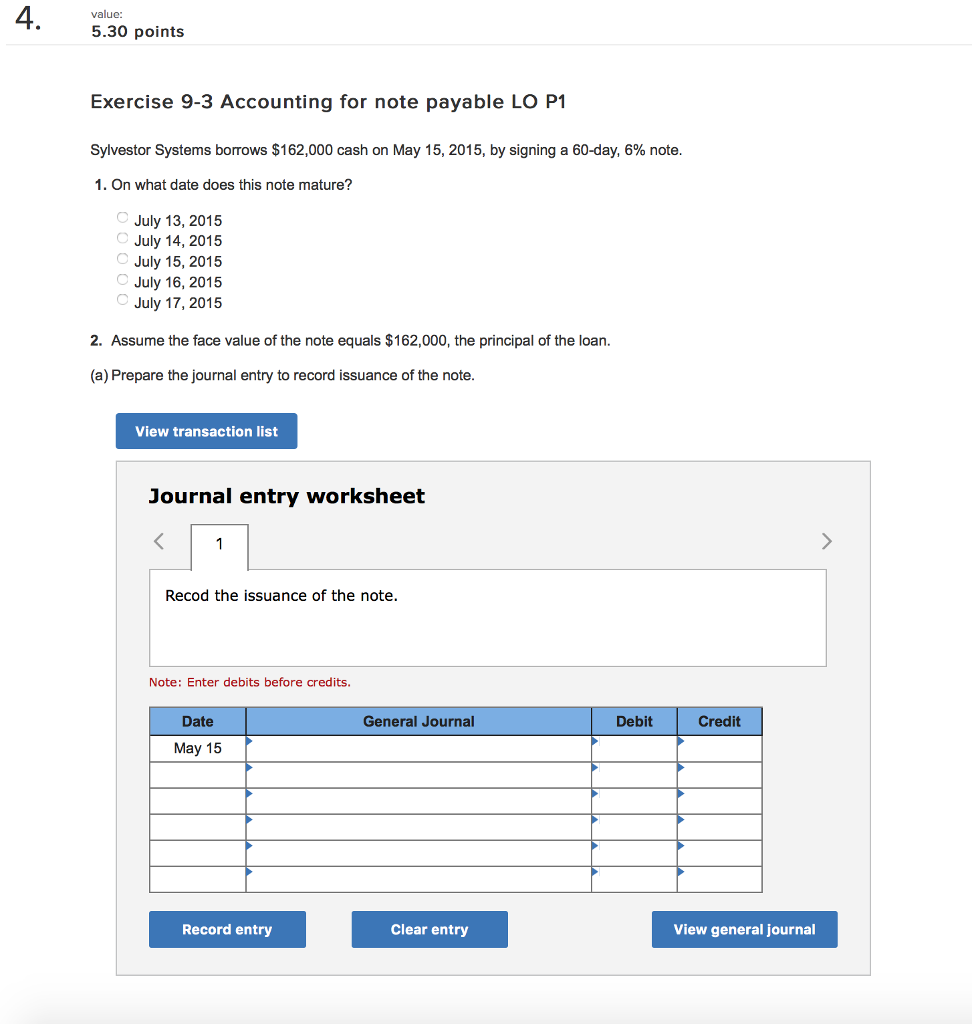

Question: b) First, complete the table below to calculate the interest expense at maturty. Use those calculated values to prepare your journal entry to record payment

b) First, complete the table below to calculate the interest expense at maturty. Use those calculated values to prepare your journal entry to record payment of the note at maturity. (Use 360 days a year. Do not round intermediate calculations.) Interest at Maturity Principal Rate (%) Time Total interest View transaction list Journal entry worksheet Record the payment of the note at maturity. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts