Question: b) Gading Group Berhad is doing a profitability analysis to build a 100,000 tonne/year Methanol plant in Tanjung Langsat, Johor. Table 2.2 shows the cash

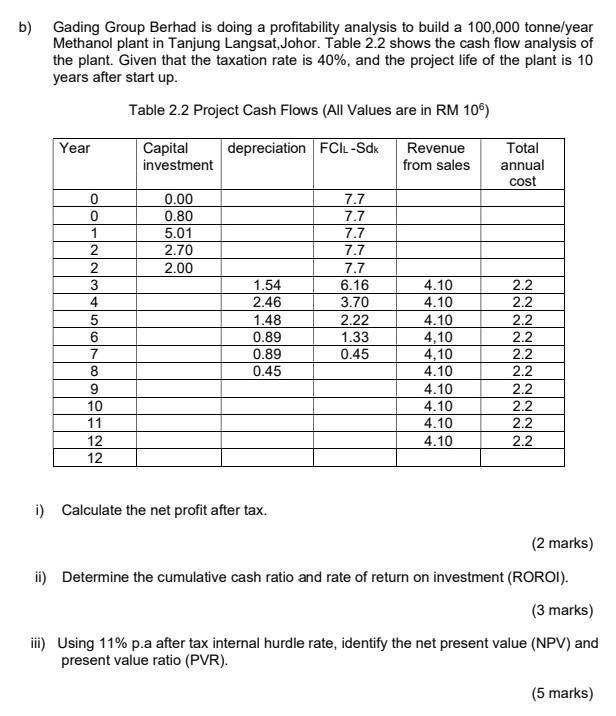

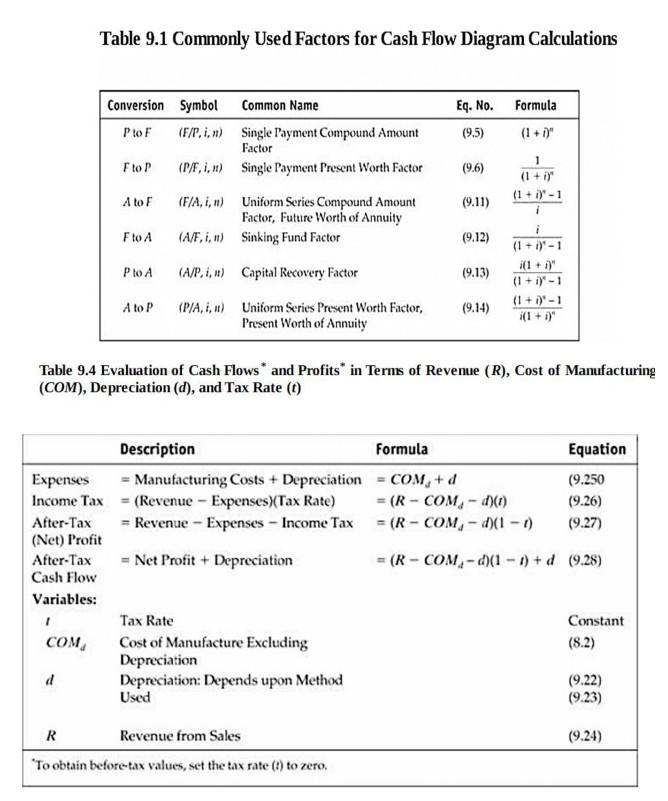

b) Gading Group Berhad is doing a profitability analysis to build a 100,000 tonne/year Methanol plant in Tanjung Langsat, Johor. Table 2.2 shows the cash flow analysis of the plant. Given that the taxation rate is 40%, and the project life of the plant is 10 years after start up. Table 2.2 Project Cash Flows (All Values are in RM 106) Year Capital investment depreciation FCIL-Sdk Revenue from sales Total annual cost 0.00 0.80 5.01 2.70 2.00 0 0 1 2 2 3 4 5 6 7 8 9 10 11 12 12 7.7 7.7 7.7 7.7 7.7 6.16 3.70 2.22 1.33 0.45 1.54 2.46 1.48 0.89 0.89 0.45 4.10 4.10 4.10 4,10 4,10 4.10 4.10 4.10 4.10 4.10 NNNNNNNNNN 2.2 2.2 2.2 2.2 2.2 2.2 2.2 2.2 2.2 2.2 i) Calculate the net profit after tax. (2 marks) ii) Determine the cumulative cash ratio and rate of return on investment (ROROI). (3 marks) iii) Using 11% p.a after tax internal hurdle rate, identify the net present value (NPV) and present value ratio (PVR). (5 marks) Table 9.1 Commonly Used Factors for Cash Flow Diagram Calculations Conversion Symbol Common Name PtoF (F/P.i. n) Single Payment Compound Amount Factor to P (P/F,1,n) Single Payment Present Worth Factor Eq. No. Formula (9.5) (9.6) 1 (1 + i)" (1 + i) - 1 i A to F (9.11) (F/A.i,n) Uniform Series Compound Amount Factor, Future Worth of Annuity (A/F, 1, 1) Sinking Fund Factor i Fto A (9.12) PO A (A/P...#) Capital Recovery Factor (9.13) i(1 + 1)" (1 + i) - 1 (1 + i)-1 A to P (9.14) (P/A, 1, ) Uniform Series Present Worth Factor, Present Worth of Annuity Table 9.4 Evaluation of Cash Flows and Profits* in Terms of Revenue (R), Cost of Manufacturing (COM), Depreciation (d), and Tax Rate (1) Formula Equation = COM,+ d = (R-COM, -d)() = (R-COM, -d)(1 - 1) (9.250 (9.26) (9.27) = (R-COM, -d)(1 - 1) + d (9.28) Description Expenses = Manufacturing Costs + Depreciation Income Tax = (Revenue - Expenses)(Tax Rate) After-Tax = Revenue - Expenses - Income Tax (Net) Profit After-Tax = Net Profit + Depreciation Cash Flow Variables: Tax Rate COM Cost of Manufacture Excluding Depreciation d Depreciation: Depends upon Method Used 1 Constant (8.2) (9.22) (9.23) (9.24) R Revenue from Sales *To obtain before tax values, set the tax rate (1) to zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts