Question: need as soon as possible please b) Gading Group Berhad is doing a profitability analysis to build a 100,000 tonne/year Methanol plant in Tanjung Langsat,

need as soon as possible please

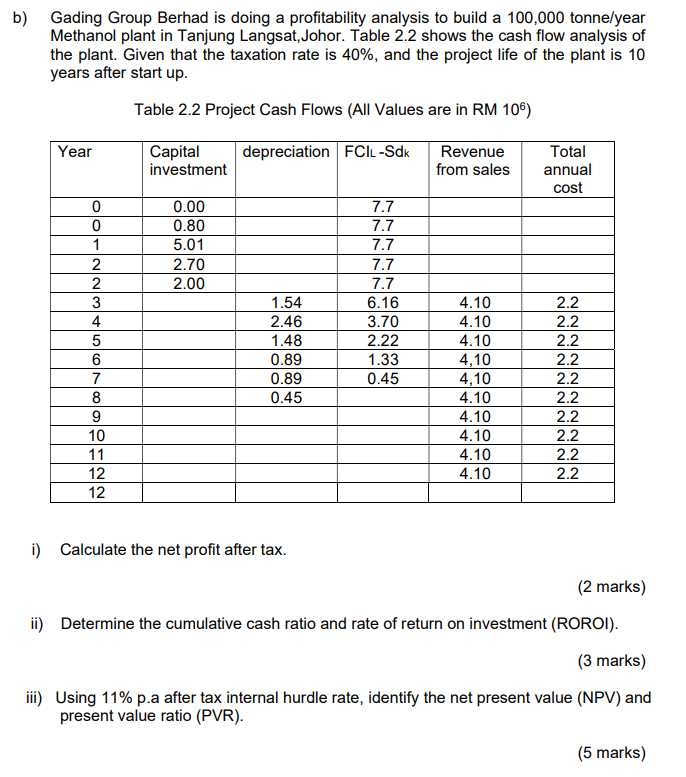

b) Gading Group Berhad is doing a profitability analysis to build a 100,000 tonne/year Methanol plant in Tanjung Langsat, Johor. Table 2.2 shows the cash flow analysis of the plant. Given that the taxation rate is 40%, and the project life of the plant is 10 years after start up. Table 2.2 Project Cash Flows (All Values are in RM 106) Year Capital investment depreciation FCIL-Sdk Revenue from sales Total annual cost 0 0 1 0.00 0.80 5.01 2.70 2.00 WNN 7.7 7.7 7.7 7.7 7.7 6.16 3.70 2.22 1.33 0.45 NNN 1.54 2.46 1.48 0.89 0.89 0.45 4 5 6 7 8 9 10 11 12 12 4.10 4.10 4.10 4,10 4,10 4.10 4.10 4.10 4.10 4.10 2.2 2.2 2.2 2.2 2.2 2.2 2.2 2.2 2.2 2.2 i) Calculate the net profit after tax. (2 marks) ii) Determine the cumulative cash ratio and rate of return on investment (ROROI). (3 marks) iii) Using 11% p.a after tax internal hurdle rate, identify the net present value (NPV) and present value ratio (PVR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts