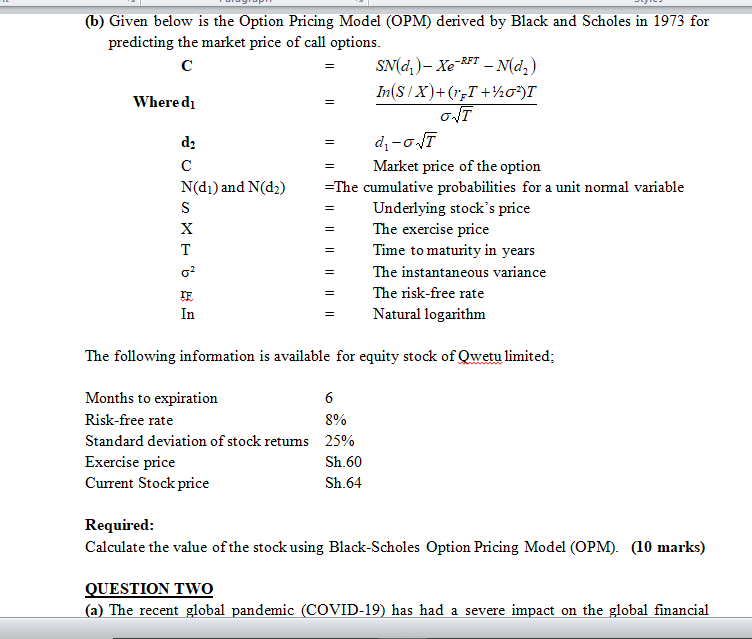

Question: (b) Given below is the Option Pricing Model (OPM) derived by Black and Scholes in 1973 for predicting the market price of call options. SN(d)-Xe-KFT

(b) Given below is the Option Pricing Model (OPM) derived by Black and Scholes in 1973 for predicting the market price of call options. SN(d)-Xe-KFT - N(d) Where di In(S/X)+(+4202) OVT dz di-ot Market price of the option N(d) and N(d) =The cumulative probabilities for a unit normal variable S Underlying stocks price X The exercise price T Time to maturity in years The instantaneous variance IF The risk-free rate In Natural logarithm The following information is available for equity stock of Qwetu limited; Months to expiration 6 Risk-free rate 8% Standard deviation of stock retums 25% Exercise price Sh.60 Current Stock price Sh.64 Required: Calculate the value of the stock using Black-Scholes Option Pricing Model (OPM). (10 marks) QUESTION TWO (a) The recent global pandemic (COVID-19) has had a severe impact on the global financial

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts