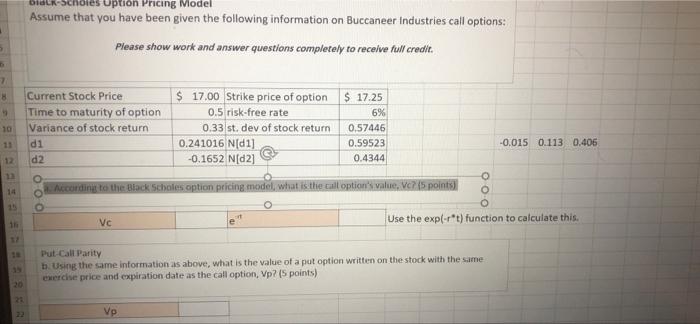

Question: first question second question Black-Scholes Option Pricing Model Assume that you have been given the following information on Buccaneer Industries call options: 5 Please show

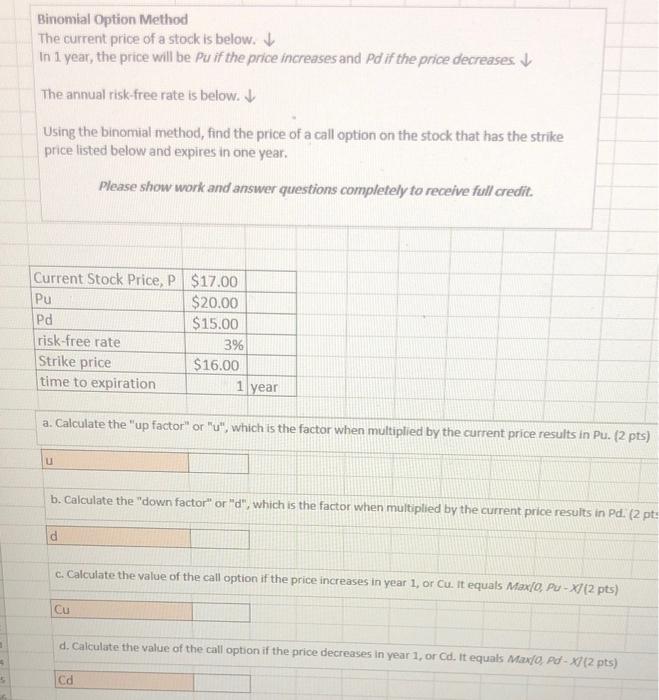

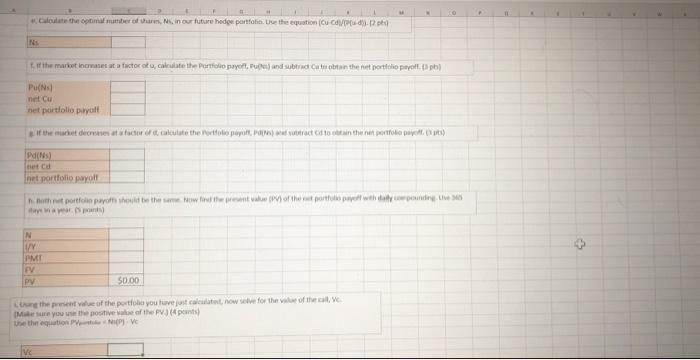

Black-Scholes Option Pricing Model Assume that you have been given the following information on Buccaneer Industries call options: 5 Please show work and answer questions completely to receive full credit. 6 7 8 Current Stock Price $ 17.00 Strike price of option $ 17.25 0.5 risk-free rate Time to maturity of option 6% Variance of stock return 0.33 st. dev of stock return 0.57446 d1 0.59523 0.241016 N[d1] -0.1652 N[d2] d2 0.4344 According to the Black Scholes option pricing model, what is the call option's value, Vc? (5 points) O Vc Put Call Parity b. Using the same information as above, what is the value of a put option written on the stock with the same exercise price and expiration date as the call option, Vp? (5 points) 20 23 Vp 22 9 10 11 12 13 14 15 16 37 18 000 -0.015 0.113 0.406 Use the exp(-rt) function to calculate this. 5 Binomial Option Method The current price of a stock is below. In 1 year, the price will be Pu if the price increases and Pd if the price decreases. The annual risk-free rate is below. Using the binomial method, find the price of a call option on the stock that has the strike price listed below and expires in one year. Please show work and answer questions completely to receive full credit. Current Stock Price, P $17.00 Pu $20.00 Pd $15.00 risk-free rate 3% Strike price $16.00 time to expiration 1 year a. Calculate the "up factor" or "u", which is the factor when multiplied by the current price results in Pu. (2 pts) u b. Calculate the "down factor" or "d", which is the factor when multiplied by the current price results in Pd. (2 pt: d c. Calculate the value of the call option if the price increases in year 1, or Cu. It equals Max[0, Pu-X/(2 pts) Cu d. Calculate the value of the call option if the price decreases in year 1, or Cd. It equals Max/0, Pd-X] (2 pts) Cd e Calculate the optimal number of shares, Ni, in our future hedge portfolio. Use the equation (Cu-Cd/Pu-d)). (2 ph Ns t. If the market increases at a factor of u, calculate the Portfolio payoff, Pue) and subtract Ca to obtain the net portfolio payoff (pb) Pu(N) net Cu net portfolio payoff If the market decreases at a factor of d calculate the Portfolio payoft, Pd) and subtract Cd to obtain the net portfolio payoff (3 pts) Pd(s) net Cd net portfolio payoff h. Both net portfolio payoffs should be the same Now find the present value (PV) of the net portfolio payoff with daily compounding Live days in a year (5) N VY PMI FV PV $0.00 Long the present value of the portfolio you have just calculatet, now solve for the value of the call, Ve (Make sure you use the positive value of the PV) (4 points) Une the equation PVNP) Ve vc 3 Black-Scholes Option Pricing Model Assume that you have been given the following information on Buccaneer Industries call options: 5 Please show work and answer questions completely to receive full credit. 6 7 8 Current Stock Price $ 17.00 Strike price of option $ 17.25 0.5 risk-free rate Time to maturity of option 6% Variance of stock return 0.33 st. dev of stock return 0.57446 d1 0.59523 0.241016 N[d1] -0.1652 N[d2] d2 0.4344 According to the Black Scholes option pricing model, what is the call option's value, Vc? (5 points) O Vc Put Call Parity b. Using the same information as above, what is the value of a put option written on the stock with the same exercise price and expiration date as the call option, Vp? (5 points) 20 23 Vp 22 9 10 11 12 13 14 15 16 37 18 000 -0.015 0.113 0.406 Use the exp(-rt) function to calculate this. 5 Binomial Option Method The current price of a stock is below. In 1 year, the price will be Pu if the price increases and Pd if the price decreases. The annual risk-free rate is below. Using the binomial method, find the price of a call option on the stock that has the strike price listed below and expires in one year. Please show work and answer questions completely to receive full credit. Current Stock Price, P $17.00 Pu $20.00 Pd $15.00 risk-free rate 3% Strike price $16.00 time to expiration 1 year a. Calculate the "up factor" or "u", which is the factor when multiplied by the current price results in Pu. (2 pts) u b. Calculate the "down factor" or "d", which is the factor when multiplied by the current price results in Pd. (2 pt: d c. Calculate the value of the call option if the price increases in year 1, or Cu. It equals Max[0, Pu-X/(2 pts) Cu d. Calculate the value of the call option if the price decreases in year 1, or Cd. It equals Max/0, Pd-X] (2 pts) Cd e Calculate the optimal number of shares, Ni, in our future hedge portfolio. Use the equation (Cu-Cd/Pu-d)). (2 ph Ns t. If the market increases at a factor of u, calculate the Portfolio payoff, Pue) and subtract Ca to obtain the net portfolio payoff (pb) Pu(N) net Cu net portfolio payoff If the market decreases at a factor of d calculate the Portfolio payoft, Pd) and subtract Cd to obtain the net portfolio payoff (3 pts) Pd(s) net Cd net portfolio payoff h. Both net portfolio payoffs should be the same Now find the present value (PV) of the net portfolio payoff with daily compounding Live days in a year (5) N VY PMI FV PV $0.00 Long the present value of the portfolio you have just calculatet, now solve for the value of the call, Ve (Make sure you use the positive value of the PV) (4 points) Une the equation PVNP) Ve vc 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts