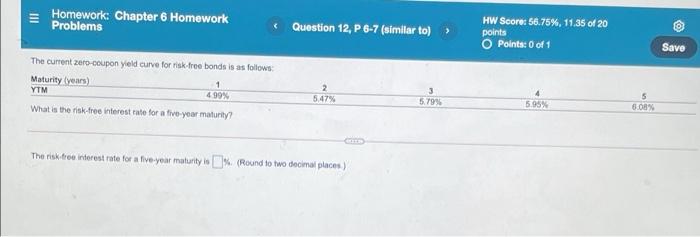

Question: b Homework: Chapter 6 Homework Problems Question 12, P 6-7 (similar to); HW Score: 56.75%, 11.35 of 20 points Points: 0 of 1 Save The

Homework: Chapter 6 Homework Problems Question 12, P 6-7 (similar to); HW Score: 56.75%, 11.35 of 20 points Points: 0 of 1 Save The current zero-coupon yield curve for risk-free bonds is as follows: Maturity years) 1 YTM 499% What is the risk-free interest rate for a five-year maturity? 2 5.47% 3 5.799 5.95% 6.08% The risk tree interest rate for a five-year maturity > (Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts