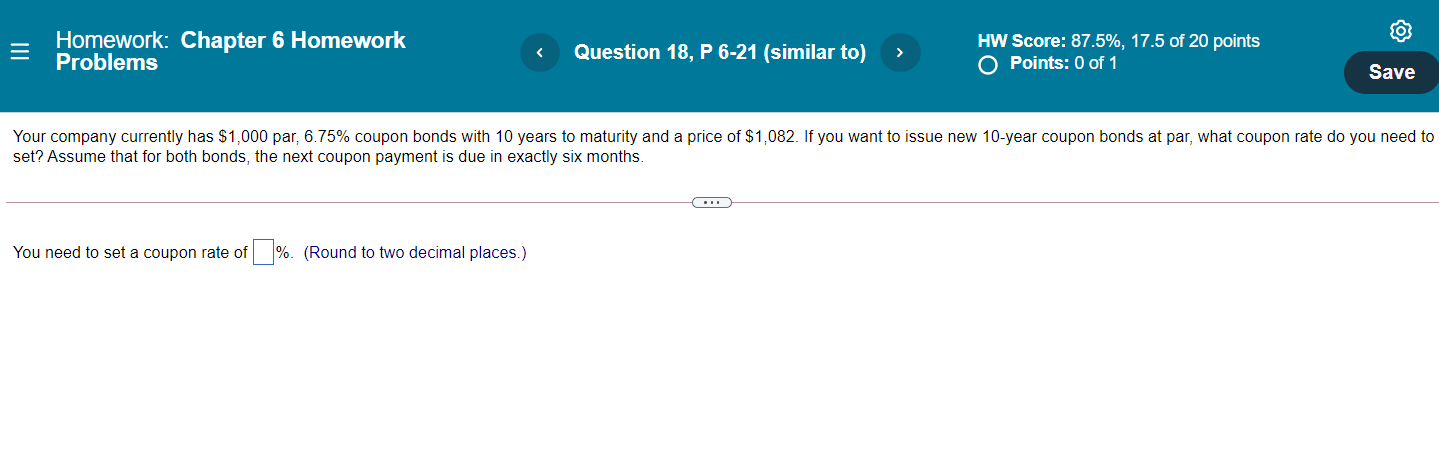

Question: = Homework: Chapter 6 Homework Problems Question 18, P 6-21 (similar to) > HW Score: 87.5%, 17.5 of 20 points O Points: 0 of 1

= Homework: Chapter 6 Homework Problems Question 18, P 6-21 (similar to) > HW Score: 87.5%, 17.5 of 20 points O Points: 0 of 1 Save Your company currently has $1,000 par, 6.75% coupon bonds with 10 years to maturity and a price of $1,082. If you want to issue new 10-year coupon bonds at par, what coupon rate do you need to set? Assume that for both bonds, the next coupon payment is due in exactly six months. You need to set a coupon rate of %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts