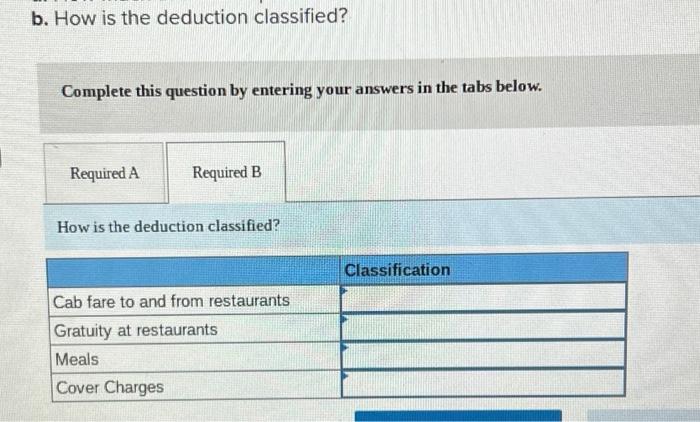

Question: b. How is the deduction classified? Complete this question by entering your answers in the tabs below. How is the deduction classified? Jackie owns a

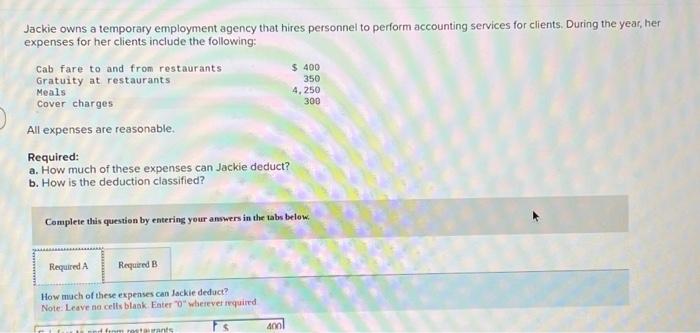

b. How is the deduction classified? Complete this question by entering your answers in the tabs below. How is the deduction classified? Jackie owns a temporary employment agency that hires personnel to perform accounting services for clients. During the year, her expenses for her clients include the following: All expenses are reasonable. Required: a. How much of these expenses can Jackie deduct? b. How is the deduction classified? Complete this question by eatering your answers in the tabs below. How much of these expenses can Jackie deduct? Note. Leave an cells blaak. Eater " 0 " wheiever mquired

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts