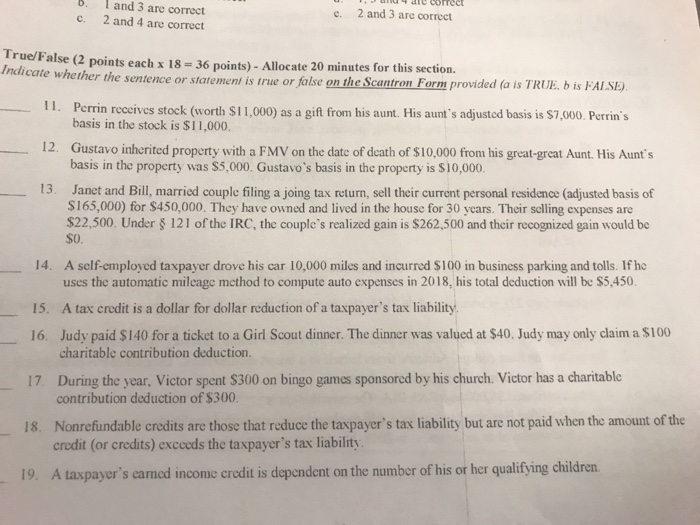

Question: B. I and 4 are corect 3 are correct c. 2 and 4 are correct c. 2 and 3 are correct True/False (2 points each

B. I and 4 are corect 3 are correct c. 2 and 4 are correct c. 2 and 3 are correct True/False (2 points each x 18 -36 points)- Allocate 20 minutes for this section. the sentence or statemeni is true or false on the Scantron Form provided (a is TRUE. b is FALSH 11. Perrin rececives stock (worth S11,000) as a gift from his aunt. His aunt's adjustod basis is $7,000. Perrin's basis in the stock is $11,000. 12. Gustavo inherited property with a FMV on the datc of death of $10,000 from his great-great Aunt. His Aunt' s basis in the property was $5,000. Gustavo's basis in the property is $10,000. 13. Janet and Bill, married couple filing a joing tax return, sell their current personal residence (adjusted basis of S165,000) for $450,000. They have owned and lived in the house for 30 years. Their solling expenses are $22,500. Under S121 of the IRC, the couplc's realized gain is $262,500 and their recognized gain would be SO A self-employed taxpayer drove his car 10,000 miles and incurred $100 in business parking and tolls. If he uses the automatic mileage method to compute auto expenses in 2018, his total deduction will be $5,450 A tax credit is a dollar for dollar reduction of a taxpayer's tax liability. 14. 15. Judy paid $140 for a ticket to a Girl Scout dinner. The dinner was valued at $40. Judy may only claim a $100 charitable contribution deduction 16. 17. During the year, Victor spent $300 on bingo games sponsored by his church. Victor has a charitable contribution deduction of $300 Nonrefundable credits are those that reduce the taxpayer's tax liability but are not paid when the amount of the credit (or credits) excceds the taxpayer's tax liabilnty 18. 19. A taxpayer's caned incomc credit is depcndent on the number of his or her qualifying children

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts