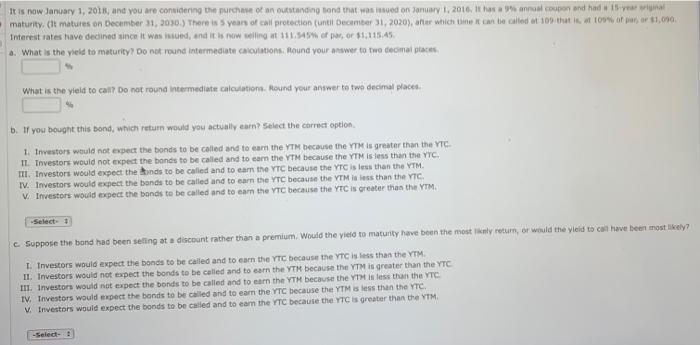

Question: b. If you bought this bond, which return would you actually earn? seled the carrect option. 1. Investers weuld not expect the bonds to be

b. If you bought this bond, which return would you actually earn? seled the carrect option. 1. Investers weuld not expect the bonds to be called and to eam the YTM because the YMM is greater than the YTC II. Investors would not expect the bonds to be called and to eam the YMM because the YTM is less than the YTC. III. Investors would expect the thinds to be called and to eam the YTC because the YTC is less than the VTM. IV. Ifvestors would expect the bands to be called and to earn the YTC because the YTM is less than the YTC. V. Imvestors would rxpect the banas te be called and to eam the YTC because the Yrcis creater thas the YTM. c. Suppose the bond had been seling at a discount rather than a premium. Would the viefd to maturity have been the most ianly retum, of withid the yieid to ckin have Been enost likely? I. Investors would expect the bonds to be called and to earn the rre because the yTc is less than the YTM. II. Investors would not expect the bonds to be celled and to earn the YTM becausen the YTM is greater than the YTC III. Investors would not expect the bonds to be called and to earn the YTM because the YTH is less thain the YTC TV. Thestars would erpect the banits to be called and to eam the YTC because the YTM is less than the YTC. V. Invertars would expect the bonds to be called and to eam the YTC because the YTC a greater than the YTM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts