Question: b. If you bought this bond, which return would you actually earn? Select the correct option. I. Investors would expect the bonds to be called

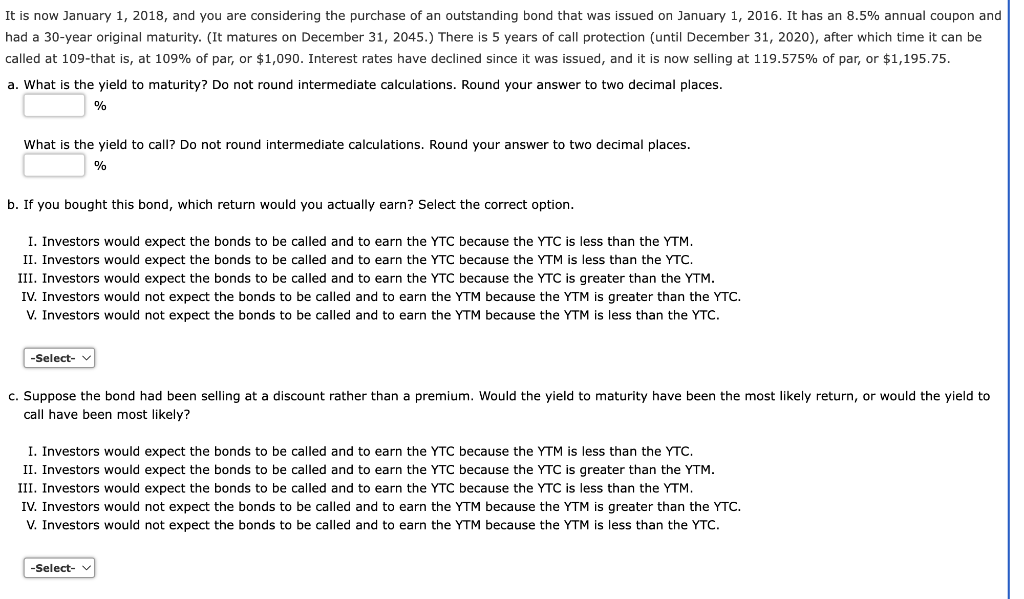

b. If you bought this bond, which return would you actually earn? Select the correct option. I. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. II. Investors would expect the bonds to be called and to earn the YTC because the YTM is less than the YTC. III. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. IV. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. V. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. c. Suppose the bond had been selling at a discount rather than a premium. Would the yield to maturity have been the most likely return, or would the yield to call have been most likely? I. Investors would expect the bonds to be called and to earn the YTC because the YTM is less than the YTC. II. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. III. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. IV. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. V. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. b. If you bought this bond, which return would you actually earn? Select the correct option. I. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. II. Investors would expect the bonds to be called and to earn the YTC because the YTM is less than the YTC. III. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. IV. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. V. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. c. Suppose the bond had been selling at a discount rather than a premium. Would the yield to maturity have been the most likely return, or would the yield to call have been most likely? I. Investors would expect the bonds to be called and to earn the YTC because the YTM is less than the YTC. II. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. III. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. IV. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. V. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts