Question: (b) In the following year, the performance sharing plan parameters were: $ millions Threshold Target Stretch Earnings from Operations $420 $490 $560 Given the same

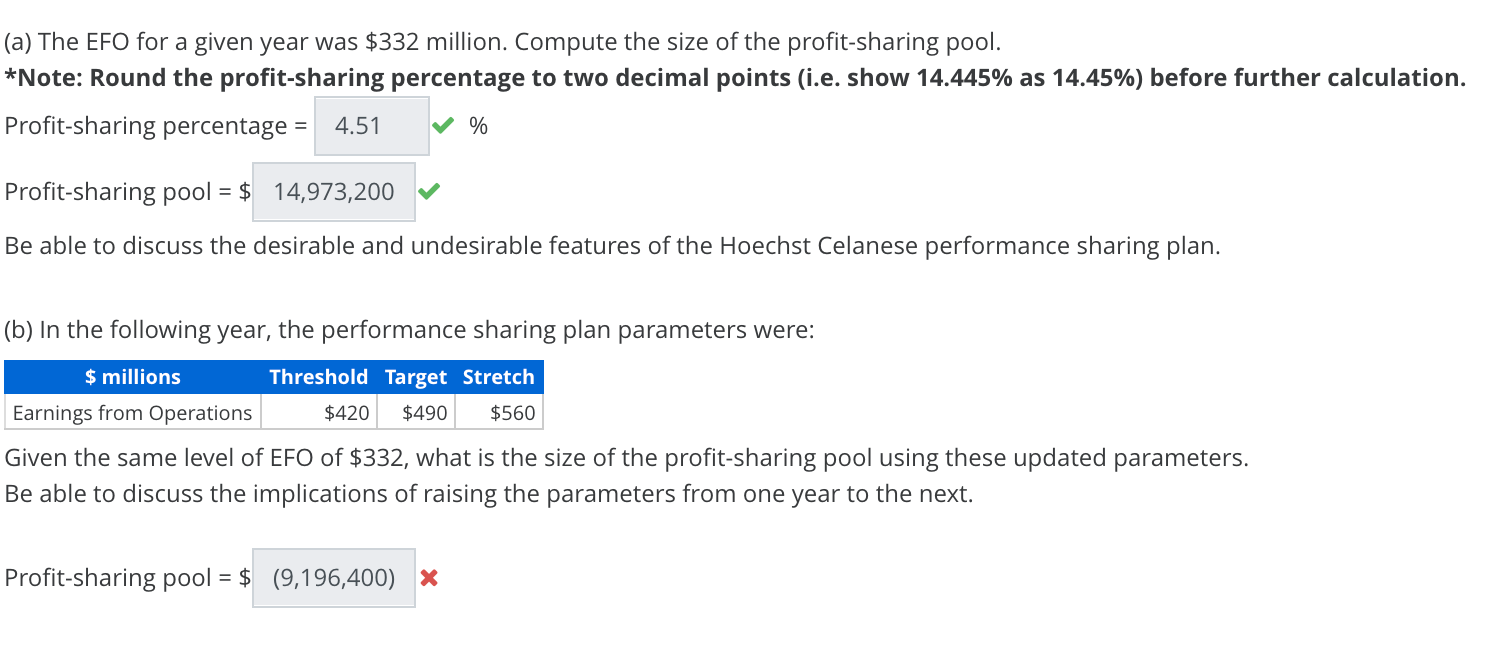

(b) In the following year, the performance sharing plan parameters were:

| $ millions | Threshold | Target | Stretch |

|---|---|---|---|

| Earnings from Operations | $420 | $490 | $560 |

Given the same level of EFO of $332, what is the size of the profit-sharing pool using these updated parameters. Be able to discuss the implications of raising the parameters from one year to the next.

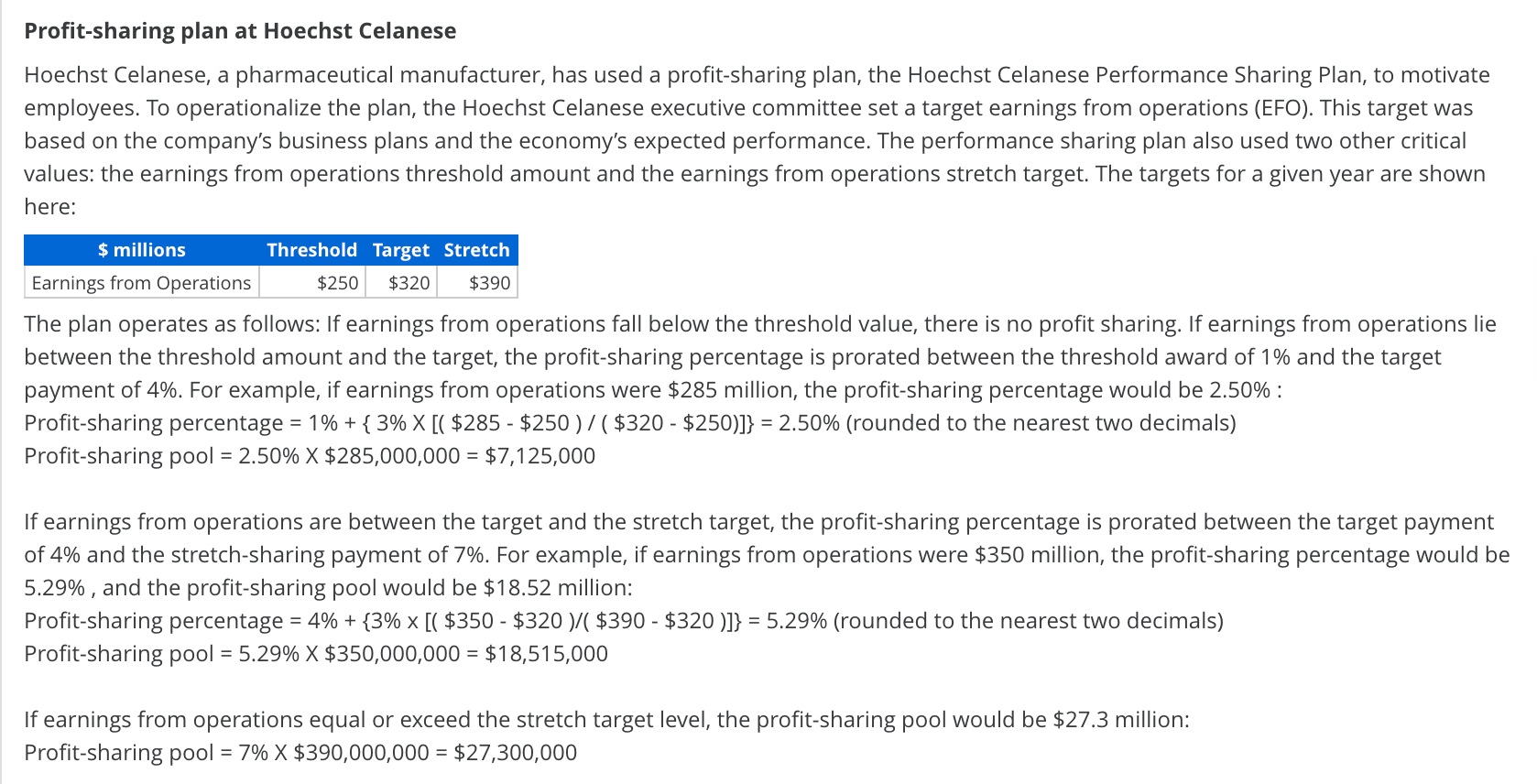

Profit-sharing plan at Hoechst Celanese Hoechst Celanese, a pharmaceutical manufacturer, has used a profit-sharing plan, the Hoechst Celanese Performance Sharing Plan, to motivate employees. To operationalize the plan, the Hoechst Celanese executive committee set a target earnings from operations (EFO). This target was based on the company's business plans and the economy's expected performance. The performance sharing plan also used two other critical values: the earnings from operations threshold amount and the earnings from operations stretch target. The targets for a given year are shown here: $ millions Threshold Target Stretch $250 $320 $390 Earnings from Operations The plan operates as follows: If earnings from operations fall below the threshold value, there is no profit sharing. If earnings from operations lie between the threshold amount and the target, the profit-sharing percentage is prorated between the threshold award of 1% and the target payment of 4%. For example, if earnings from operations were $285 million, the profit-sharing percentage would be 2.50% : Profit-sharing percentage = 1% + { 3% X [( $285 - $250)/($320 - $250)]} = 2.50% (rounde to the rest two decimals) Profit-sharing pool = 2.50% X $285,000,000 = $7,125,000 If earnings from operations are between the target and the stretch target, the profit-sharing percentage is prorated between the target payment of 4% and the stretch-sharing payment of 7%. For example, if earnings from operations were $350 million, the profit-sharing percentage would be 5.29% , and the profit-sharing pool would be $18.52 million: Profit-sharing percentage = 4% + {3% x [( $350 - $320 )/( $390 - $320 )]} = 5.29% (rounded to the nearest two decimals) Profit-sharing pool = 5.29% X $350,000,000 = $18,515,000 If earnings from operations equal or exceed the stretch target level, the profit-sharing pool would be $27.3 million: Profit-sharing pool = 7% X $390,000,000 = $27,300,000 (a) The EFO for a given year was $332 million. Compute the size of the profit-sharing pool. *Note: Round the profit-sharing percentage to two decimal points (i.e. show 14.445% as 14.45%) before further calculation. Profit-sharing percentage = 4.51 % Profit-sharing pool = $ 14,973,200 Be able to discuss the desirable and undesirable features of the Hoechst Celanese performance sharing plan. (b) In the following year, the performance sharing plan parameters were: $ millions Threshold Target Stretch Earnings from Operations $420 $490 $560 Given the same level of EFO of $332, what is the size of the profit-sharing pool using these updated parameters. Be able to discuss the implications of raising the parameters from one year to the next. Profit-sharing pool = $ (9,196,400) *

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts