Question: Profit - sharing plan at Hoechst Celanese shown here: target payment of 4 % . For example, if earnings from operations were $ 2 2

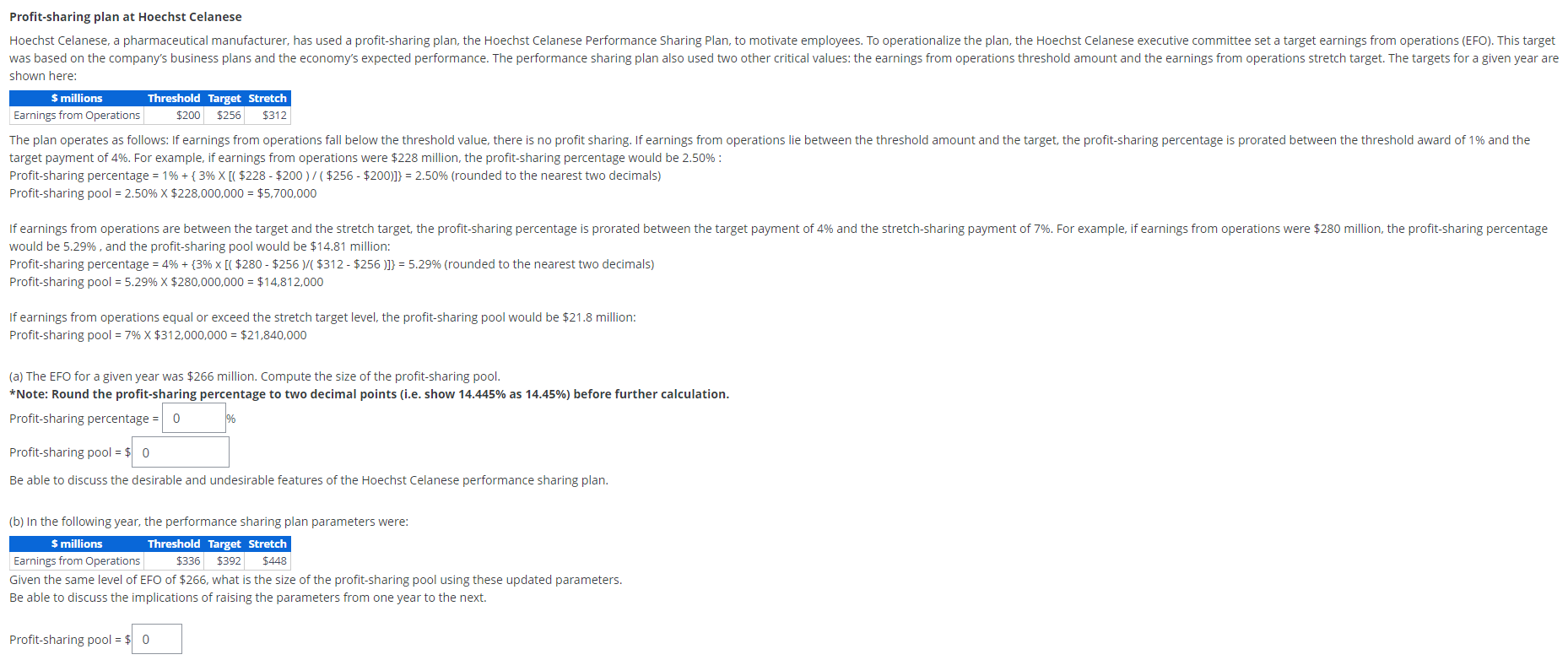

Profitsharing plan at Hoechst Celanese

shown here:

target payment of For example, if earnings from operations were $ million, the profitsharing percentage would be :

Profitsharing percentage rounded to the nearest two decimals

Profitsharing pool $$

would be and the profitsharing pool would be $ million:

Profitsharing percentage rounded to the nearest two decimals

Profitsharing pool $$

If earnings from operations equal or exceed the stretch target level, the profitsharing pool would be $ million:

Profitsharing pool $$

a The EFO for a given year was $ million. Compute the size of the profitsharing pool.

Note: Round the profitsharing percentage to two decimal points ie show as before further calculation.

Profitsharing percentage

Profitsharing pool $

Be able to discuss the desirable and undesirable features of the Hoechst Celanese performance sharing plan.

b In the following year, the performance sharing plan parameters were:

Given the same level of EFO of $ what is the size of the profitsharing pool using these updated parameters.

Be able to discuss the implications of raising the parameters from one year to the next.

Profitsharing pool $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock