Question: B is not the correct response for sure please help find the correct response to this question A client's fund has a benchmark comprising 50%

B is not the correct response for sure please help find the correct response to this question

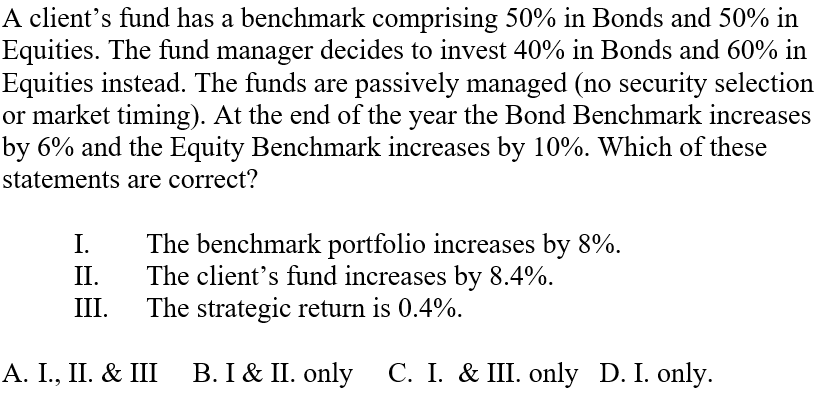

A client's fund has a benchmark comprising 50% in Bonds and 50% in Equities. The fund manager decides to invest 40% in Bonds and 60% in Equities instead. The funds are passively managed (no security selection or market timing). At the end of the year the Bond Benchmark increases by 6% and the Equity Benchmark increases by 10%. Which of these statements are correct? I. The benchmark portfolio increases by 8%. II. The client's fund increases by 8.4%. III. The strategic return is 0.4%. A. I., II. \& III B. I \& II. only C. I. \& III. only D. I. only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts