Question: (b) John bought a gold ring 50 years ago for $55. Recently he needs to sell the ring to a pawn shop to raise money

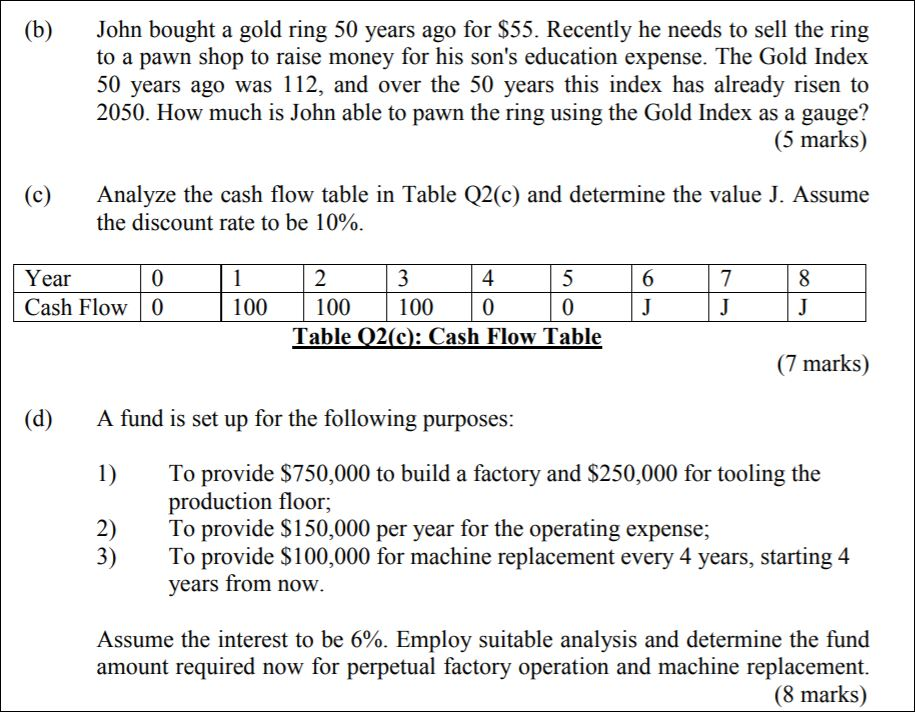

(b) John bought a gold ring 50 years ago for $55. Recently he needs to sell the ring to a pawn shop to raise money for his son's education expense. The Gold Index 50 years ago was 112, and over the 50 years this index has already risen to 2050. How much is John able to pawn the ring using the Gold Index as a gauge? (5 marks) c) Analyze the cash flow table in Table Q2(c) and determine the value J. Assume the discount rate to be 10%. 6 7 8 Year Cash Flow 0 0 1 | 100 2 3 4 5 100 100 0 0 Table 02c): Cash Flow Table J (7 marks) (d) A fund is set up for the following purposes: 1) To provide $750,000 to build a factory and $250,000 for tooling the production floor; To provide $150,000 per year for the operating expense; To provide $100,000 for machine replacement every 4 years, starting 4 years from now. 3) Assume the interest to be 6%. Employ suitable analysis and determine the fund amount required now for perpetual factory operation and machine replacement. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts