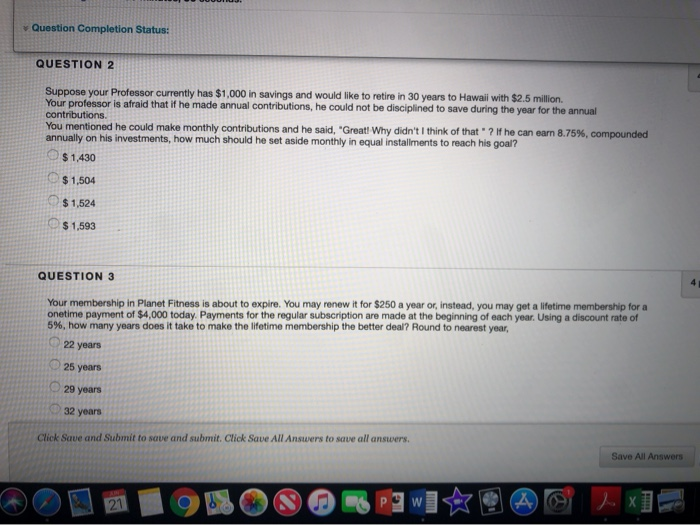

Question: Question Completion Status: QUESTION 2 Suppose your Professor currently has $1,000 in savings and would like to retire in 30 years to Hawai with $2.5

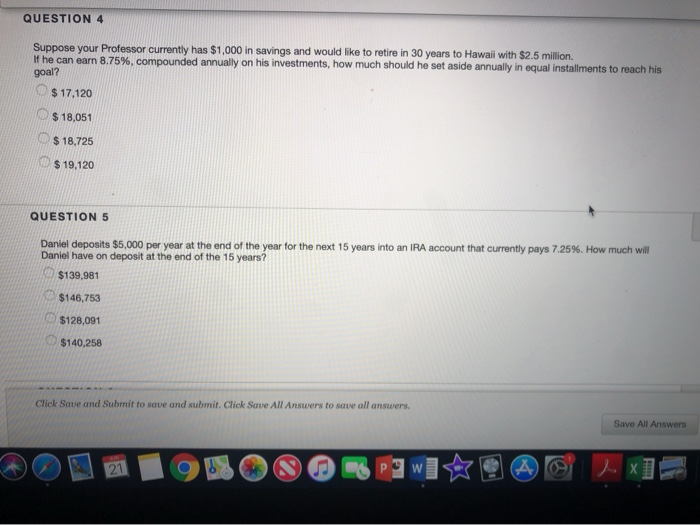

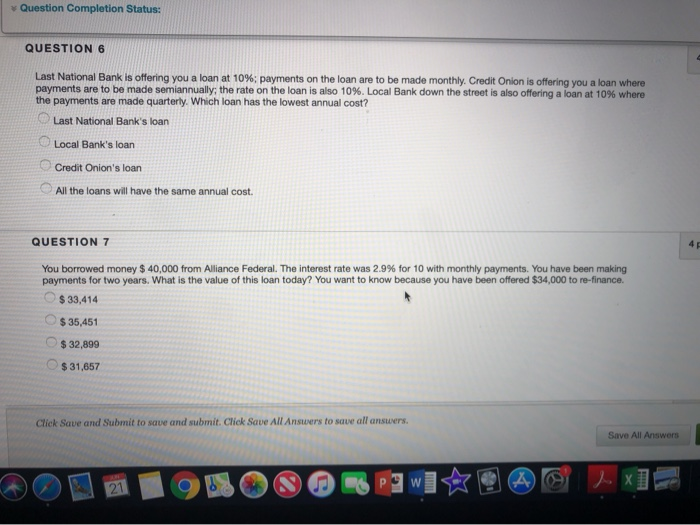

Question Completion Status: QUESTION 2 Suppose your Professor currently has $1,000 in savings and would like to retire in 30 years to Hawai with $2.5 million. Your professor is afraid that if he made annual contributions, he could not be disciplined to save during the year for the annual contributions. You mentioned he could make monthly contributions and he said, "Great! Why didn't I think of that ? If he can earn 8.75 %, compounded annually on his investments, how much should he set aside monthly in equal installments to reach his goal? O$1,430 $1,504 $1,524 $1,593 QUESTION 3 Your membership in Planet Fitness is about to expire. You may renew it for $250 a year or, instead, you may get a lifetime membership for a onetime payment of $4,000 today. Payments for the regular subscription are made at the beginning of each year. Using a discount rate of 5 % , how many years does it take to make the lifetime membership the better deal? Round to nearest year, 22 years 25 years 29 years 32 years Click S ub to save and submit. Click Save All Answers to save all answers. Save All Answers AN W 21 QUESTION 4 Suppose your Professor currently has $1,000 in savings and would like to retire in 30 years to Hawaii with $2.5 million. If he can earn 8.75 % , compounded annually on his investments, how much should he set aside annually in equal installments to reach his goal? $17,120 $ 18,051 $ 18,725 $19,120 QUESTION 5 Daniel deposits $5,000 per year at the end of the year for the next 15 years into an IRA account that currently pays 7.25%. How much will Daniel have on deposit at the end of the 15 years? $139,981 $146,753 $128,091 $140,258 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers W Question Completion Status: QUESTION 6 Last National Bank is offering you a loan at 10% ; payments on the loan are to be made monthly. Credit Onion is offering you a loan where payments are to be made semiannually; the rate on the loan is also 10 %. Local Bank down the street is also offering a loan at 10% where the payments are made quarterly. Which loan has the lowest annual cost? Last National Bank's loan Local Bank's loan Credit Onion's loan All the will have the same annual cost. QUESTION 7 You borrowed money $ 40,000 from Alliance Federal. The interest rate was 2.9% for 10 with monthly payments. You have been making payments for two years. What is the value of this loan today? You want to know because you have been offered $34,000 to re-finance. $ 33,414 $35,451 $32,899 $31,657 Click Save and Submit to save and submit. Click Save All Ansuers to save all answers. Save All Answers W 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts