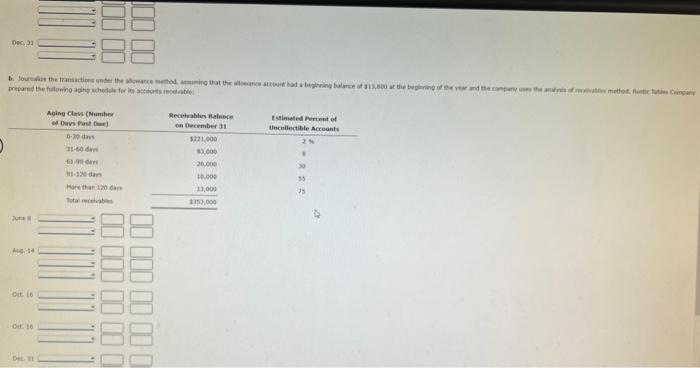

Question: b. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of $13,800 at the beginning of the year

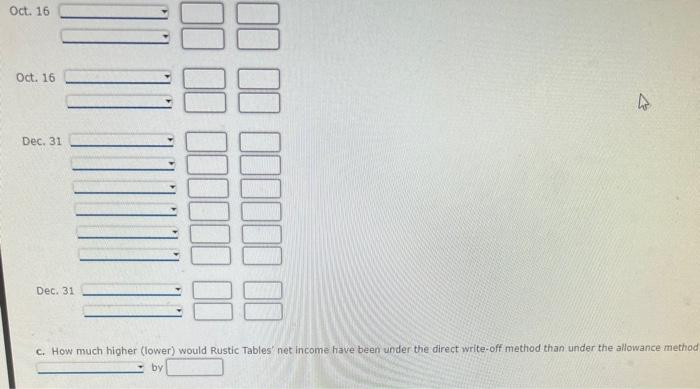

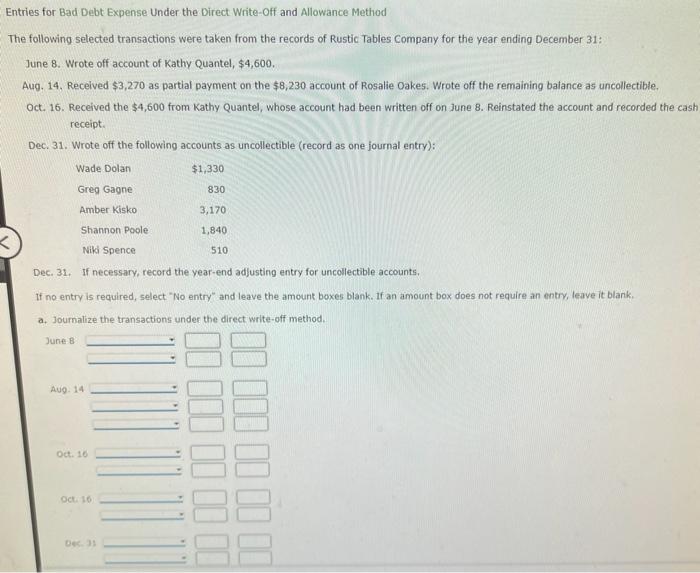

Dec, Joure the transactions under the watethod ming that the castcourt to begin to do at the beginning prepared the following in schedule for sale che methoden Aging Claus (Nur of Days Paste) - Estimated Percent of tecollectible Accounts Receivables Balance on December 31 5721,000 33.000 20,000 10.000 13,000 3153,000 > 11 More than 10 55 35 Total A10 16 DEL Oct. 16 Oct. 16 M Dec. 31 Dec. 31 C. How much higher (lower) would Rustic Tables' net income have been under the direct write-off method than under the allowance method by Entries for Bad Debt Expense Under the Direct Write-off and Allowance Method The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8. Wrote off account of Kathy Quantel, $4,600. Aug, 14, Received $3,270 as partial payment on the $8,230 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16. Received the $4,600 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan $1,330 Greg Gagne 830 Amber Kisko 3,170 1,840 11 More than 10 55 35 Total A10 16 DEL Oct. 16 Oct. 16 M Dec. 31 Dec. 31 C. How much higher (lower) would Rustic Tables' net income have been under the direct write-off method than under the allowance method by Entries for Bad Debt Expense Under the Direct Write-off and Allowance Method The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8. Wrote off account of Kathy Quantel, $4,600. Aug, 14, Received $3,270 as partial payment on the $8,230 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16. Received the $4,600 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan $1,330 Greg Gagne 830 Amber Kisko 3,170 1,840

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts