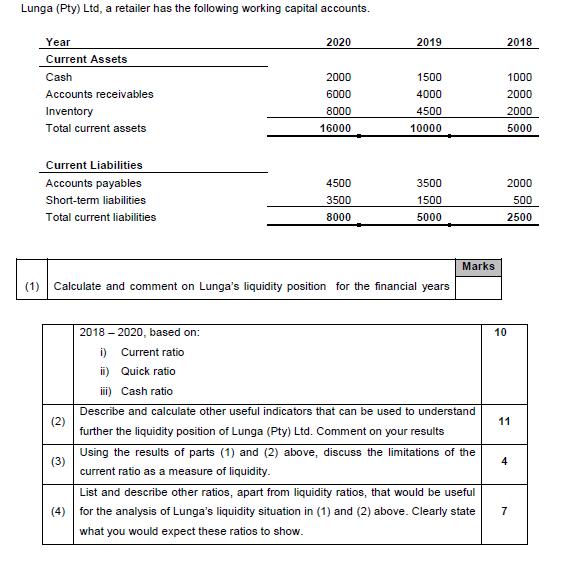

Question: Lunga (Pty) Ltd, a retailer has the following working capital accounts. Year 2020 2019 2018 Current Assets Cash 2000 1500 1000 Accounts receivables 6000

Lunga (Pty) Ltd, a retailer has the following working capital accounts. Year 2020 2019 2018 Current Assets Cash 2000 1500 1000 Accounts receivables 6000 4000 2000 Inventory 8000 4500 2000 Total current assets 16000 10000 5000 Current Liabilities Accounts payables 4500 3500 2000 Short-term liabilities 3500 1500 500 Total current liabilities 8000 5000 2500 Marks (1) Calculate and comment on Lunga's liquidity position for the financial years 2018 2020, based on: i) Current ratio 10 ii) Quick ratio i) Cash ratio Describe and calculate other useful indicators that can be used to understand (2) further the liquidity position of Lunga (Pty) Ltd. Comment on your results 11 Using the results of parts (1) and (2) above, discuss the limitations of the (3) 4 current ratio as a measure of liquidity. List and describe other ratios, apart from liquidity ratios, that would be useful (4) for the analysis of Lunga's liquidity situation in (1) and (2) above. Clearly state 7 what you would expect these ratios to show.

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Part 1 i Current Ratio Current AssetsCurrent Liabilities The Current ratio remained same for all the years It is maintained at 2 This is a good current ratio where current assets are almost double the ... View full answer

Get step-by-step solutions from verified subject matter experts