Question: (b) One particularly large sales invoice has just been signed for $5m (five million dollars) and is due to be received in 90 days' time.

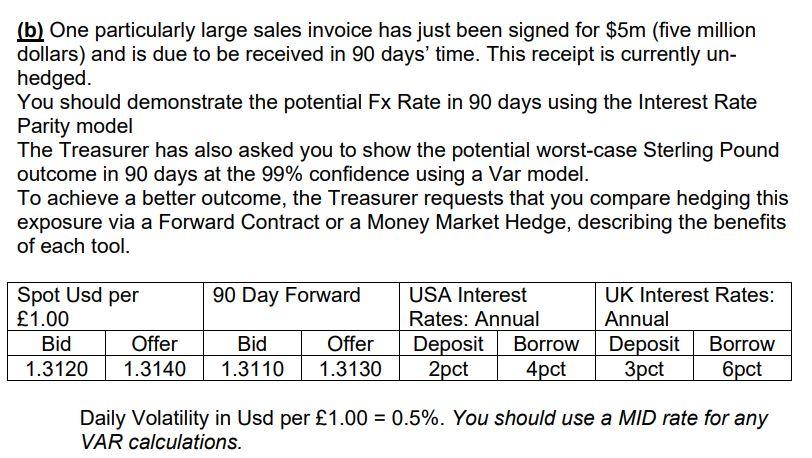

(b) One particularly large sales invoice has just been signed for $5m (five million dollars) and is due to be received in 90 days' time. This receipt is currently unhedged. You should demonstrate the potential Fx Rate in 90 days using the Interest Rate Parity model The Treasurer has also asked you to show the potential worst-case Sterling Pound outcome in 90 days at the 99% confidence using a Var model. To achieve a better outcome, the Treasurer requests that you compare hedging this exposure via a Forward Contract or a Money Market Hedge, describing the benefits of each tool. Daily Volatility in Usd per 1.00=0.5%. You should use a MID rate for any VAR calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts