Question: How has the movie industry changed since MoviePass ceased operation? Since that time, has the external environment become more or less conducive to a MoviePass-style

How has the movie industry changed since MoviePass ceased operation? Since that time, has the external environment become more or less conducive to a MoviePass-style service?

(200 words minimum; 10 points

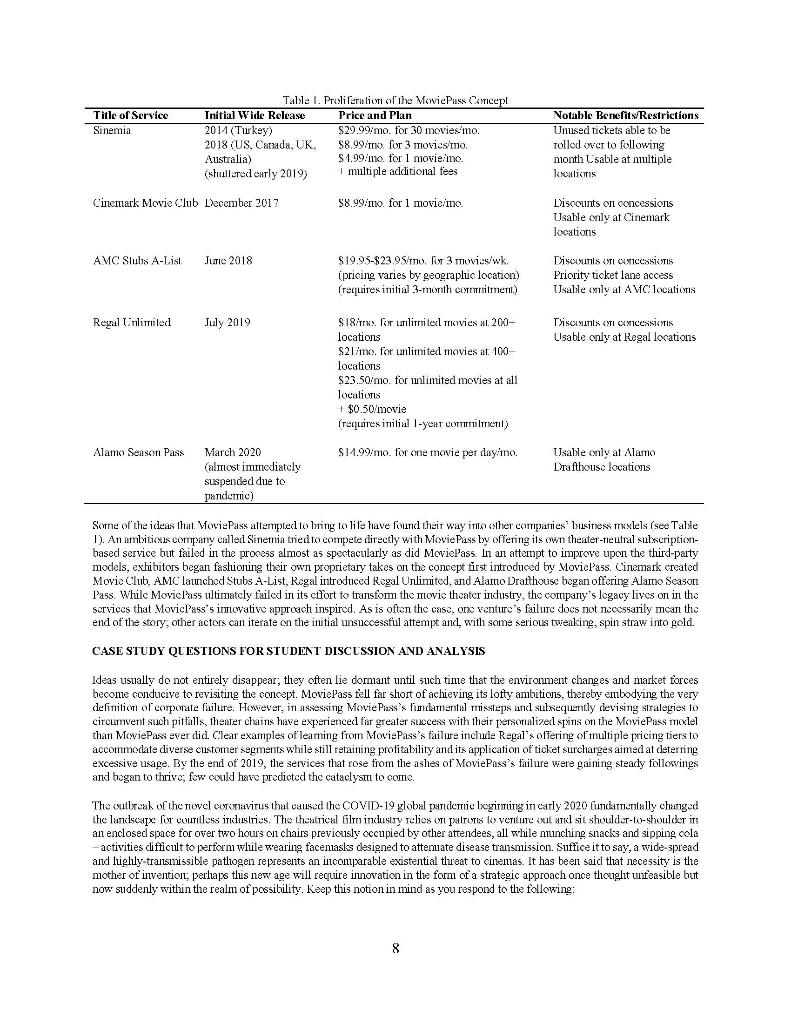

MOVIEPASSED OUT: LESSONS GLEANED FROM CORPORATE FAILURE ABSTRACT It is often said that those who fail to learn from history are condemned to repeat it" (Churchill, 1948). For this reason, the practice of revisiting and dissecting past corporate failwes can prove higlily instructional. In fact, conducting such post-mortens might SOTDCi TICs reveal not just pxist inslakes that should be avoided but also thcorctically brilliant ideas that failed because they wer: cithT potly-exccuech, insullicienilly supportoch, or simply ahead of their line. This article prescris a leaching case study of the theatrical filtri subscription service MoviePass's rise and Fall ani in so doing, alltiTols to provide an interesting and prwocalive naitalive for examination of a company that failed spolcularly. It is wake. MuviePass lel a legacy of realized poltuial and inwative ideas that eluled Mwie Passs leadership but that have discelated into other companies offerings. This article aims to engender an appreciation for the value of analytically discussing failure and to promote an uuderstanding of how engaging in such an exercise can help decision makers - here, within the context of the pandemic-ravaged movie industry, an exanuned market generalizable to countless other areas sorely affected tluoughout 2020 and beyond. This illustrative case study simultaneously helps to fill a gap in management literature by examining corporate failure through a strategic lens, thereby providing an effective instructional tool for management educators and facilitating a prime opportunity for discussion of one of the industries hit hardest by the COVIT)-19 pandemic. Keywords: corporate failure, MoviePass, COVID-19, case study Cinema las considerably evolved from the pre-World War I Silent Years, to the introduction of talkies and colonized film reels, through the Golden Ers, and eventually to the modern movicwatching cxpcriance that we cnjoy today (Sklar & Cook, 2020). With these shifts in the film industry have come notable changes to the business models that companies employ to attract and serve customers, generate revenue and maintain sustainable operations. Such evolution is certainly not limited to the movie sector. In particular, entrepreneurial innovators of the 21stcentury, frequently spurred on by the opportunities that advances in internet technology present, have successfully cimagined many traditional business models, tearing down the old guard and replacing it with radical new concepts. Uber and Lyft have disrupted taxi service, Bird scooters have afforded new freedom in personal transportation, and Airbnb has upended the leddging industry. Not every effort at breaking the established mold is successful, however, especially upon first attempt. Still, there exists much value in analyzing even the most disastrous ofmiscalculations, in dissecting what ideas were perhaps sound, which were flawed. and how the findings can benefit fimre actors. This manuscript presents the case of a company that attempted to shatter the dominant paradigm only to ultimately fall well short of the firm's ambitious goals. This illustrative case study seeks to stimulate discussion about all that can be gleaned and learned from such a failure. Ironically, failure often plays a key role in the innovation process. To best determine what works, one must first rule out what docs not work, this process of climination typically critails at least a few failures along the way (Coclho & McClurc, 2005). Attempting to accomplish sumthing that no one else has ever achieved carries with it a ccrtain level of inherent risk, so the innovator must accept the fact that the first itcration of a plan may not necessarily live up to expectations (Coclho & McClure, 2005). Frequ.titly, Thiultiple aldetupls must be made to itut out the initial flaws; thus, successful ciliepiuncurs Ick to view tuissteps as extremely valuable learning experiences that can be leveraged to improve successive efforts (Coelho & McClure, 2005). As a character on the IIBO comedy series Silicon Valley once liumorously, and so astutely, proclaimed in an effort to smooth over one of his company's failures, "What those in dying business sectors call failure, we in tech know to be pre-greatiess" (Anobi & Berg. 2015). Although this supposed maxin, within the show's context, was deployed in service of putting a positive spin on a catastrophie, the Sculatrici beats a kerticles ruth. There is, in fact, very olien a thin line betweeti failure and success, will perceived trosslepsmatiy Limnes acully serving as Cursdruclive sleptatig sluties along the path to victory (Coelho & McClure, 2005). RATIONALE FOR THE RESEARCH Although managers may be encouraged to not fear failure especially small mistakes and to treat errors as learning opportunities, individuals do not always take the recessary stops to analyze failure in a manner that could prove constructive (Caruin & Edmundson, 2005). Corporate failurc, defined as a sigtuificant negative organizational incongruity between desited outcomics and actual results, can prove edifying but only which the causes are factors surrounxling the failure are sullici tilly and thoughtfully ScTwinized (Carin & Edmondsom, 2005). Cutipatrics can butuc fit mulutly from examinitiation of their own failures but also from vicarious assessment of other chilities' missiepos (Blackw. Carcile, Kitmel & Pillig, 2017). Some businesses are less risk-averse that are others, anul the wagers Thail these organizations place can shape an industry and the players willini il, regardless of how these bets pan out. While some companies are content to focus on capturing market share through incremental innovation, other firnis strive for the racical reinvention of previously-established business models. An industry may persist largely unchanged for years simply because the existing paradigm goes unchallenged; then, in an instant, a single actor can upend the prevailing mindset by daring to innovate and retlunk the framework that had, up until that point, been firmly entrenched. Whether the risk-taker succeeds or fails, these daring moves can help observers better understand market conditions and environmental factors so that they can strategire more effectively, 1 An italy That lakes a first leap of faith stanics to gain a list- iwer advantage, capturing resources, capaxilities, anul customer demand before others even have a chance (Lieberman & Montgomery, 1998; Sotka & Schmidt, 2004). These ambitious actors, often dubbed prospectors, take on a great deal of risk in retum for the promise of great reward (Miles & Snow. 1978). Sometimes, first-moving prospectors' aspirations yield highly fruitful results, other times, the prospectors' grand designs fail to take shape. leaving the door open to early followers and late movers (Lieberman & Montgomery, 1998). Entities that adopt a more cautious "wait-and-see" approach, frequently referred to as analyzers, can benefit from the hard lessons that unsuccessful prospectors are forced to learn (Miles & Snow, 1978; Sofka & Schmidt, 2004). These analyzers, like generals surveying a battlefield as the first wave of troops fall Mey to hidden traps, have the luxury of monitoring prospectors in order to ascertain the struggles that these rivals face. The analyzers can then use this information to follow in the first-mower's footsteps and dodge the metaphorical minefields encountered by prospectors. Even when a prospector's goals do not come to fruition, lessons can still be learned (Pretorius, 2008). Toc often failures are quickly swept under the proverbial nig, never to be spoken of again. Such a mindset seeningly prevails in the strategic management literalure, evidenced by : muncity of research that should be examining lilure as a meatis lay which logleun valiualle kleele from what can be perceived as trislakes (Coellier & McClure, 2005. Prema, 2008). In fact, Tesearch supports the theory thal, in both business and academia examination of others failures can we eveti triore instructive that can stlying success stories (Blerow et al., 2017). As previously allirmed, these mistakes often serve as stepping stones on the journey to eventual success (Coelho & McClure, 2005). Furthermore, strategists should leam from the past. It make a concertel eftert to focus squarely on the future. What worked in the past may not necessarily work in the future, conversely, what did not work in the past may che day be worth revisiting. As a case in point, the example of Microsoft's failed WebTV platform is herein presented. In 1996, Microsoft launched WebTV with the objective of delivering wcb-based content to users' televisions (Hill, 2020). At that time, the concept struggled to gain traction (Smith, 2016). Years later, however, internet speeds caught up to Microsoft's criginal vision, television set resolutions increased to enable greater clarity, and developers began designing custom-made web-based applications tailored specifically to televisions. The advent of these developments finally afforded Microsoft the ability to effectively integrate the software base that it had developed for WebTV into its Xbox line of videogame and entertainment systens by 2012, a full web browser liad even been added (Warren, 2012) - albeit after competitors had already started to emulate the ida (Breen, 2007: Duunas, 2008). The firm's 1996 brainchild had simply arrived aliead of its time, its value at last realized by both Microsclis Uw Tupupring of the lechticking and her firms cagettess to infilltale the internici-on-TV realiti. One provider of cumilent particularly well-suited to the television screeti was a growing DVD-ly-mail rental firm called Velflix. In 2007, the company legan to diversify its offerings by streaming select movies and television shows via the internet (Arxlerom, 2007. Netflix, 11.d.). Approximately che decade afier Microsoft's first- mer attempts hail fizzled, Netflix's efforts resulted in the culmination of fusing intemet-based content with television. Texlay. Netflix streaming, the majority of which is viewed on televisions (Tqlxal, 2020), accounts for more than twelve percent of downstream internet traffic (Cullen 2019). Clearly, what some night initially dismiss as an ill-conceived flop can, over time, blossom into a fantastic and lucrative opportunity. Netflix co-founder Mitch Lowe, intrigued by the prospect of a company's attempting to apply the Netflix model to theaters, fervcnuly believed that the budiling tirprcticurial venture MoviePass could decidedly disrupt the thicalcr-going movie model in much the site way that Netflix had disruptcil the home movic-vicwiny Letplate (Goltlich 2017) Sonic media cullets evaluated to Mori.Pass as Netflix for cinemas (Branesco, 2018) Lowe was so impressorl by the 1start that he decided to join the company Unfortunately, the artitions and innwalive approaches that MoviePass implemented cluring we's 2016 10 2020 letu HS CEO of MewiePass lol lolhe lits dernise. Although MoviePass sul Teted a calatrious collapse, sculitizing the sillution by means of an in-depth case study can reveal fascinating strategic insights. CASE STUDY The following case study presents a specific example of corporate failure in an effort to illustrate how a series of strategic management decisions can result in conscqucrices that, although disastrous for the film in question, Scive to provide a cautionary tale and elucidation for management scholars and practitioners. Equipped with the understanding of corporate failure gained through investigation of the case presented, students may then begin to generalize about how the lessons gleaned apply in other instances. Illustrative teaching case studies are often effectively employed within university programs to enhance student learning and engagement through the linking of theoretical concepts with real-world events (McFarlane, 2015). While the introduction of case study exercises into the curriculum may necessitate additional research and preparation on the part of the professor. the value added for the students proves extremely worthwhile (McFarlane, 2015). This case study stimulates critical thinking and analysis as it traces the life cycle of MoviePass, from the company's humble origins to its tragic demise. Development Entrepreneurs Stacy Spikes and llamet Watt believed that they could fundamentally change the way that people thought about going to the movies. In Spikes uxl Wall's vision Cor the Cure of theatrical experiences, Tuviegoers would have the option to pay 2 a lat monillily fee kralend an unlimited number of theatrical movie screenings. The public hail altendly show: w interest in this type of all-you-can-watch service, as Nettlix and other at-liome streaming video providers had grown exponentially by offering veritable buffets of content to users paying monthly subscription fees (Arango & Carr, 2010: Callalan 2009). Those who had signed up for such otterings could then concentrate on deciding the entertainment that could potentially be worthy of their time rather than their having to deliberate over which would prove worthy of their money. Viewers could take a chance on an unknown property without fear of regret that they had "Hushed their money down the drain in this way, the barriers to trying something new lowered, and this novel approach afforded subscribers the opportunity to expand their viewing horizons. Should patrons be dissatisfied with or disappointed their initial programming selection qualms were few. Subscribers could easily switch to a different option without having incurred any real cost other than the time invested in assessing that their first choice was not to their liking Spikes and Wall hope that a sctvice presenting customers with similarly low barriers to taking a chance of healrically-released Comiletil would cricourage people to all tal mote movies in cinemas, a result that test film distributions would view quite favorably (Kuy, 2019). Tri aktilium, MoviePass's co-founders envisioned a future in which twie stabios cull drive aticillary teenus thH DVD, digital cwnk walanuel Toketchuridise offers, and draw aulietices to special screeting, " wih Spikes's TwoTriSTIK ---Saulics ariel distributers will receive an unparalleled marketing (pportunity, with the applications atsilily lo largel . Tricvie lovers based on their movie viewing habits(Block, 2011). Indeed, the pitch caught the attention of those within the film industry who recognized the threat that the rise ot'at-home streaning options - particularly Netflix - posed to the theater industry. In 2011, with theatrical movie ticket sales in deep decline - the worst sales more than fifteen years (l'uttle, 2011; Verrier & Fritz, 2011) - conditions seemed ripe for MoviePass to test its innovative business model. Tre-Production MoviePass ran its first beta in June 2011, limiting its tral run to San Francisco Bay area residents (Chow, 2018). The company fiuctioned as an intermediary, a ticket broker of sorts, purchasing large quantities of tickets and then distributing these tickets to paying subscribers in exchange for montluy dues (Block, 2011). For $50 a month, customers were entitled to attend one movie every single day of the month (Marshall, 2019). If someone attended 30 movies, that person would essentially have received, based on 2011's national average ticket price of $7.93, an approximate value of $238 for an uptiont price of just $50 NATO, 11.d.). A platired 5.30 ption woull grant sets up to four tickets a month (a far ricre mewust value of $31.72), although both tiers required acklitional payment for special screenings, such as those shown in premium TMAX auditoriums or enhanced with 31) technology (Watercutler, 2011). VoviePass customers could easily ike their smartphones to select the movie that they wished to see and then, upon reaching the veme, present their phones to ticket takers as proof of purchase (Dickey, 2011). Formidable demarul for the service evidenced itself in the form of 19.000 individuals quickly signing on for the private beta test (Chow, 2018). Spikes and Watt seemed to have a blockbuster-in-the-making on their hands. Almost immediately, however, their strategy hit a major silag. In stark contrast to the cultusiasto expressed by some studio cxccutives and movie distributors, theater TLcts such as AMC Thcares, one of North America's largest cxhibitors, stood finely opposed to the concept (Block, 2011). Despite being alcay engaged in relationslups with MovieTickets.com la web site owned by AOL, one of MoviePass's biggest investors) and Fandango.com, both of which enployed more traditional a la carte models of selling movie tickets via the intemet. AMC had entered into no such arrangement with MoviePass (Block, 2011; Dickey, 2011). Allegedly never having been approached by the MoviePass executives or liaving even been made aware of the service, AMC stated via a spokesperson "We were surprised to see the press release and subsequent press coverage of MoviePass earlier this week as it included several of our San Francisco locations . It was news to us lo see ihal. we were parlicipants and we will be communicating lehexe theatres they are molto accept MoviePass (Block, 2011: Dickey. 2011). The prospect of increased movie altericlance, and the resultant spike in concession sales that the insurge could instigate, was apparently Tencugh for many theater chains to cosign the idea. Tack of andkusement from cinema owners stopped MexiePass's leta test in its tracks. This type of standoff would present a significant impediment to MoviePass's proliferation and expansion efforts throughout the service's existence. Recling from the closed bcta tcst failure, the Moviclass strategic leaders regrouped and fcrvenitly brainstormed to devise ways to ackless the issucs that their first foray made abundantly apparent. The team carns up with the idea of introducing a voucher system that would require subscribers to print out vouchers that they could then redece at the theater box office (Marshall, 2019). Both customers and theaters complained that the voucher approach was in dire need of streamlining. Patrons felt constrained by the requirement of printing out voucliers before leaving home, and theaters did not appreciate the protracted redemption process (Marshall, 2019). In response, Movie Pass developed a rechargeable debit card system that allowed subscribers, through a simartphone app, to select a movie show tine and once laving done so. lave the ticket price deposited to the card (Marshall, 2019). Although this plan also faced heavy opposition from AMC and other cinemas, MoviePass moved forward, in October 2012, with a nationwide inviteonly beta test of the new reloadable debit card method. Diving the beta test, MoviePass offered early adopters up to ne movie a clay in exchange for a subscription lee priced between $20 and $31 a month (pricing varied laserlom gertaphical region, as verified by phone GPS) with a meyear commitment. (Fingas. 2012: Marshall, 2019.7.weig 2012). The ire that MoviePass 3 drew from exhirts, AMC chief among them delinitely complicatoil the company's plats, however, it would not be long before theaters began to relent their steadfast anti-MoviePass positions As movie ticket sales continued to trend downward while business models amploying subscription-based access to media leg. Netflix and music service Spotify) thrived, AMC finally abandoned its resistance in its battle against Movielass. In the waring days of 2014, AVC announced its plan to launch, in association with MoviePass, a $30 to $45 version of the service bearing the slightly-adjusted, AMC-specific moniker MoviePass Premium (Lang. 2014). After battling MoviePass for three-and-a-half years, AMC was not necessarily thrilled to enter into a strategic alliance with its former nemesis, but the theater chain was shaken by sustained periods of lackluster movie attendance amid unsettling market trends toward more democratized accessibility evidenced in other media sectors. An AMC executive confessed, "It frankly wouldn't be smart to ignore the success of subscription in other arcas of media, a evidence of the firm's ecling pressur: lo take into consideration less-conventional business moxicls (France, 2014). Whether the result of AMC's acting out of optimism in adopting a new approach or out of a sense of survival-oriented desperation, MoviePass lad finally gained a solid foothold. Unfortunately, it did not take long for the buclcling relationship to sour', is inlemal changes williti MoviePass created a chain of catastrophic calatrities Production Mitch Lowc, FOTIT Netflix cxecutive and Robox a DVD total kiosk servica) president, scived as an advisor to the fledgling MoviePass voiturs until 2016. At this pastil, the company had solidified ils crolling, atul Lowe became MoviePass's Chief Executive Officer, an appointment that marked a definitive turning point for MoviePass (Marshall, 2019). Under Love's leadership, the company began its patter of constantly tinkering, floating a wide variety of new plans including a two-movies-per-month tier priced between $15 and $21, a threemovies-per-month tier for $22 to 531, and a four-movies-per-month tier for $40 to $50 (Hardawar, 2016, Marshall, 2019). As the service evolved from its beta form the organization under Lowe's direction tested $50 unlimited (standard 2D movies only) services in select markets, $50 six-movies-per-month (2D and 3D) offerings in others. $99 unlimited options that included access to 3D an IMAX screenings in certain cilies, and multiple other pentru alions in ficused segments of ils user population (Harrlawar, 2016. Sciretla, 2016). The sentexbet pricing and constanly-shifting deals created a certain (legree of market confiliom and imitation, and continual adljustment of limitations. Certain theater chaitis only sometimes accepted MoviePass, others did not accept it at all users could not secure tickets for a movie within 24 hours of their last ticket purchase, but then this restriction was lified reserved seating options were often not available, and some subscribers were suddenly, due to scammers' misusing the service, forced to snap photos of their physical tickets and send the pictures to MoviePass as verification (Firik, 2017. Sciretta, 2016). MoviePass's erratic policies lessened the attractiveness of the service, but MoviePass bcasted a customer base that had growtI to 20,000 subscribers strong (Marshall, 2019). These impressive numbers led Stuctio Movic Grill, a cinema chain with a modest national reach - at the time, 24 U.S locations in Coritrast to AMC's 661 CS locations and another 244 inlotational thalas) - to make an incloent in MoviePass (Bond, 2016; Marshall, 2019: Szalai, 2010). The December 2016 TUTKUSTICT of Studio Movie Grill's new strategic paritiership with MoviePass brought with it tol only minise for the future bul also are intriguing limitol-litte promotional Offer By late 2016, MoviePass liad. for the most part, established a monthly price point of roughly $50 for its unlimited tier (up to one 2D) movie per day, no 24-hour waiting periods, show times selected on phone to generate deposit on debit card, and price dependent on location) (Bond, 2016, Fink, 2017). While a $50 price point might prove very steep for the nearly-ninety percent of North American moviegoers who see an average of fewer than cne film per month in theaters, it would, in theory, still prove economically sound for most inclividuals who go to the movies more than five times a month (MPA 2020). With such a narrow target market, however, the MoviePass model would likely prove unviable because the business's blueprint was, in part, contingent upon accumulating large quantities of customer data that could be sold to movie studios, distributors, and other interested parties (Sherry, 2019). This with the announcement of the Studio Movie Crill alliance came a bold attempt at rapidly expanding MoviePass's user base-offering the unlimited service tice to Studio Movic Grill patrons for a special monthly rate of just under $9.95 (Bond, 2016; Robinson-lacobs, 2017) The promotional price was offered only to a limited segment of consumers- those within the proximity of the Studio Movic Grill multiplexus - and was niever promised to remain in cffect invlcfinitely Novottheless, this 9.95 promotional offer opened a Pandora's Box that would eventually serve as a primary cotiliibutor lo MoviePass's downfall and ullimale filure Soun alt iiludlucing this annoticeul olet exclusive lo Sludio Muie Grill paltomis, MwiePasseriletel in serious negolialiomis with dua atalytics lintu Helios atil Malhesum, a roul of negotiations that culminated in Helices atul Mulhesumi's Aly 2017 purchase of a majoily slahe in MwizPass (Marshall, 2019). At this priil, MuiePass theti pivated ils strategy form fully linus on accumulating customer cluta. To that ench the entijmy lew inspiration from its Slulio Mowie Chill petrictional offer anul mude the fateful decision to lower the price of its culinuted service from approximately $50 (varied by market) to a flat nationwide monthly rate of just $9.95 (Chow, 2018). Given that the price of a movie ticket in 2017 averaged 58.97, customers would almost break even after seeing just one film INATO, 11.d.). A subscriber who fully maximized the service by attending thirty movies in 4 one month would receive a value of $269.10. meaning that that perxuri would have savel $2.59.15 with a MoviePass subscription Of course, tlus calculation depends on an individual's going to the movies every single day of the month an inprobable scenario given that statistically, the majority of moviegoers were unlikely to visit theaters more than once a month (MPA, 2020). Still, film fanatics stood to come out ahead after seeing only two movies, with the savings' mounting with each additional viewing. Monetarily, the $9.95 price point proved most compelling, prompting people to sign up in such prodigious droves that these potential subscribers, in their zeal, actually crashed both Movielass's app and web site (Chow, 2018). The company's strategy, however, no longer hinged as intently on subscription fees as it once had. Instead, in conjunction with its majority shareholder Ilelics and Matheson, MoviePass predominantly concerned itself at least in the short term with collecting and selling customer data (Sherry, 2019). MoviePass's strategic leaders believed that the revenue generated from its valuable data would result in sustained growth and allow the company to undertake new oppurluulics down the line that would include low.city operating custs by riegotiating disovutiled bulk lickal Tales and establishing ils own film production subsidiary (Shery, 2019, MoviePass and esscrutially placed a huge bel on the fulure. If its gamble stood any chance of paying off the company would need 6 Til the jackpul" ly having everything all meat perfectly into place. Herwever, altresli mecliately, the firm's high-risk plans "wont bent." As soon as MoviePass slashed its subscription price to $9.95, AMC terminated the partnership it had (somewhat reluctantly) established with MoviePass, issuing a statement that read in part "AMC believes that holding out to corsuners that first run movies can be watched in theatres at great quantities for a monthly price of S995 isn't doing moviegoers any favors. In AMC's view, that price level is unsustainable and only sets up consumers for ultimate disappointment down the road if or when the product can no longer be fulfilled" (AMC Entertainment Holdings, Inc., 2017). MoviePass's business model was butikinig on St Customers' phying mhly subscription dues but not laking full allvatilage of the service. Ideally, subscribers would allend mly a few movies, if any, each mult, while MoviePass would geticale supplemental revenue by continuing to harvest the data of both active and less engaged users alike. At $50 a month, the strategy perhaps night have been feasible if enough users signed up, but, at $9.95 a month, AMC believed the profit equation to be entirely untenable. a AMC was not alone in its rationale, even MoviePass cofounder Stacy Spikes did not view $9.95 as a price point that could be maintained. The idea for the bargain rate came about, hot on the heels of the Studio Movie Grill limited time offer, as a means to reach 100,000 subscribers in as short a period of time as possible (Guerrasio, 2019). Helics and Matheson actually included this as a contract provision when it purchased its majority stake in MoviePass (Guerrasio, 2019). The $9.95 price point was never meant to remain in place indefinitely, it was intended solely as a limited-time promotional offer designed to spur precipitous growth and help the file more quickly achieve critical Mass Thc longer-tatic plate was that once the 100,000 subscriber target was reached, which matcrialized less than 48 hours after the ollut went live, the price would revert to a ninac sustainable level (GUCITAS10, 2019) In building the corripily, Sprikos klicw from expcritice hal such a rock-bollur price could not remain in place, and hic implored the executive care to discontinue the of:7, especially once the goal was so razielly - it fact ulimust immcdiately achieved (Gucitasio, 2019). Recently-appointed MoviePass CEO Milch Lowe, as well as tow ownsts Helics and Malhesum, did not share Spikes's statice that the chal should be halled (Guettasi), 2019). Sinkes clashed will these andurile decisica trukets until he was uncerenicniously fired five nionths later, via an inipersonal January 9, 2018 email, a curt missive from the company that Spikes had created and for which he had untiringly spent the last decade of his life cultivating (Guerrasio, 2019). Dropping the price to $9.95, and keeping it there long a fier acquiring 100,000 customers, did lead to exponential growth, but this spike in subscriptions also meant that MoviePass was bleeding capital. Demand outpaced the company's capabilities. As MoviePass reached its 100,000-subscriber milestone in August 2017, the company found itself unable to proficiently supply customers with the debit cards necessary for them to utilize the service, and customer service became overwhelmed with complaints, disgruntled patrons, etc. (Marshall, 2019). Despite the company's losing an average of S35 on each customer (given that a single movie ticket cquated to approximately the sainc price of an cutire month of the Moviclass scrvicc), MoviePass persisted in its pursuit of swift augmentation. Incredibly, the nucber of customers balloond to OTC million in December of 2017, hit two million in February 2018, and reached Ticarly three million by April 2018 (Chow, 2018: Marshall, 2019, Rodrigucz 2018; Statl, 2019b) During the course of this Tapal expresion, the fine aliually went so far as to instilul two acklitional terminary price crops - une in Femwry to $95 for me year ($7.95 JXT Tekotuh) and other in March to the staggeringly low price of $695 a Troth (Clark, 2018; Helios atch Malheson Analytics Tw.. 2018; Marshall, 2019). The strakcyy lo expeditiously allract huge rutibets of takmers Jawed a resounding success, but whether this represented a sound approach is another matter entirely. Wrap While Moviclass touted its impressive subscription numbers, the firm faced incise intamal challenges as a result of these very San McInburstup figurss. Or August 14, 2018,purcht in Helios and Matheson, which now owned 92 pret of MoviePass and involved itself in little outside of Movie Pass, reported a second-quarter loss of SI 26.6 million (Reclriguez, 2018). By offering millions of people, every mild, gouxl worth up to $269.10 for my $9.95, MawiePass was bxud to incur a steady stream of substantial monthly deficits. MoviePass's leadership and the fim's Helios and Matheson owners, however, wagered that it was worth continually sustaining mammoth losses as a means by which to build an impressive customer base. They anticipated that an assemblage of such magnitude would become so valuable and sought after that MoviePass's subscriber data would one day afford the company fornudable bargaining power. The accrued bargaining power could provide the leverage necessary in negotiations with theaters for bulk ticket purchase discounts, profit-sharing plans for moviegoers' connession stand purchases (which reportedly drastically increased because of Movielass), and other cost-saving / revenue-gcncrating opporturutics (Gessner, 2020; Statt. 2019b). From there, it was anticipated that additional advances could be made through integrating MoviePass capabilities with other services. For example, the firm could mere fully capitalize on its trove of identifiable user data and direct connection to customers by incorporating tie-ins with restaurants and ride-sharing apps (Statt, 2019b). These grand plans, however, all hinged on MoviePass's ability to a) acquire a critical mass of subscribers from whom b) the company could harvest valuable data that would prove sufficiently enticing that c) studios, clistributors, theaters, and other interested entities would want to partner with MoviePass, all while d) slaving of bankruptcy long cnough to notieve goals a, b, axlo. Unfortunately lix MwiePass, owside parties were tot as eager to enler ile purtrierships as MoviePass had hoped and the organization was losing money bl. a procligious tale. Prominent theater chains such as AMC Theatres had not wrily refused to che business with MoviePass but were actively opposed to the MoviePass business model (AMC Entertainment Holdings, Inc., 2017). Movie studios feared the danger of their content's being devalued, and customers were growing irritated with the toxic combination of the company's constant experimentation, everfluctuating offerings, poor comunication, and abysmal customer service (Lang, 2018; Notopoulos, 2018). Leaderslup knew, even prior to the public release of the exceedingly disquirting August 2018 earnings report, that the fimm stood in urgent need of a course correction 50 Desperate to stem the lossa, MoviePass began engaging in what many believe qualified as anticonsumer, underhanded business tactics (eg. Berger & Iluddleston, 2018: Coldewey, 2018; D'Alessandro, 2018, Keck, 2019: Nordine, 2018; Wilkinson, 2018). First. MoviePass started restricting both the films and the show times for which subscribers could reserve tickets, often blacking ou the most popular movies and times (D'Alessandro, 2018; Norditu. 2018) Alantingly, in some cases, frequetul Movi:Pass USLTS passwords were even intentionally changed (allegedly) CUSTOTICS could not log it and pret tickets for extremely in-ce-Triatul diiles that we projectel lo crijiy blockbuslat TITUS (Kock, 2019). Subsequently, CEO Milch Twe's worils raised grave privacy CUTIOTTIS when he buste during his keytisie speech at the Entertaiturnitat. Fiture Fixion, alxw the company's alrility to Irack users, creepily divulging "We gel al CTTIKAS atunt of information. We watch how you drive from liome to the movies. We watch where you go afterwards (Coldewey, 2018) MoviePass claimed to purportedly be only in the exploration phase of exploiting this data, but the veracity of Lowe's assertion remains impossible to definitively ascertain (Coldewey, 2018). Next, the firm resolutely did away with the unlimited tier only to bring it back two weeks later (Plaugic, 2018), this time introducing Uber-style surge pricing - charging extra to procure indemand tickets (ie opening weekends. box office blockbusters, etc.) - for all month-to-month subscribers (Hemandez, 2018). Soon after, the app began experiencing suspicious outages that the company first tried to blanx on technical issucs but later admitted were artificially created as a result of its having insufficient funds to pay for customers' tickets (Berger & Huddleston. 2018). Operationis only managed to T-SUITC Once Helios and Matheson borrowed five million dollars in the form of an incrgency loan (Berger & Iluddleston, 2018). Clearly, MoviePass was in dire straits. On the day that it had filed its second-quarter earnings report (August 14, 2018), MoviePass yet again scrapped its unlimited plan, imposing a three-movie-per-month limit on its 59.95 subscription (Rodriguez, 2018). Shockinely, customers wlio liad previously Caricelled their MoviePass suliscriptions bul still had the MoviePass app installed on their phics were greeted with the news of MoviePass's Tiew restrictions in at maverickalle message seemingly designed to cluse these former subscribers into accidentally renewing their subscriptions (Wilkinson, 2018). (The page was itilerilimially styled to resemble a staticare le al service wpxInle with users prompted to click alig promitenlly-clisplayer ambiguously-wended "1 Accept" button that would then reactivate their lapred memberships.) Both customer trust and investor faith plutrimeted to the point that. VoviePass's shareholders sued Helios and Matheson, alleging that the company's CEO and CFO defrauded stockholders by withholding and fabricating information in an effort to artificially inflate the share price; simultaneously, MoviePass's disillusioned users began organizing a class action lawsuit on the basis of deceptive trade practices (Berger, 2018; Ganun 2018; Lee, 2018; Maddaus, 2019). By this point, Helios and Matheson and, by extension, Movielass faced myriad threats. Plagued by abysmal trops in customer satisfaction and by the prospect of being delisted from the NASDAQ stock exchange as a result of repeatedly flooding the market with sharcs, thus causing the stock price to plummet. the entire operation teetered on the brink of disaster (Lee, 2018). It was only a matter of time before MoviePass met its ultimate denuse. As MoviePass contimed toward its tragic fate, in a desperate bid for survival, management unscrupulously continued to take advantage of consumers. The company reinstated lapsed subscribers by automatically enrolling fornier users, without their consent, into a once again!) newly revived version of the unlimited plan that agai bune CTAS Testriclius (Slut 2018). These linisinspecting CommeT TSTILTS would find their credil cutils charged triomhly unless, Ice awar, they explicitly opleil out of the service (Stall 2018). MwiPass had alitunel senyal'ils customers through 6 what many classified as deceptive practices and anti-consumer action that fitner sulxcribers filed class-action lawsuils (Cooper, 2018; Cricchiola & Squres. 2019; Hughes, 2019a; Maddaus. 2019). In ce case, the plaintiffs allege that Movie Pass Inc., its corporate parent Helics and Matheson Analytics Tric., and their officers conspired to breach its contracts with consumers and connut fraud through email in violation of the Racketeer Influenced and Corrupt Organizations Act" (Cooper, 2018). On the same day that MoviePass took out pricey ad space on Time Square billboards, a New York couple sued the company for allegedly engaging in a "deceptive and unfair bait-and-switch scheme, because MoviePass's numcrous blackouts and restrictions resulted in their two S105.35 subscriptions providing them with tickets to attend only three movies in a span of ten months (Crucchiola & Squircs, 2019; Hughes, 2014; Maddaus, 2019). After destroying the stock price by oversaturating the market with shares. Ilelies and Matheson was delisted from the NASDAQ stock exchange on February 13, 2019 (Cllingson, 2019). The following month marked the impending termination of the MoviePass service, with the company's making a last ditch effort to yet again, reinstate its urlinuted service plan (thuis time with more plainly. slaloalbu. quale stringent restrictions) under the mutiker MoviePass Unicaped (Porter, 2019a). Just over three months later, MoviePass effectively took its final bow with management's sudden removal of MoviePass's online presence during one of the biggest U.S. box office times, Fourth of July weekend (Hayden 2019; Hughes. 2019): Porter, 2019b). The arty's awer story that the platform's operations had to be impurarily simpetulel for a few weeks to effect the implementation of mobile app upgrades - and that this maintenance period just happened to coincide with July 18 weekend did not hold up to scrutiny. Mitch Lowe's claim There's never a good time to have to do this" (Hayden. 2019: Hughes, 2019; Porter, 2019bdid not ring true to these following the company's saga as they saw through the ploy of painting the conspicuous timing as merely inconvenient; indeed, service was not restored to subscribers witil late August even then, some members could not log in and MoviePass closed forever nere days later on September 13, 2019 (Spangler, 2019: Statt, 2019a). To make matters even worse, shortly before announcing the stuttering of all Movie Pass operations, the company shared news that it had left thousands of ils custurIcts' personal "creclil carel Timbers, expiration lates, Willing allesses, and matrics cumpletely expused it ati HITTTT sleutel online calabrese (Stall, 2019). The litul chuple of the MoviePass sluty was writerium JuriLary 28, 2020, wheti MoviePasspurenil Craty Heliosarul Malheson lileel for lutiknipley (Spaniyler, 2020). Post-Production Despite its making a big splash, cspecially with its $9.95 unlimited plan, MoviePass failed to truly disrupt the film industry as somric had predicted it would. Little did anyone know that a bonafide disruption to the movie business in particular to thcatcts - would occur in March of 2020. The global lockdown resulting from the COVID-19 pridemic affected massive disorder for almost every industry and forced to vic thcalcts around the world to close while Talionis atlctupled to lessen the devastating impact of the wel CUTUTA virus (Rubin, 2020). In the wake of the disastrous oullzzak, lilin distribors, theuliical extitilors, and countless other muvis industry participants were forced to rethink strategies that had remained in place for decades. Conventional approaches were discarded in favor of forward-thinking innovations, as previously risk-averse companies experimented with new, untested methods. sometimes, in the process, raising the ire of inchustry partners. For example, Universal Pictures's decision to forego a theatrical release of Trolls World Tour in favor of distributing directly to consumers via at-home digital on-demand platforms was met with AMC Theatres's lanning all finire Universal releases from its establishments (Pallotta, 2020). When the reality of how much life had changed as a result of the coronavirus sank in the two companies reached an agreement that lifted the lan, the new contract also significantly shortened the window during which AMC's thcators would have exclusive access to Cniversal films prior to the movies' video-on-demand (VOD) relcascs (Lang & Rubin 2020). Agreements such as this continued to scd shockwaves through the industry, as movic studies such as Disticy stifted major releases away from theaters and loward streaming services and other direct consuICT distribution mechanismus (Solstran, 2020) Powerhouse Studio Waitier Bros, made the unprecedieriled decision to release ils crilir: slate of 2021 films COTILLATCTIy itt theaters anch of the Wartut Media streaming platfon HBO Max, themely lotally disrupting the industry's business as usual" (WAITICT Brus. 2020). With all of the industry's players' working knula TIW TICAnal, perhaps there exist Taxtlanties Cor MoviePass-lik. services to thrive in a marketplace struggling to rethink and rebuild prospects that the discussion questions appended to this case explore Distribution Oftentimics, innovators introduce ideas that at first, may scein outlandish but later take hold within the instrcam cither through these visionaries' own deeged efforts or as a result of subsequent entities' emulating the concept but putting their own spins on the initial design. At the height of MoviePass's notoriety, both theatrical exlubitors and direct MoviePass competitors began to entertain notions of how to offer moviegoers subscription services that would make fiscal and strategic sense for both the company offering the plan and the consumers enrolling in the programi 7 Title of Service Sinemia Table 1. Proliferation of the MoviePass Concept Initial Wide Release Price and Plan 2011(Turkey) $29.99/mo. for 30 movies mo. 2018 (US, Canada, UK $899.no for 3 movies'mno. Australia) $ 1.99:mo. for 1 movie me. (skullcted early 2019) multiple additional fees Notable Benefits/Restrictions Unused tickets able to be rolled over to following month Csable at niultiple loalii Cinemark Movie Club December 2017 $8.99.mo for 1 movie mo Discounts on concessions Usable only at Cinemark locations AMC Slubs A-List June 2018 $19.95-$23.95m. for 3 movies/wk. (pricing varies by geographic location) (requires initial 3-month commitment) Tisoutils TI concessions Priority ticket lane access Usalile mly at AVC locations Regral Unlimited July 2019 Tiscaunis moments Usable only at Regal locations $18/10. Por lilitri del trivvies al. 200- locations $21:mo. for umlimited movies at 100 locations $23.50:mo. for unlimited movies at all locations $0.50/movie (requires imilial 1-year courrietil) Alamo Season Pass $14.99/mo. for one movie per day mo. Usable only at Alamo Drafthouse locations March 2020 (almost immediately Suspended due to paridetc) Some of the ideas that. MoviePass altempted to bring to life have found their way into other companies business tulels (see Talde 1). An ambitieus company called Sinetria tried to compete directly with Movie Pass by offering its own theater-tieutral sulscription- based service but failed in the process almost as spectacularly as did MoviePass. In an attempt to improve upon the third-party models, exhibitors began fashioning their own proprietary takes on the concept first introduced by Movielass. Cinemark created Movie Club AMC launched Stubs A-List, Regal introduced Regal Unlimited, and Alamo Drafthouse began offering Alano Season Pass. While Movic Mass ultimately failed in its ctfort to transform the movie theater industry, the company's legacy lives or in the Services that Moviclass's immovative approach inspired. As is often the case, une venture's failure does not necessarily mcan the end of the story, other actors can iterate on the initial unsuccessful attempt and, with some serious tweaking, spin straw into gold. CASE STUDY QUESTIONS FOR STUDENT DISCUSSION AND ANALYSIS Ideas usually do not entirely disappear, they often lie dommant until such time that the environment changes and market forces become conducive to revisiting the concept. MoviePass tell far short of achieving its lofty ambitions, thereby embodying the very definition of corporate failure. However, in assessing Movie Pass's fundamental missteps and subsequently devising strategies to circumvent such pitfalls, theater chains have experienced far greater success with their personalized spins on the MoviePass molel than MoviePass ever did. Clear examples of learning from MoviePass's failure include Regal's offering of multiple pricing tiers to accommodate diverse customer segments while still retaining profitability and its application of ticket surcharges aimed at deterring excessive usage. By the end of 2019, the services that rose from the ashes of MoviePass's failure were gaining steadly followings and began to thrive; few could have predicted the cataclysm to come. The vulcah of the Tuvcl cormavirus that caused the COVID-19 global parcitric Oxgirming in carly 2020 fincm.Tilally changed the landscape fur countless industries. The theatrical Gilmu inchustry telies Oti pulmons lo velut cut atkl sit shoulder-lo-shouldkt in an enclosed space for over two hours on chairs previously occupied by other attendees, all while niunching snacks and sipping cola activities difficult to perform wlule wearing facemasks designed to attemiate disease transmission. Suffice it to say, a wide-spread and lughly-transmissible pathogen represents an incomparable existential threat cinemas. It has been said that necessity is the mother of invention, perlaps tlus new age will require innovation in the form of a strategic approach once thought sible but now suddenly within the realm of possibility. Keep this notion in mind as you respond to the following: 8Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts