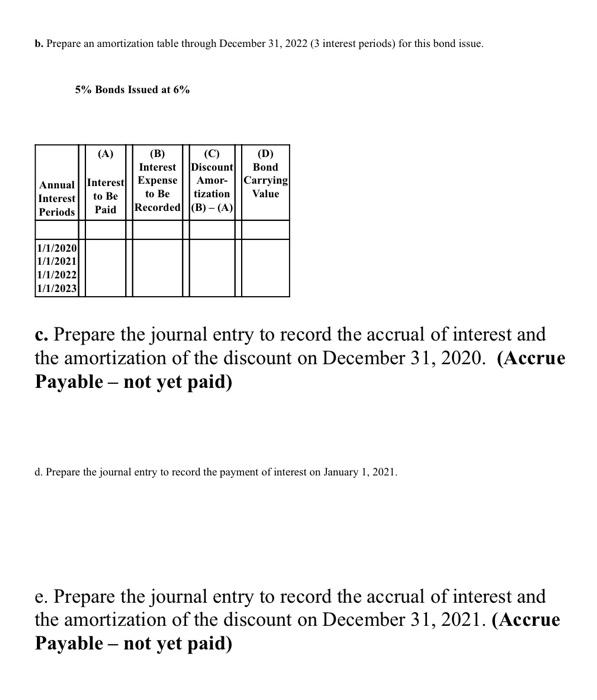

Question: b. Prepare an amortization table through December 31,2022 ( 3 interest periods) for this bond issue. 5% Bonds Issued at 6% c. Prepare the journal

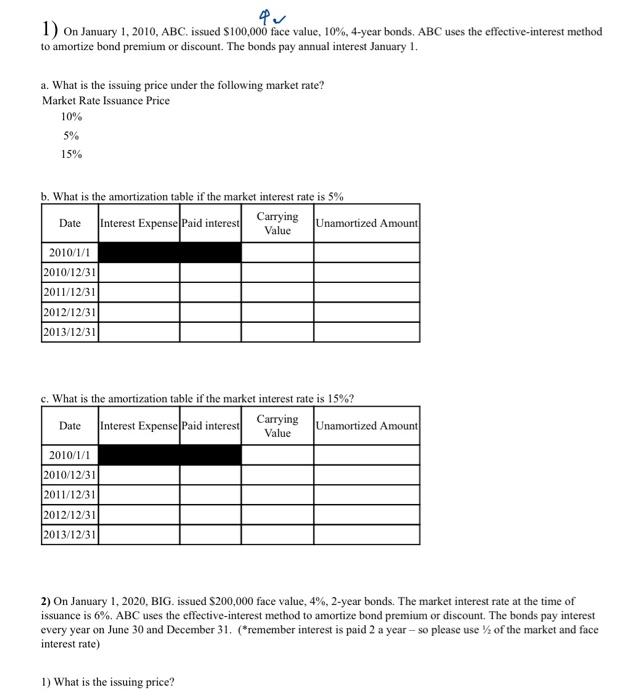

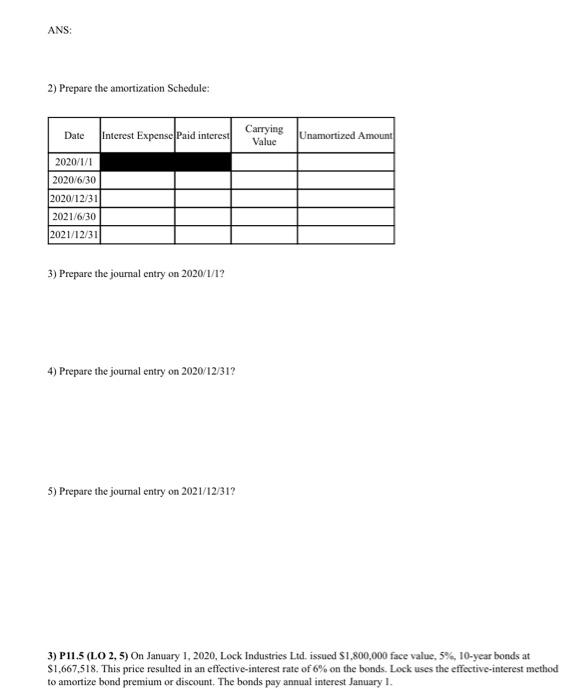

b. Prepare an amortization table through December 31,2022 ( 3 interest periods) for this bond issue. 5% Bonds Issued at 6% c. Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2020. (Accrue Payable - not yet paid) d. Prepare the joumal entry to record the payment of interest on January 1, 2021. e. Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2021. (Accrue Payable - not yet paid) 1) On January 1,2010,ABC. issued $100,000 face value, 10%,4-year bonds. ABC uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest January 1 . a. What is the issuing price under the following market rate? Market Rate Issuance Price 10% 5% 15% b. What is the amortization table if the market interest rate is 5% o. What is the amortization tahle if the market interest rate is 15% ? 2) On January 1, 2020, BIG. issued $200,000 face value, 4%, 2-year bonds. The market interest rate at the time of issuance is 6%. ABC uses the effective-interest method to amortize bond premium or discount. The bonds pay interest every year on June 30 and December 31 . (*remember interest is paid 2 a year - so please use 1/2 of the market and face interest rate) ANS: 2) Prepare the amortization Schedule: 3) Prepare the joumal entry on 2020/1/1 ? 4) Prepare the joumal entry on 2020/12/31 ? 5) Prepare the joumal entry on 2021/12/31 ? 3) P11,5 (LO 2,5) On January 1, 2020, Lock Industries Ltd. issued 51,800,000 face value, 5\%, 10-year bonds at $1,667,518. This price resulted in an effective-interest rate of 6% on the bonds. Lock uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest January 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts