Question: P6-6 Determining Bad Debt Expense Based on Aging Analysis and Interpreting Ratios L06-4 IceKreme Inc. makes ice cream machines for sale to ice cream parlours.

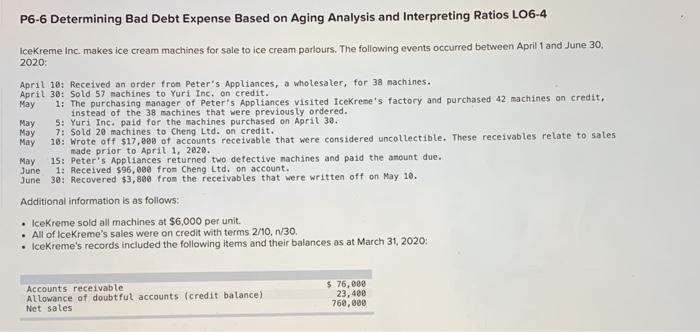

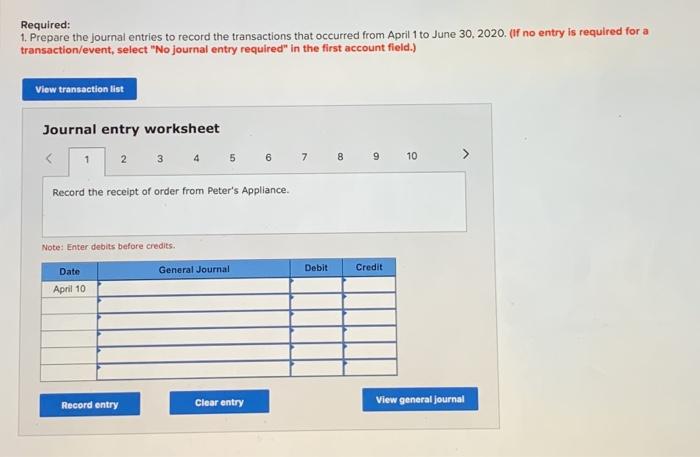

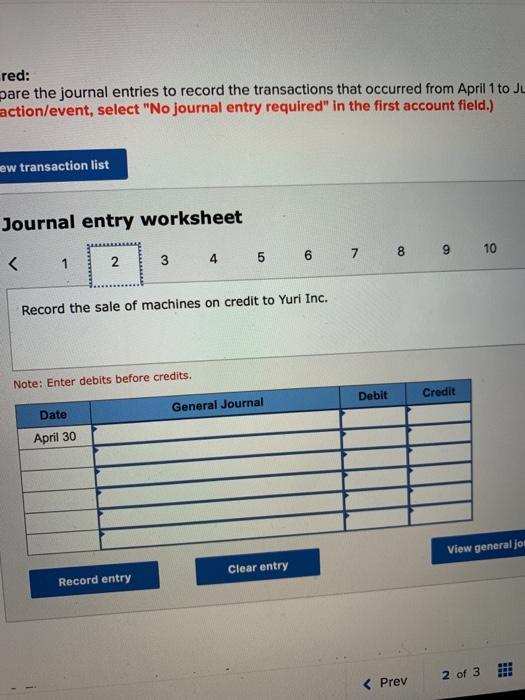

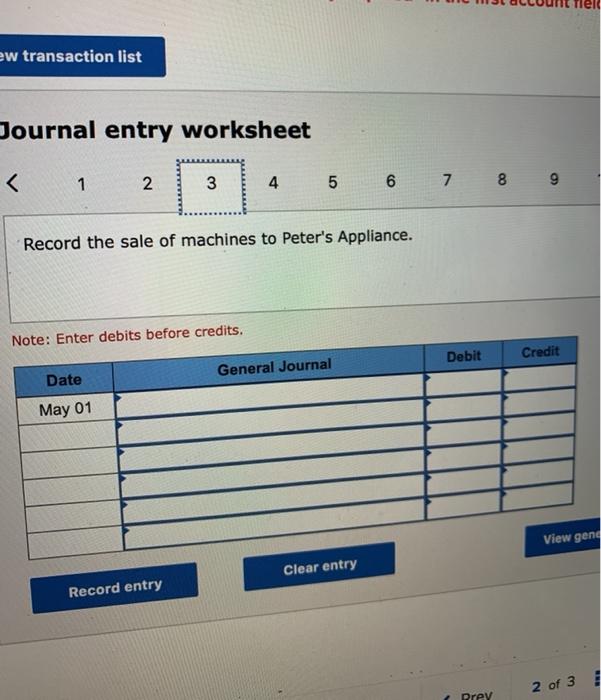

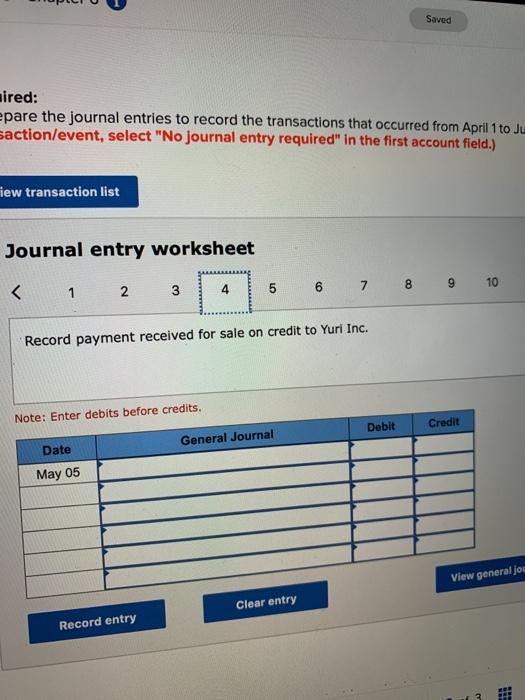

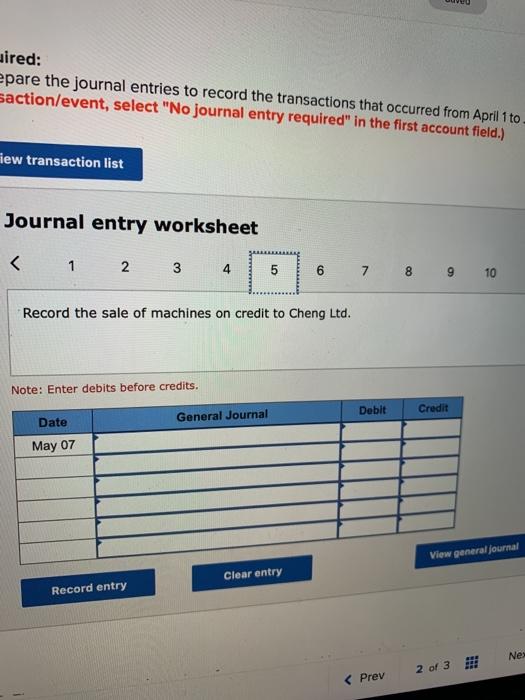

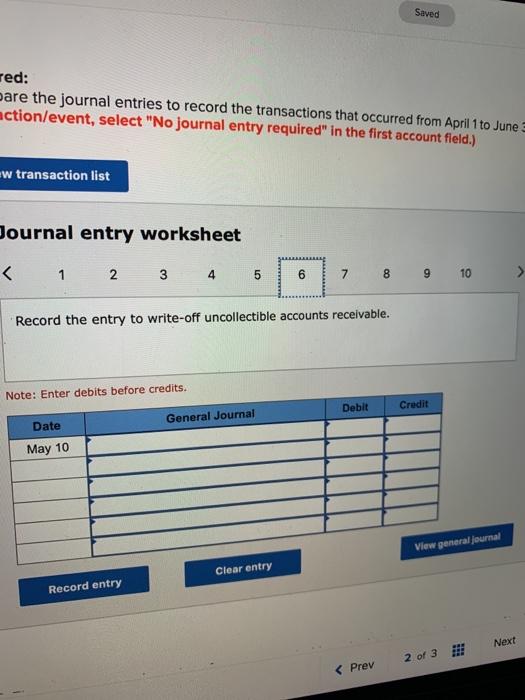

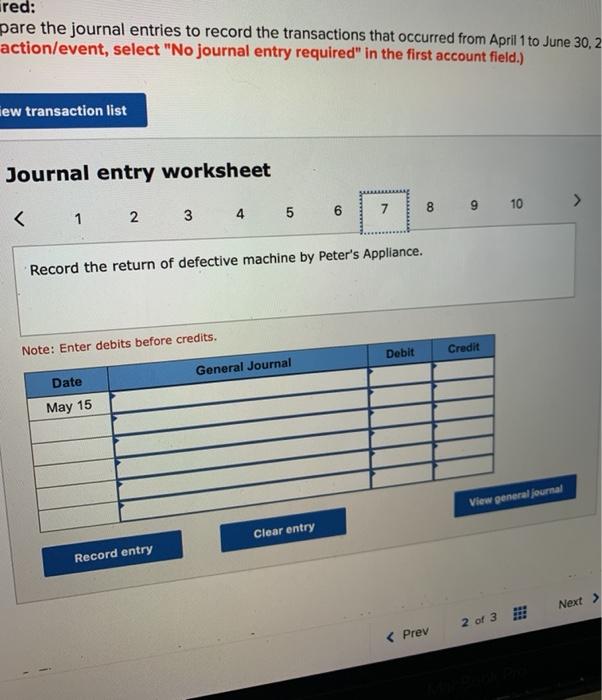

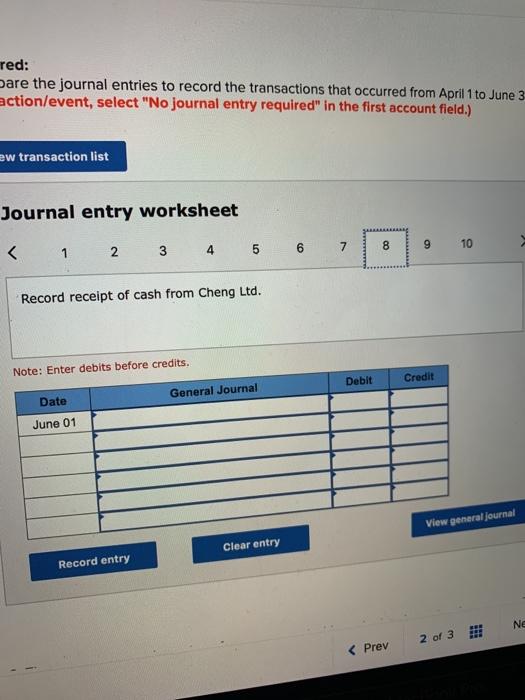

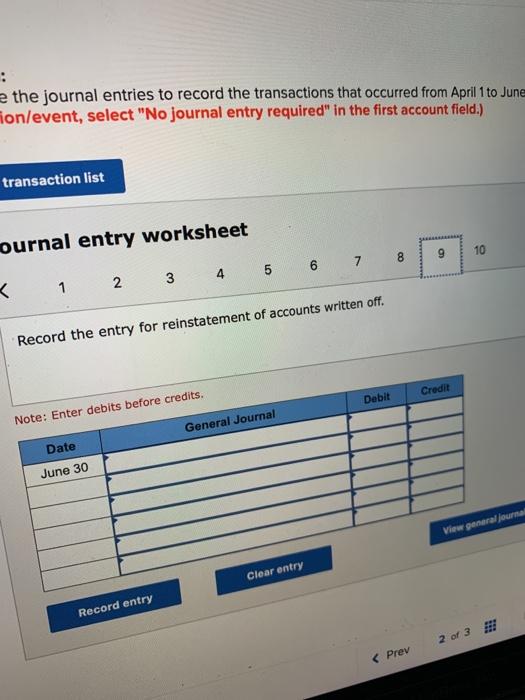

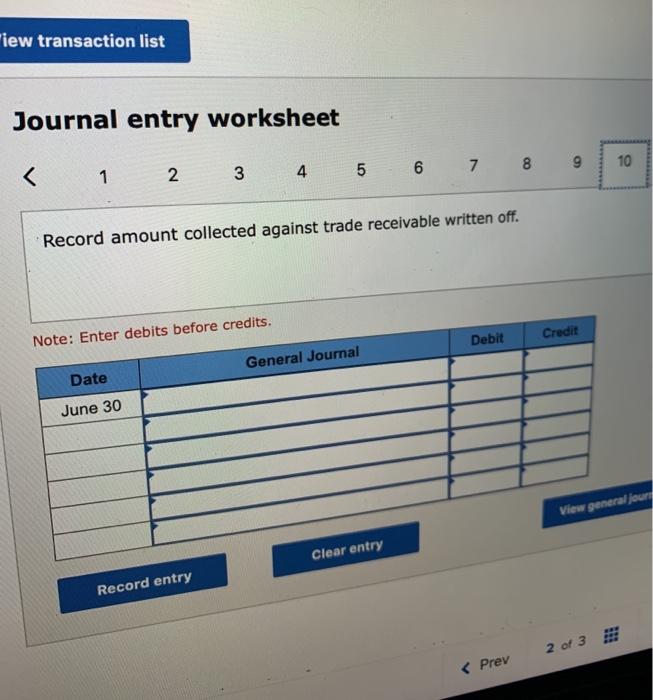

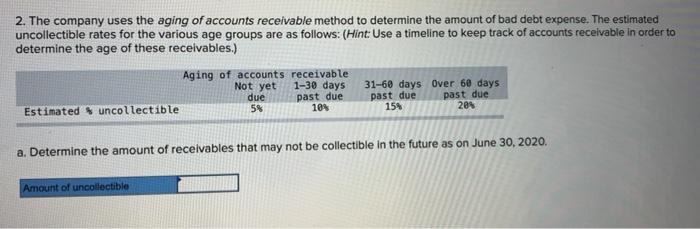

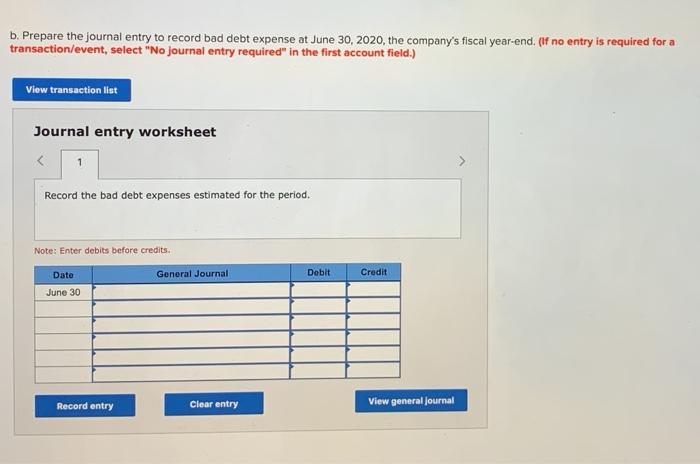

P6-6 Determining Bad Debt Expense Based on Aging Analysis and Interpreting Ratios L06-4 IceKreme Inc. makes ice cream machines for sale to ice cream parlours. The following events occurred between April 1 and June 30, 2020 April 10: Received an order from Peter's Appliances, a wholesaler, for 38 nachines. April 30: Sold 57 machines to Yuri Inc. on credit. May 1: The purchasing manager of Peter's Appliances visited Icerene's factory and purchased 42 machines on credit, instead of the 38 machines that were previously ordered. May 5: Yuri Inc. paid for the machines purchased on April 30. May 7: Sold 20 machines to Cheng Ltd. on credit. May 10: Wrote oft $17,000 of accounts receivable that were considered uncollectible. These receivables relate to sales May 15: Peter's Appliances returned two defective machines and paid the amount due. June 1: Received 596,000 from Cheng Ltd. on account. June 30: Recovered $3,800 from the receivables that were written off on May 10. Additional information is as follows: IceKreme sold all machines at $6,000 per unit . All of IceKreme's sales were on credit with terms 2/10, 1/30 IceKreme's records included the following items and their balances as at March 31, 2020: Accounts receivable Allowance of doubtful accounts (credit balance) Net sales $ 76,000 23,400 760,000 Required: 1. Prepare the journal entries to record the transactions that occurred from April 1 to June 30, 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts