Question: b) Present comparative income statement data for the years 2021 to 2023, starting with income before the cumulative effect of any accounting changes. c) Assume

b) Present comparative income statement data for the years 2021 to 2023, starting with income before the cumulative effect of any accounting changes.

c) Assume that the beginning retained earnings balance (unadjusted) for 2021 was $630,000. At what adjusted amount should the beginning retained earnings balance for 2021 be shown, assuming that comparative financial statements were prepared?

d) Assume that the beginning retained earnings balance (unadjusted) for 2023 is $900,000 and that comparative financial statements are not prepared. At what adjusted amount should this beginning retained earnings balance be shown?

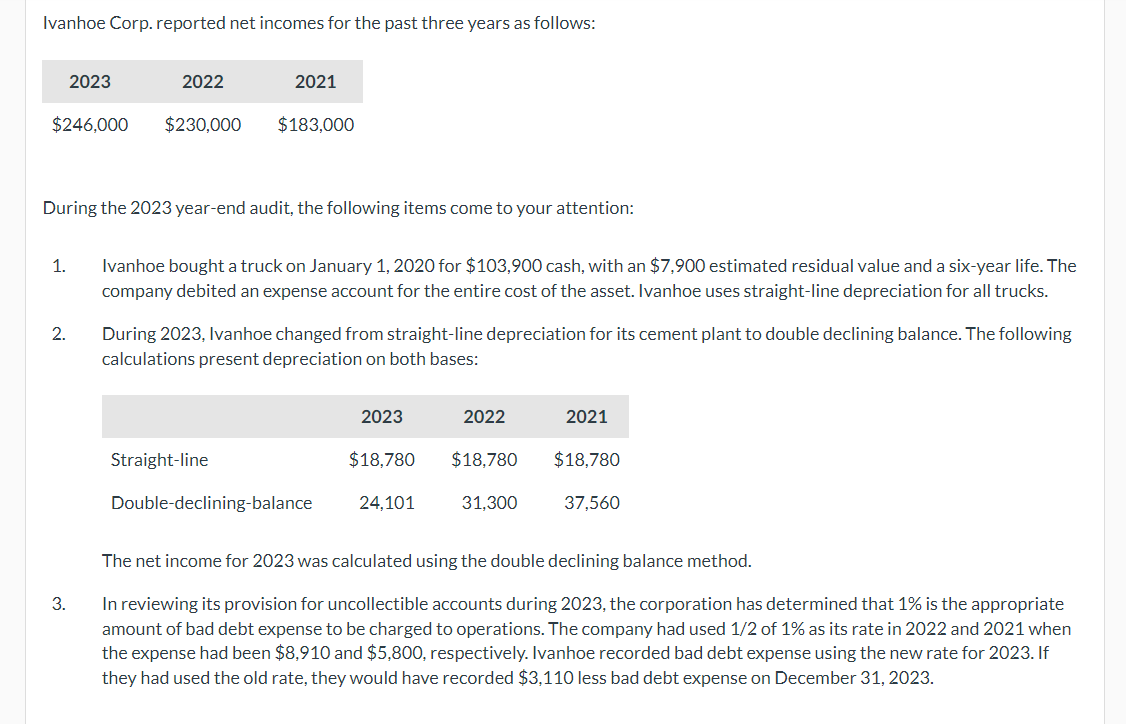

Ivanhoe Corp. reported net incomes for the past three years as follows: During the 2023 year-end audit, the following items come to your attention: 1. Ivanhoe bought a truck on January 1, 2020 for $103,900 cash, with an $7,900 estimated residual value and a six-year life. The company debited an expense account for the entire cost of the asset. Ivanhoe uses straight-line depreciation for all trucks. 2. During 2023, Ivanhoe changed from straight-line depreciation for its cement plant to double declining balance. The following calculations present depreciation on both bases: The net income for 2023 was calculated using the double declining balance method. 3. In reviewing its provision for uncollectible accounts during 2023 , the corporation has determined that 1% is the appropriate amount of bad debt expense to be charged to operations. The company had used 1/2 of 1% as its rate in 2022 and 2021 when the expense had been $8,910 and $5,800, respectively. Ivanhoe recorded bad debt expense using the new rate for 2023 . If they had used the old rate, they would have recorded $3,110 less bad debt expense on December 31, 2023. Prepare the general journal entry required to correct the books for the item 1 situation (only) of this problem, assuming that the books have not been closed for 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts