Question: b) Project A and Project B are mutually exclusive projects with conventional cash flows. The internal rate of return for Project A is 21.81%. The

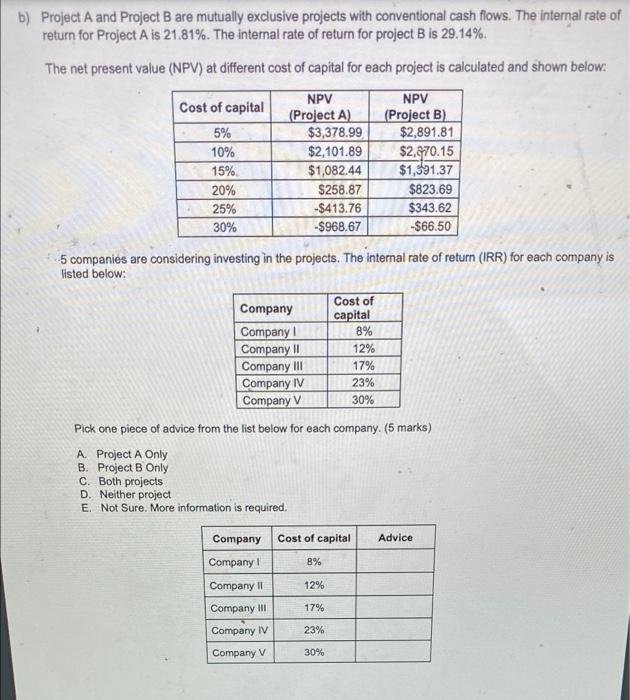

b) Project A and Project B are mutually exclusive projects with conventional cash flows. The internal rate of return for Project A is 21.81%. The internal rate of return for project B is 29.14%. The net present value (NPV) at different cost of capital for each project is calculated and shown below: Cost of capital 5% 10% 15% 20% 25% 30% NPV (Project A) $3,378.99 $2,101.89 $1,082.44 $258.87 -$413.76 -$968.67 NPV (Project B) $2,891.81 $2,270.15 $1,891.37 $823.69 $343.62 -$66.50 5 companies are considering investing in the projects. The internal rate of return (IRR) for each company is listed below: Company Company Company II Company III Company IV Company V Cost of capital 8% 12% 17% 23% 30% Pick one piece of advice from the list below for each company. (5 marks) A. Project A Only B. Project B Only c. Both projects D. Neither project E. Not Sure. More information is required. Cost of capital Advice Company Company 8% Company 11 12% Company III 17% Company IV 23% Company v 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts