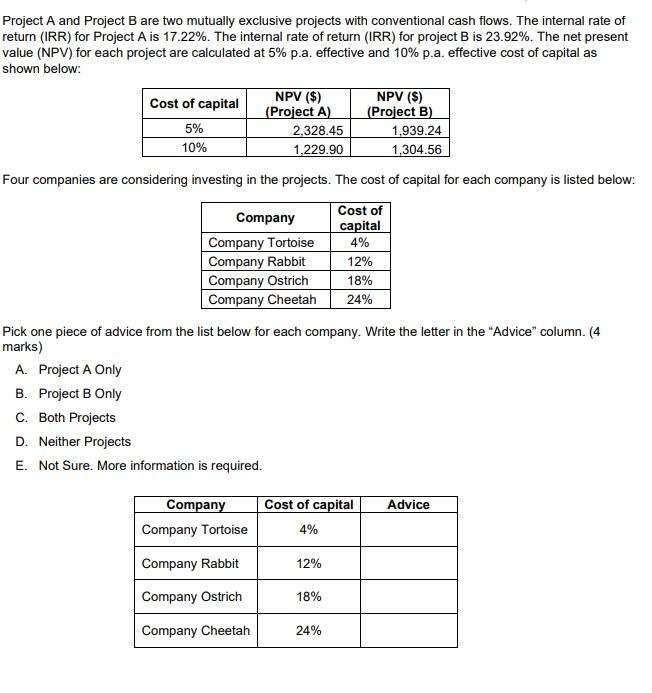

Question: Project A and Project B are two mutually exclusive projects with conventional cash flows. The internal rate of return (IRR) for Project A is 17.22%.

Project A and Project B are two mutually exclusive projects with conventional cash flows. The internal rate of return (IRR) for Project A is 17.22%. The internal rate of return (IRR) for project B is 23.92%. The net present value (NPV) for each project are calculated at 5% p.a. effective and 10% p.a. effective cost of capital as shown below: Cost of capital 5% 10% NPV ($) (Project A) 1,939.24 1,304.56 Four companies are considering investing in the projects. The cost of capital for each company is listed below: Cost of capital 4% 12% 18% 24% 2,328.45 1,229.90 Company Company Tortoise Company Rabbit Company Ostrich Company Cheetah Company Company Tortoise Company Rabbit Company Ostrich Company Cheetah Pick one piece of advice from the list below for each company. Write the letter in the "Advice" column. (4 marks) A. Project A Only B. Project B Only C. Both Projects D. Neither Projects E. Not Sure. More information is required. NPV ($) (Project B) Cost of capital Advice 4% 12% 18% 24%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts